- China

- /

- Communications

- /

- SZSE:002583

Benign Growth For Hytera Communications Corporation Limited (SZSE:002583) Underpins Stock's 26% Plummet

Unfortunately for some shareholders, the Hytera Communications Corporation Limited (SZSE:002583) share price has dived 26% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 36% in that time.

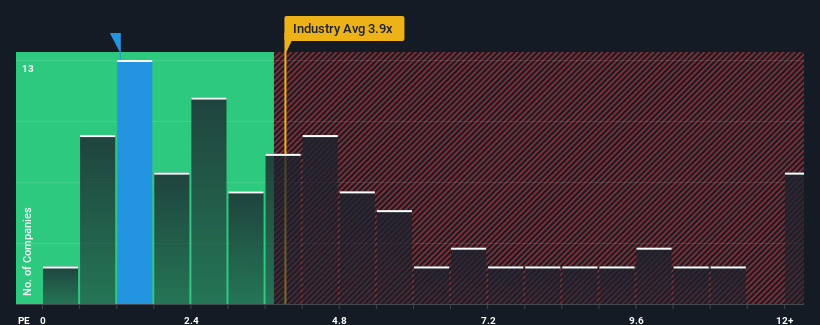

In spite of the heavy fall in price, Hytera Communications may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.2x, considering almost half of all companies in the Communications industry in China have P/S ratios greater than 3.9x and even P/S higher than 7x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Hytera Communications

What Does Hytera Communications' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Hytera Communications' revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Hytera Communications will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Hytera Communications would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a frustrating 5.4% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 24% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 19% as estimated by the dual analysts watching the company. That's shaping up to be materially lower than the 50% growth forecast for the broader industry.

In light of this, it's understandable that Hytera Communications' P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Having almost fallen off a cliff, Hytera Communications' share price has pulled its P/S way down as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Hytera Communications' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Hytera Communications that you need to be mindful of.

If these risks are making you reconsider your opinion on Hytera Communications, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hytera Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002583

Hytera Communications

Provides communications technologies and solutions under the Hytera brand name in China and internationally.

Excellent balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives