- China

- /

- Auto Components

- /

- SZSE:002536

Unearthing December 2024's Undiscovered Gems with Growth Potential

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating consumer confidence and mixed economic indicators, small-cap stocks have shown resilience despite broader market volatility. With the S&P 600 for small-cap stocks reflecting these dynamics, identifying promising opportunities requires a keen eye for companies with solid fundamentals and growth potential amidst shifting economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Anhui Tuoshan Heavy Industry (SZSE:001226)

Simply Wall St Value Rating: ★★★★★☆

Overview: Anhui Tuoshan Heavy Industry Co., Ltd. focuses on the research, design, production, sale, and service of engineering machinery parts and assembly with a market capitalization of CN¥2.04 billion.

Operations: Anhui Tuoshan Heavy Industry generates revenue primarily from the sale of engineering machinery parts and assemblies. The company has a market capitalization of CN¥2.04 billion, reflecting its scale in the industry.

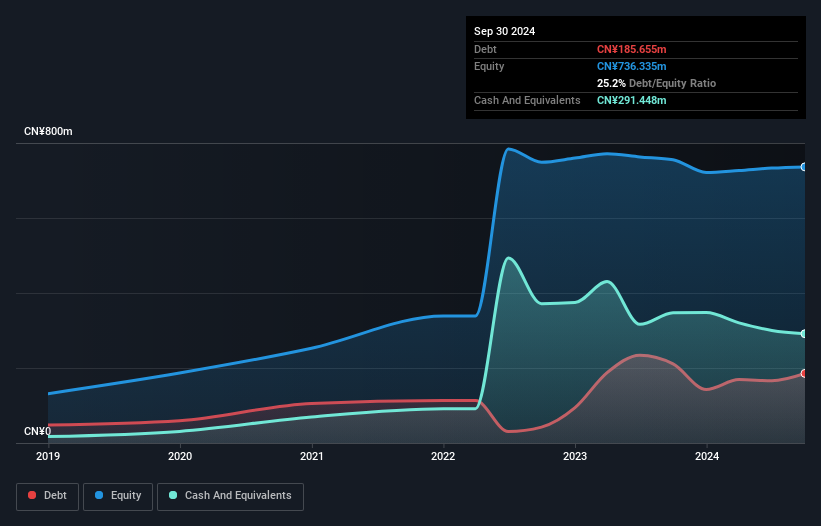

Anhui Tuoshan Heavy Industry, a company in the machinery sector, has shown notable progress over the past year. Its earnings grew by 6.4%, outpacing the industry average of -0.06%. The debt-to-equity ratio improved from 32.6% to 25.2% over five years, indicating better financial management. A significant one-off gain of CN¥4 million impacted recent results, while sales for nine months ending September 2024 increased to CN¥441 million from CN¥370 million a year earlier. Net income turned positive at CN¥15 million compared to a previous loss, reflecting an encouraging turnaround in performance despite challenges with free cash flow remaining negative.

- Unlock comprehensive insights into our analysis of Anhui Tuoshan Heavy Industry stock in this health report.

Learn about Anhui Tuoshan Heavy Industry's historical performance.

Jiangsu Yinhe ElectronicsLtd (SZSE:002519)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Yinhe Electronics Co., Ltd. operates in the fields of new energy electric vehicle components, defense and military special equipment, and digital TV intelligent terminal equipment both in China and internationally, with a market cap of CN¥7.03 billion.

Operations: Jiangsu Yinhe Electronics generates revenue through its involvement in new energy electric vehicle components, defense and military special equipment, and digital TV intelligent terminal equipment. The company's financial performance reflects a focus on these sectors with a market cap of CN¥7.03 billion.

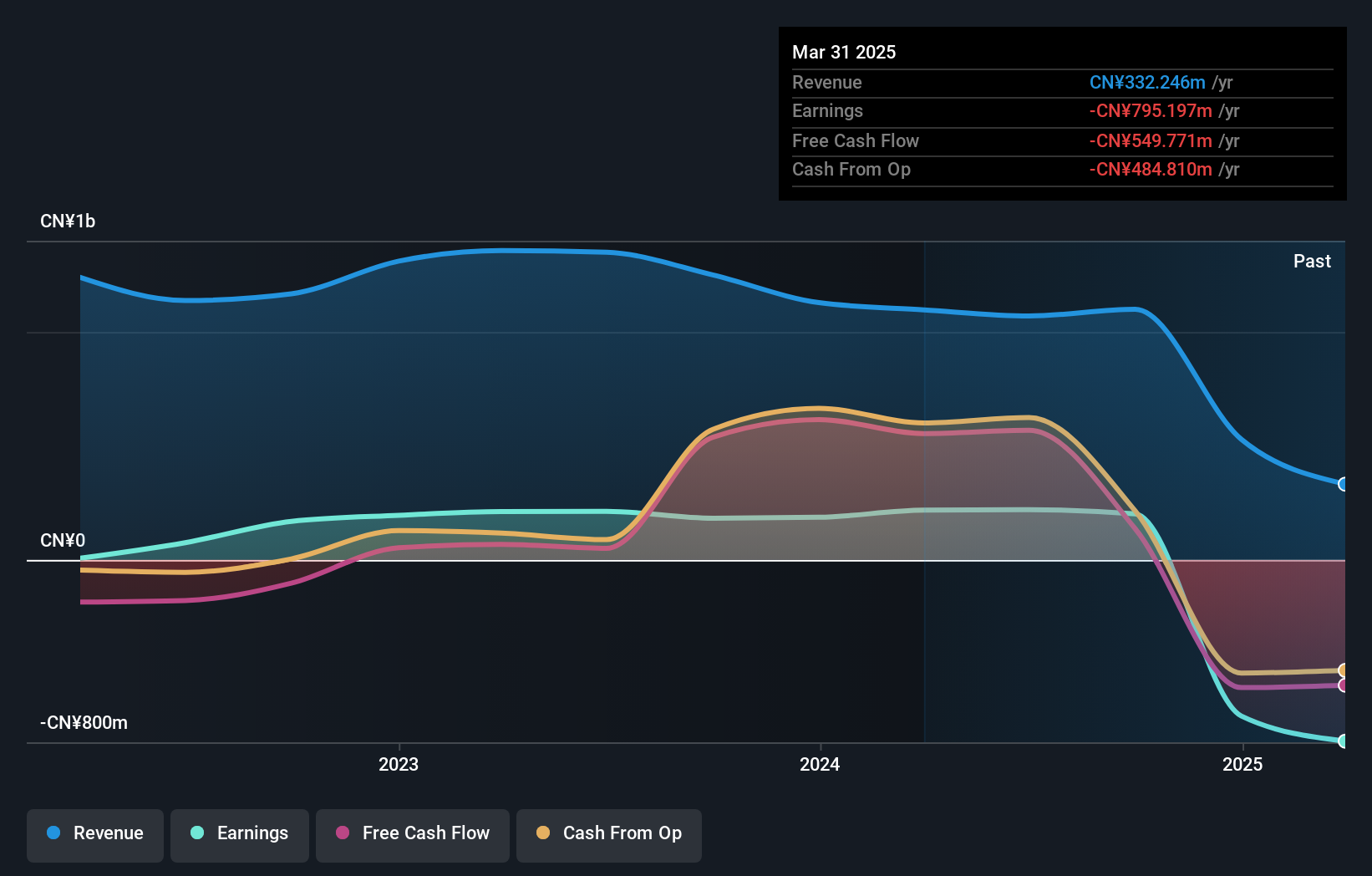

Jiangsu Yinhe Electronics, a nimble player in the electronics sector, showcases solid fundamentals with earnings growth of 10.7% over the past year, outpacing the industry's 1.9%. The company is debt-free now, a stark contrast to five years ago when its debt-to-equity ratio was 15.2%. This financial health is complemented by high-quality earnings and positive free cash flow. Despite sales dipping slightly to CNY 813 million from CNY 842 million last year, net income rose to CNY 141.95 million from CNY 126.82 million, reflecting resilience and effective cost management amidst market challenges.

- Get an in-depth perspective on Jiangsu Yinhe ElectronicsLtd's performance by reading our health report here.

Understand Jiangsu Yinhe ElectronicsLtd's track record by examining our Past report.

Feilong Auto Components (SZSE:002536)

Simply Wall St Value Rating: ★★★★★★

Overview: Feilong Auto Components Co., Ltd. processes, manufactures, and sells auto parts both in China and internationally, with a market cap of approximately CN¥6.91 billion.

Operations: Feilong Auto Components generates its revenue primarily from the sale of automotive parts, amounting to approximately CN¥4.50 billion.

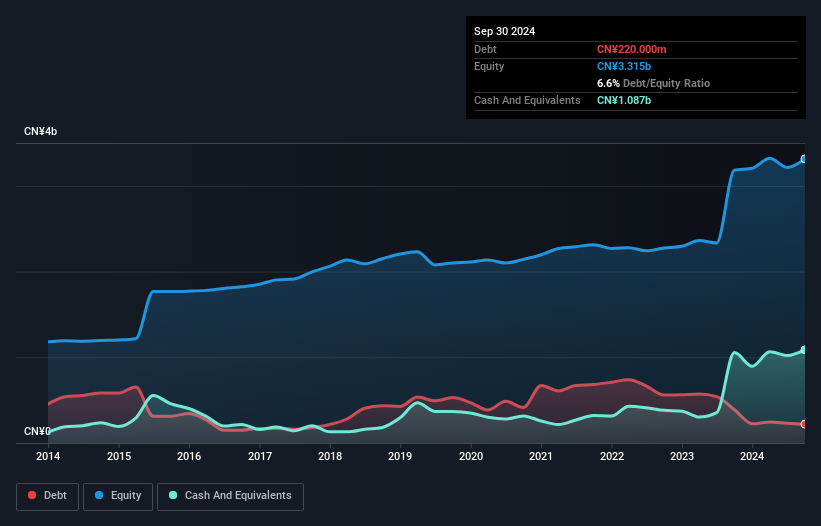

Feilong Auto Components, a relatively small player in the auto components industry, has demonstrated impressive earnings growth of 21% over the past year, outpacing the industry's 10.5%. With a price-to-earnings ratio of 22.8x, it trades at a favorable value compared to the CN market's 36.1x. The company enjoys high-quality earnings and has reduced its debt-to-equity ratio significantly from 25% to just under 7% over five years. Recent financials reveal sales for nine months ending September reached CNY 3.50 billion up from CNY 3.07 billion previously, with net income rising to CNY 266 million from CNY 225 million last year.

- Delve into the full analysis health report here for a deeper understanding of Feilong Auto Components.

Explore historical data to track Feilong Auto Components' performance over time in our Past section.

Next Steps

- Gain an insight into the universe of 4626 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002536

Feilong Auto Components

Feilong Auto Components Co., Ltd., together with its subsidiaries, process, manufactures, and sells automotive parts processing and manufacturing in China and internationally.

Flawless balance sheet with high growth potential and pays a dividend.

Market Insights

Community Narratives