- China

- /

- Communications

- /

- SZSE:002544

This Broker Just Slashed Their Cetc Potevio Science&Technology Co.,Ltd. (SZSE:002544) Earnings Forecasts

Market forces rained on the parade of Cetc Potevio Science&Technology Co.,Ltd. (SZSE:002544) shareholders today, when the covering analyst downgraded their forecasts for this year. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting the analyst has soured majorly on the business. The stock price has risen 5.8% to CN¥24.90 over the past week. We'd be curious to see if the downgrade is enough to reverse investor sentiment on the business.

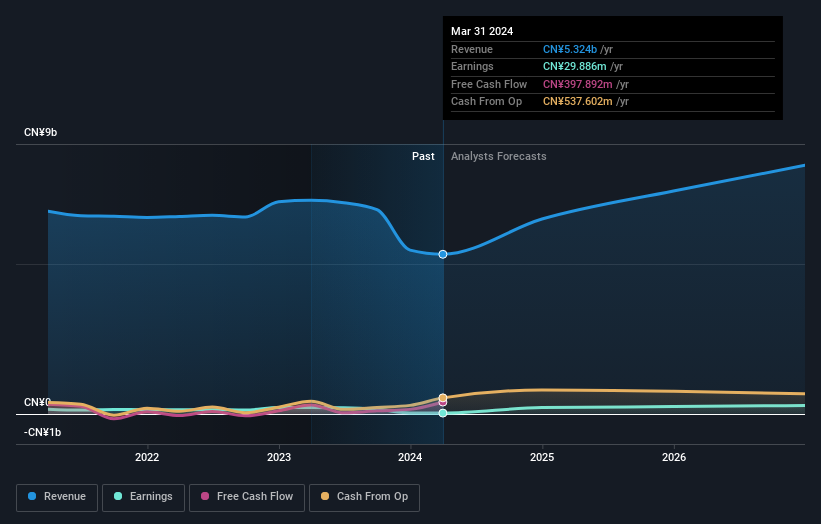

Following the downgrade, the most recent consensus for Cetc Potevio Science&TechnologyLtd from its single analyst is for revenues of CN¥6.5b in 2024 which, if met, would be a major 22% increase on its sales over the past 12 months. Statutory earnings per share are presumed to leap 608% to CN¥0.31. Prior to this update, the analyst had been forecasting revenues of CN¥7.9b and earnings per share (EPS) of CN¥0.41 in 2024. It looks like analyst sentiment has declined substantially, with a measurable cut to revenue estimates and a large cut to earnings per share numbers as well.

Check out our latest analysis for Cetc Potevio Science&TechnologyLtd

What's most unexpected is that the consensus price target rose 10.0% to CN¥26.76, strongly implying the downgrade to forecasts is not expected to be more than a temporary blip.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It's clear from the latest estimates that Cetc Potevio Science&TechnologyLtd's rate of growth is expected to accelerate meaningfully, with the forecast 22% annualised revenue growth to the end of 2024 noticeably faster than its historical growth of 0.2% p.a. over the past five years. Other similar companies in the industry (with analyst coverage) are also forecast to grow their revenue at 23% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that Cetc Potevio Science&TechnologyLtd is expected to grow at about the same rate as the wider industry.

The Bottom Line

The most important thing to take away is that the analyst cut their earnings per share estimates, expecting a clear decline in business conditions. Lamentably, they also downgraded their sales forecasts, but the business is still expected to grow at roughly the same rate as the market itself. The rising price target is a puzzle, but still - with a serious cut to this year's outlook, we wouldn't be surprised if investors were a bit wary of Cetc Potevio Science&TechnologyLtd.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At least one analyst has provided forecasts out to 2026, which can be seen for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002544

Cetc Potevio Science&TechnologyLtd

Provides network communication solutions in China.

Flawless balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion