- China

- /

- Electronic Equipment and Components

- /

- SZSE:002767

Optimistic Investors Push Hangzhou Innover Technology Co., Ltd. (SZSE:002767) Shares Up 26% But Growth Is Lacking

Despite an already strong run, Hangzhou Innover Technology Co., Ltd. (SZSE:002767) shares have been powering on, with a gain of 26% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 53% in the last year.

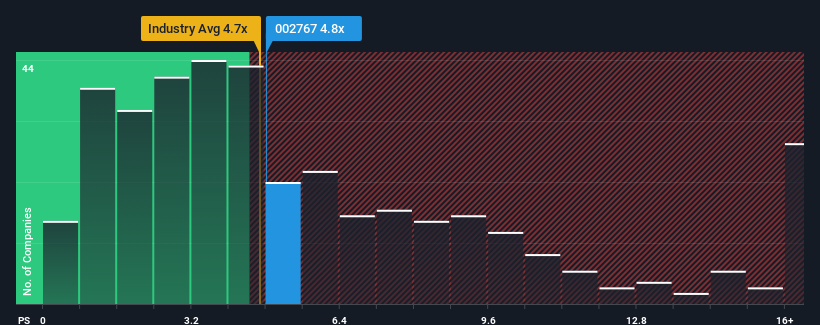

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Hangzhou Innover Technology's P/S ratio of 4.8x, since the median price-to-sales (or "P/S") ratio for the Electronic industry in China is also close to 4.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Hangzhou Innover Technology

What Does Hangzhou Innover Technology's Recent Performance Look Like?

We'd have to say that with no tangible growth over the last year, Hangzhou Innover Technology's revenue has been unimpressive. Perhaps the market believes the recent run-of-the-mill revenue performance isn't enough to outperform the industry, which has kept the P/S muted. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Hangzhou Innover Technology's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Hangzhou Innover Technology?

The only time you'd be comfortable seeing a P/S like Hangzhou Innover Technology's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Although pleasingly revenue has lifted 50% in aggregate from three years ago, notwithstanding the last 12 months. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 27% shows it's noticeably less attractive.

With this information, we find it interesting that Hangzhou Innover Technology is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Final Word

Hangzhou Innover Technology's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Hangzhou Innover Technology's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Hangzhou Innover Technology (at least 1 which makes us a bit uncomfortable), and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Innover Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002767

Hangzhou Innover Technology

Offers urban gas equipment and smart gas solutions in China.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives