- Hong Kong

- /

- Healthtech

- /

- SEHK:2192

Exploring None High Growth Tech Stocks with Promising Potential

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and interest rate expectations, major U.S. stock indices like the Nasdaq Composite have shown resilience by climbing toward record highs, although small-cap stocks have lagged behind their larger counterparts. In this environment, identifying high-growth tech stocks with promising potential requires a focus on companies that can adapt to economic shifts while maintaining robust innovation and scalability.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| eWeLLLtd | 25.36% | 25.10% | ★★★★★★ |

| AVITA Medical | 29.97% | 53.77% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 30.33% | 61.73% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.80% | 58.78% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Ascendis Pharma | 33.05% | 58.72% | ★★★★★★ |

Click here to see the full list of 1210 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Medlive Technology (SEHK:2192)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Medlive Technology Co., Ltd. operates an online professional physician platform in Mainland China and internationally with a market cap of HK$11.14 billion.

Operations: The company generates revenue primarily through its healthcare software segment, which contributed CN¥481.94 million. With a market cap of HK$11.14 billion, Medlive Technology focuses on leveraging its platform to cater to the needs of medical professionals in Mainland China and beyond.

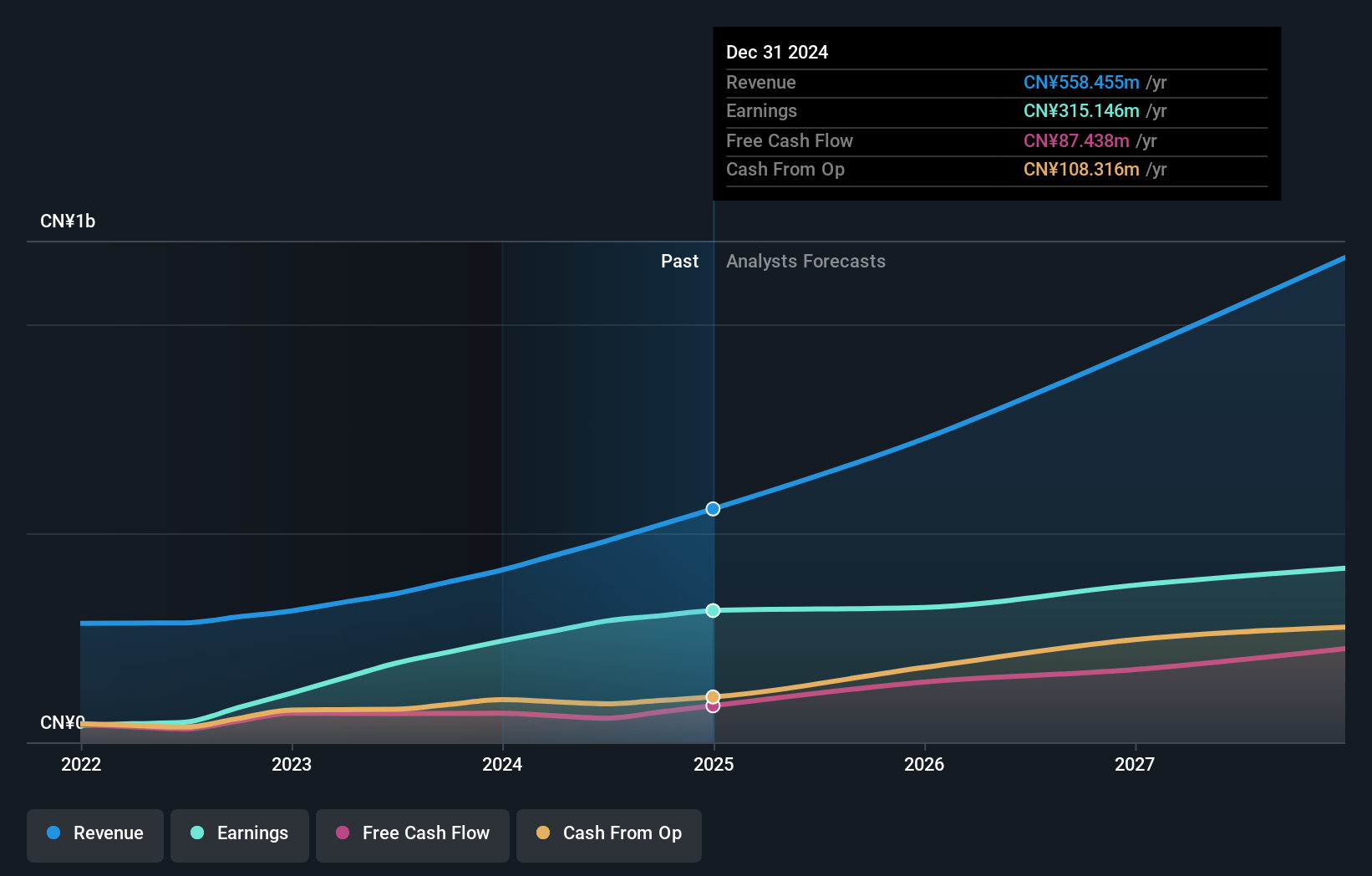

Medlive Technology, a standout in the healthcare tech sector, has demonstrated robust growth metrics that underscore its potential. With an impressive 23.8% annual revenue surge, far outpacing the Hong Kong market's average of 7.8%, Medlive is swiftly expanding its footprint. The company's earnings have similarly soared by 53.5% over the past year, eclipsing the industry's growth rate of 9.8%. This financial vitality is complemented by a strategic emphasis on R&D, ensuring Medlive remains at the forefront of innovation in healthcare solutions. Despite forecasts suggesting a modest Return on Equity at 5.5% in three years, ongoing investments and market expansion could enhance future prospects.

- Get an in-depth perspective on Medlive Technology's performance by reading our health report here.

Examine Medlive Technology's past performance report to understand how it has performed in the past.

Wus Printed Circuit (Kunshan) (SZSE:002463)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wus Printed Circuit (Kunshan) Co., Ltd. is involved in the research, development, design, manufacture, and sale of printed circuit boards in China with a market capitalization of CN¥77.76 billion.

Operations: Wus Printed Circuit (Kunshan) focuses on producing and selling printed circuit boards in China. The company's operations encompass research, development, and design activities to support its manufacturing processes.

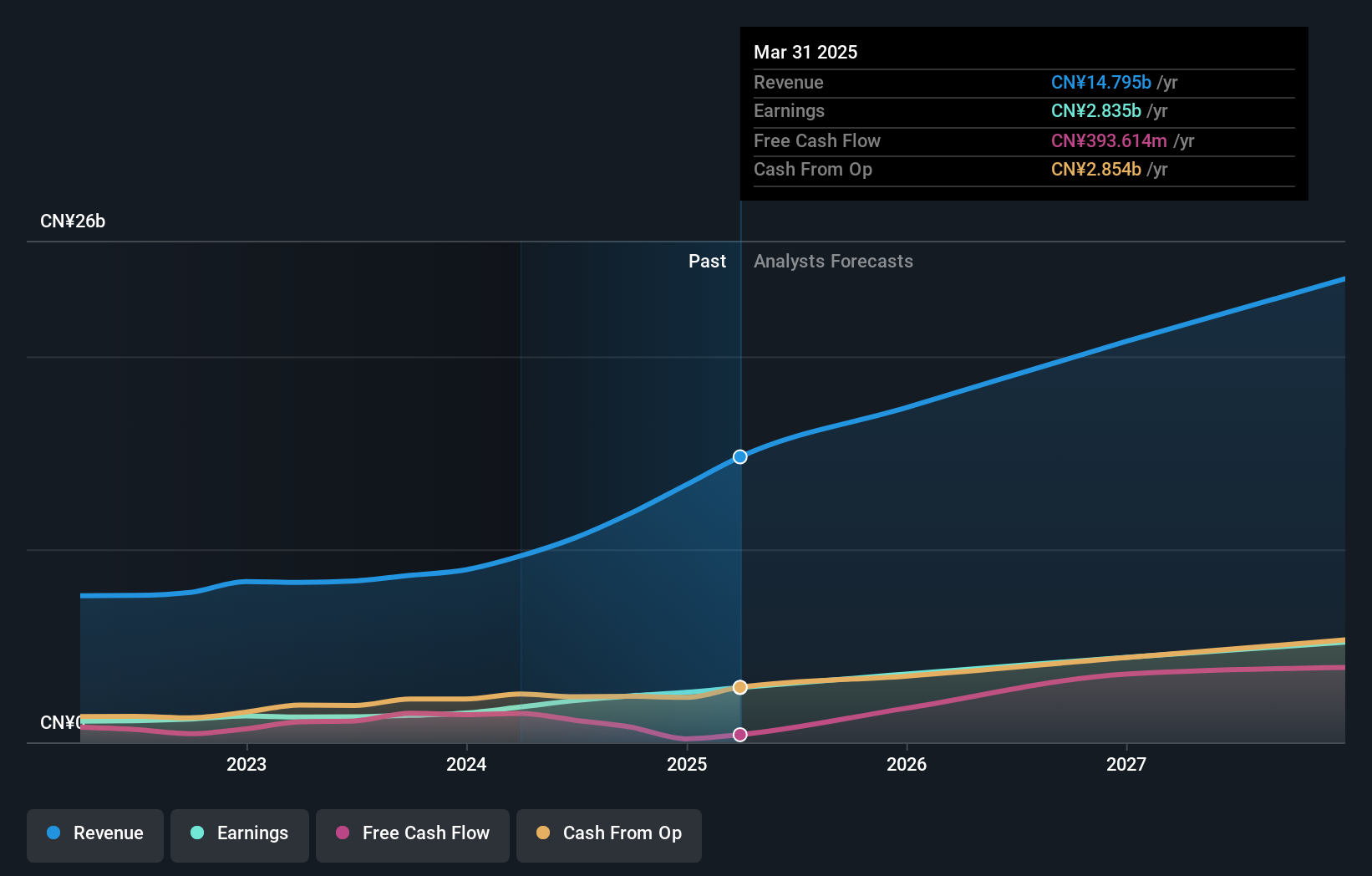

Wus Printed Circuit (Kunshan) has shown remarkable financial performance with a 71.1% increase in earnings last year, outstripping the electronic industry's growth of just 1.9%. This surge is supported by an aggressive R&D strategy, with expenses significantly contributing to innovative developments in circuit technology. Recent adjustments to the company's bylaws and strategic initiatives such as new project constructions underscore a proactive approach to scaling operations and enhancing governance structures. With revenue growing at 14.3% annually, faster than China's market average of 13.3%, Wus Printed Circuit is strategically positioned for sustained growth amidst evolving tech demands.

- Unlock comprehensive insights into our analysis of Wus Printed Circuit (Kunshan) stock in this health report.

Gain insights into Wus Printed Circuit (Kunshan)'s past trends and performance with our Past report.

Inventec (TWSE:2356)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Inventec Corporation, along with its subsidiaries, is involved in the development, manufacturing, processing, and trading of computers and related products across several regions including Taiwan, the United States, Japan, Hong Kong, Macao, Mainland China, and internationally; it has a market cap of NT$172.02 billion.

Operations: The core segment of Inventec Corporation generates NT$571.40 billion in revenue, significantly overshadowing its other department's NT$5.15 billion contribution. The company focuses on the development and trading of computers and related products across multiple regions, with a substantial market presence internationally.

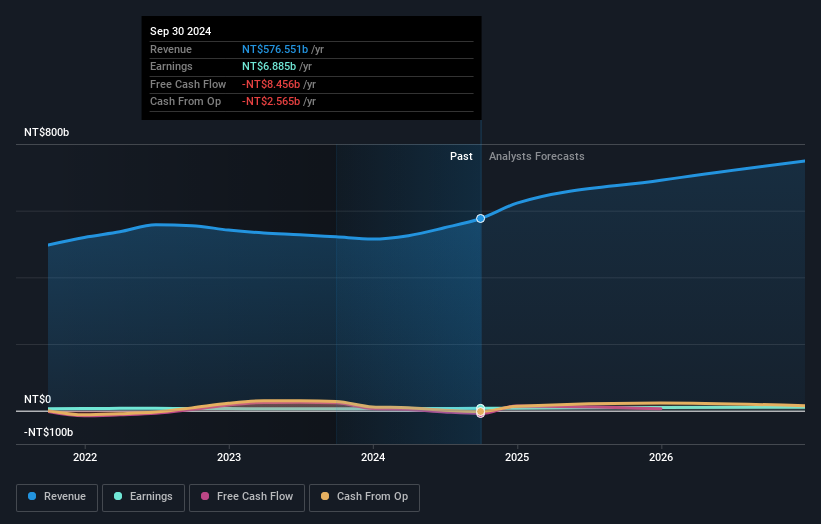

Inventec's strategic positioning in the tech industry is underscored by a robust 20.4% annual earnings growth and an 11.3% increase in revenue, outpacing the Taiwanese market average. The company's commitment to innovation is evident from its R&D spending, which has significantly contributed to its product development and competitive edge. Recent events like their presentation at the J.P. Morgan Taiwan CEO-CFO Conference highlight Inventec’s proactive engagement with investors and strategic focus on business operations updates, signaling ongoing momentum in their market sectors.

- Click here to discover the nuances of Inventec with our detailed analytical health report.

Review our historical performance report to gain insights into Inventec's's past performance.

Next Steps

- Reveal the 1210 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2192

Medlive Technology

Operates an online professional physician platform in Mainland China and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)