- Mexico

- /

- Oil and Gas

- /

- BMV:VISTA A

3 Growth Companies To Watch With Insider Ownership As High As 27%

Reviewed by Simply Wall St

As global markets rally in response to the Federal Reserve's recent rate cut, investors are increasingly optimistic about the economic outlook. Amid this positive sentiment, stocks with high insider ownership can offer unique advantages, as insiders' significant stakes often align their interests with those of shareholders and may indicate confidence in the company's growth prospects. In this favorable market environment, identifying companies where insiders hold substantial shares can be particularly compelling. Here are three growth companies to watch that boast insider ownership as high as 27%.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Yggdrazil Group (SET:YGG) | 12% | 85.5% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.7% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.3% | 95% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

Let's uncover some gems from our specialized screener.

Vista Energy. de (BMV:VISTA A)

Simply Wall St Growth Rating: ★★★★☆☆

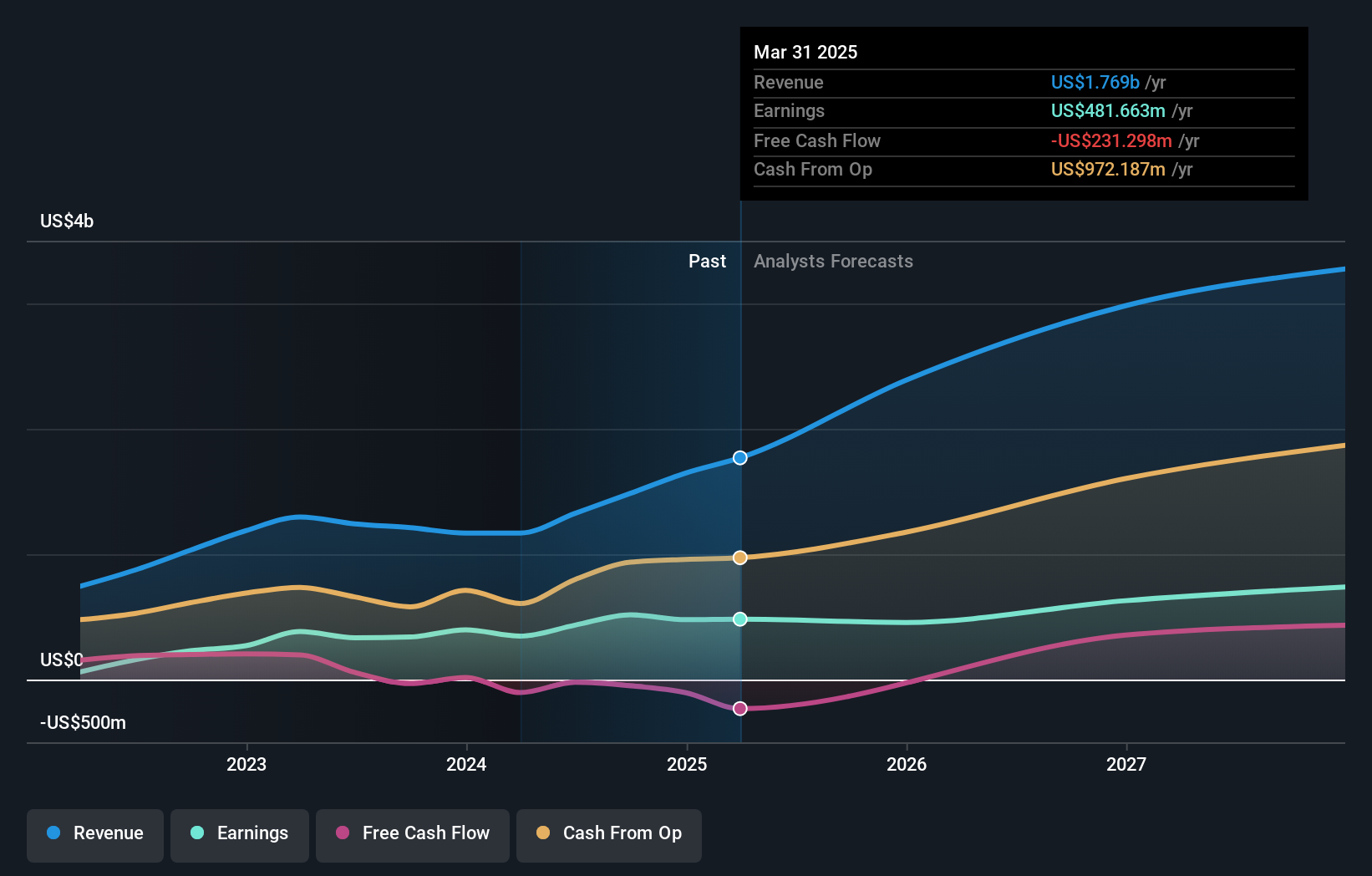

Overview: Vista Energy, S.A.B. de C.V., through its subsidiaries, engages in the exploration and production of oil and gas in Latin America and has a market cap of MX$87.52 billion.

Operations: The company's revenue from exploration and production of crude oil, natural gas, and LPG amounts to $1.33 billion.

Insider Ownership: 12.5%

Vista Energy, S.A.B. de C.V. shows strong growth potential with revenue forecasted to grow at 22.7% per year, outpacing the market's 7.1%. Earnings are projected to increase by 18.64% annually, though not significantly high, and have grown substantially in the past five years at 64.2%. Despite its high debt levels and volatile share price, Vista Energy is trading at a significant discount to its estimated fair value and has initiated a $50 million share buyback program for fiscal year 2025.

