- China

- /

- Electronic Equipment and Components

- /

- SZSE:002655

Is Gettop Acoustic (SZSE:002655) Using Too Much Debt?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Gettop Acoustic Co., Ltd. (SZSE:002655) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Gettop Acoustic

How Much Debt Does Gettop Acoustic Carry?

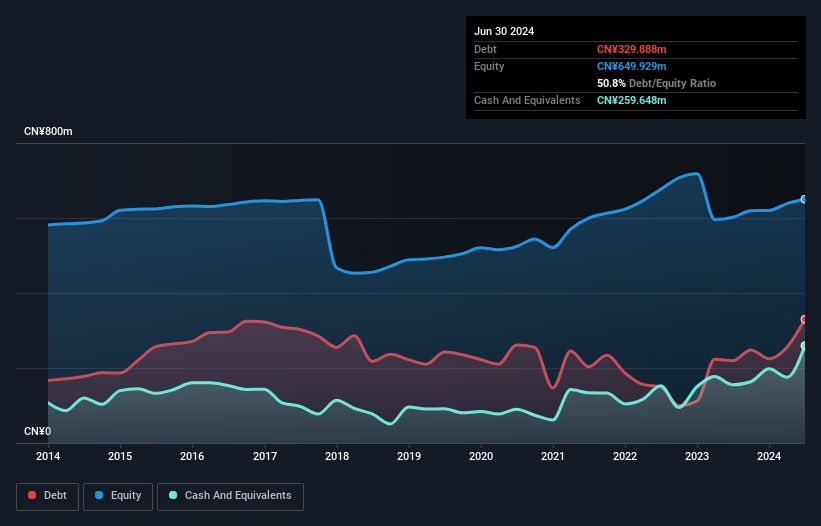

You can click the graphic below for the historical numbers, but it shows that as of June 2024 Gettop Acoustic had CN¥329.9m of debt, an increase on CN¥219.3m, over one year. However, it does have CN¥259.6m in cash offsetting this, leading to net debt of about CN¥70.2m.

A Look At Gettop Acoustic's Liabilities

Zooming in on the latest balance sheet data, we can see that Gettop Acoustic had liabilities of CN¥714.3m due within 12 months and liabilities of CN¥90.5m due beyond that. Offsetting these obligations, it had cash of CN¥259.6m as well as receivables valued at CN¥384.2m due within 12 months. So it has liabilities totalling CN¥161.0m more than its cash and near-term receivables, combined.

Given Gettop Acoustic has a market capitalization of CN¥4.89b, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. Carrying virtually no net debt, Gettop Acoustic has a very light debt load indeed.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Gettop Acoustic's net debt is only 0.45 times its EBITDA. And its EBIT easily covers its interest expense, being 13.8 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. Even more impressive was the fact that Gettop Acoustic grew its EBIT by 346% over twelve months. If maintained that growth will make the debt even more manageable in the years ahead. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Gettop Acoustic's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Gettop Acoustic produced sturdy free cash flow equating to 62% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Happily, Gettop Acoustic's impressive interest cover implies it has the upper hand on its debt. And the good news does not stop there, as its EBIT growth rate also supports that impression! Overall, we don't think Gettop Acoustic is taking any bad risks, as its debt load seems modest. So we're not worried about the use of a little leverage on the balance sheet. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Gettop Acoustic's earnings per share history for free.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002655

Gettop Acoustic

Engages in the research, development, production, and sale of micro-precision electro-acoustic components, and electroacoustic assemblies in China.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.