- China

- /

- Communications

- /

- SZSE:002935

Subdued Growth No Barrier To Chengdu Spaceon Electronics Co., Ltd. (SZSE:002935) With Shares Advancing 37%

Despite an already strong run, Chengdu Spaceon Electronics Co., Ltd. (SZSE:002935) shares have been powering on, with a gain of 37% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 14% is also fairly reasonable.

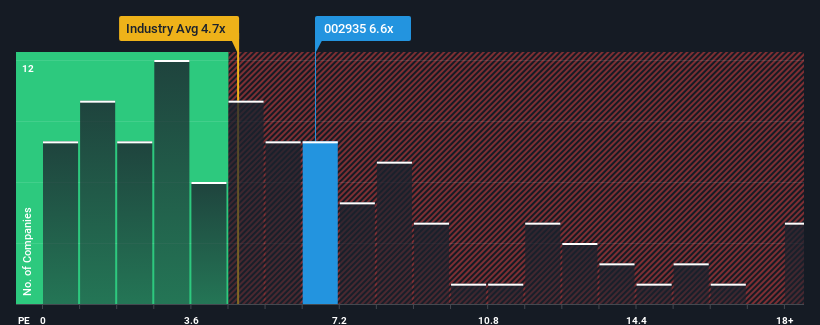

Since its price has surged higher, Chengdu Spaceon Electronics may be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 6.6x, since almost half of all companies in the Communications in China have P/S ratios under 4.7x and even P/S lower than 2x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Chengdu Spaceon Electronics

What Does Chengdu Spaceon Electronics' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Chengdu Spaceon Electronics' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Chengdu Spaceon Electronics' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Chengdu Spaceon Electronics' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 13%. Regardless, revenue has managed to lift by a handy 7.6% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 39% as estimated by the one analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 42%, which is not materially different.

With this in consideration, we find it intriguing that Chengdu Spaceon Electronics' P/S is higher than its industry peers. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Bottom Line On Chengdu Spaceon Electronics' P/S

Chengdu Spaceon Electronics shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Analysts are forecasting Chengdu Spaceon Electronics' revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Chengdu Spaceon Electronics that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002935

Chengdu Spaceon Electronics

Engages in the research and development, design, production, and sale of time-frequency and satellite application products in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion