- China

- /

- Electronic Equipment and Components

- /

- SZSE:002579

Investors in Huizhou CEE Technology (SZSE:002579) from five years ago are still down 35%, even after 8.1% gain this past week

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But in any portfolio, there will be mixed results between individual stocks. At this point some shareholders may be questioning their investment in Huizhou CEE Technology Inc. (SZSE:002579), since the last five years saw the share price fall 37%. More recently, the share price has dropped a further 11% in a month. But this could be related to poor market conditions -- stocks are down 4.9% in the same time.

The recent uptick of 8.1% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Check out our latest analysis for Huizhou CEE Technology

Because Huizhou CEE Technology made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over five years, Huizhou CEE Technology grew its revenue at 5.7% per year. That's not a very high growth rate considering it doesn't make profits. Given this fairly low revenue growth (and lack of profits), it's not particularly surprising to see the stock down 6% (annualized) in the same time frame. The key question is whether the company can make it to profitability, and beyond, without trouble. Shareholders will want the company to approach profitability if it can't grow revenue any faster.

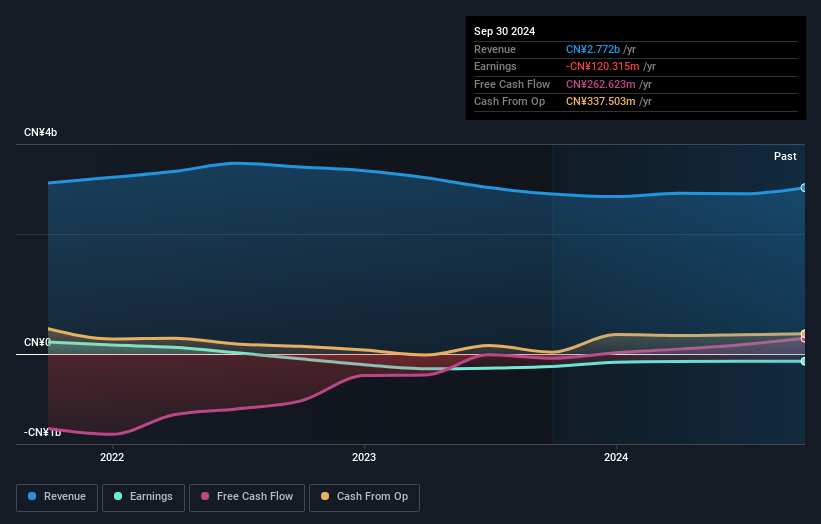

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Huizhou CEE Technology's financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Huizhou CEE Technology's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Huizhou CEE Technology's TSR of was a loss of 35% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Huizhou CEE Technology provided a TSR of 2.5% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 6% endured over half a decade. It could well be that the business is stabilizing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Huizhou CEE Technology has 2 warning signs we think you should be aware of.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Huizhou CEE Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002579

Huizhou CEE Technology

Researches and develops, produces, and sells printed circuit boards in China and internationally.

Slightly overvalued very low.