- Click to explore a detailed breakdown of our findings in Vista Energy. de's earnings growth report.

- Our valuation report here indicates Vista Energy. de may be undervalued.

Wuhan Guide Infrared (SZSE:002414)

Simply Wall St Growth Rating: ★★★★★☆

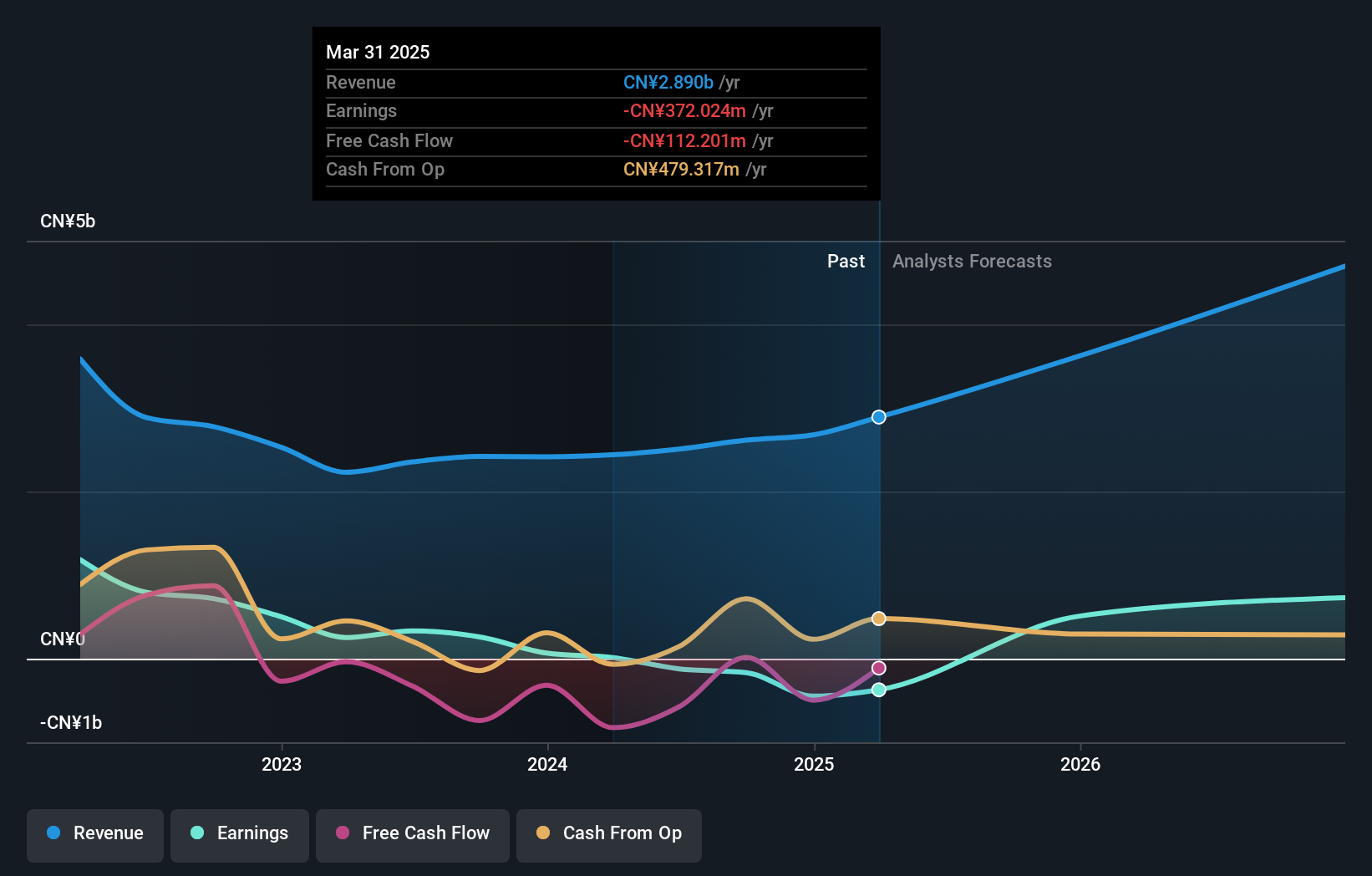

Overview: Wuhan Guide Infrared Co., Ltd. specializes in the research, development, production, and sale of infrared thermal imaging technology in Asia and has a market cap of CN¥26.05 billion.

Operations: The company's revenue segments include CN¥2.45 billion from Other Electronic Equipment Manufacturing, CN¥33.25 million from the Technical Service Industry, and CN¥7.68 million from the Leasing Industry.

Insider Ownership: 27.2%

Wuhan Guide Infrared Co., Ltd. is forecast to achieve substantial revenue growth of 23.3% annually, surpassing the Chinese market's 13.1%. Earnings are expected to grow at a robust 63.47% per year, with profitability anticipated within three years, which is above average market growth. Recent earnings showed sales of CNY 1.11 billion and revenue of CNY 1.15 billion for the first half of 2024, though net income dropped significantly to CNY 17.97 million from CNY 207.38 million a year ago.

- Take a closer look at Wuhan Guide Infrared's potential here in our earnings growth report.

- The analysis detailed in our Wuhan Guide Infrared valuation report hints at an inflated share price compared to its estimated value.

Songcheng Performance DevelopmentLtd (SZSE:300144)

Simply Wall St Growth Rating: ★★★★☆☆

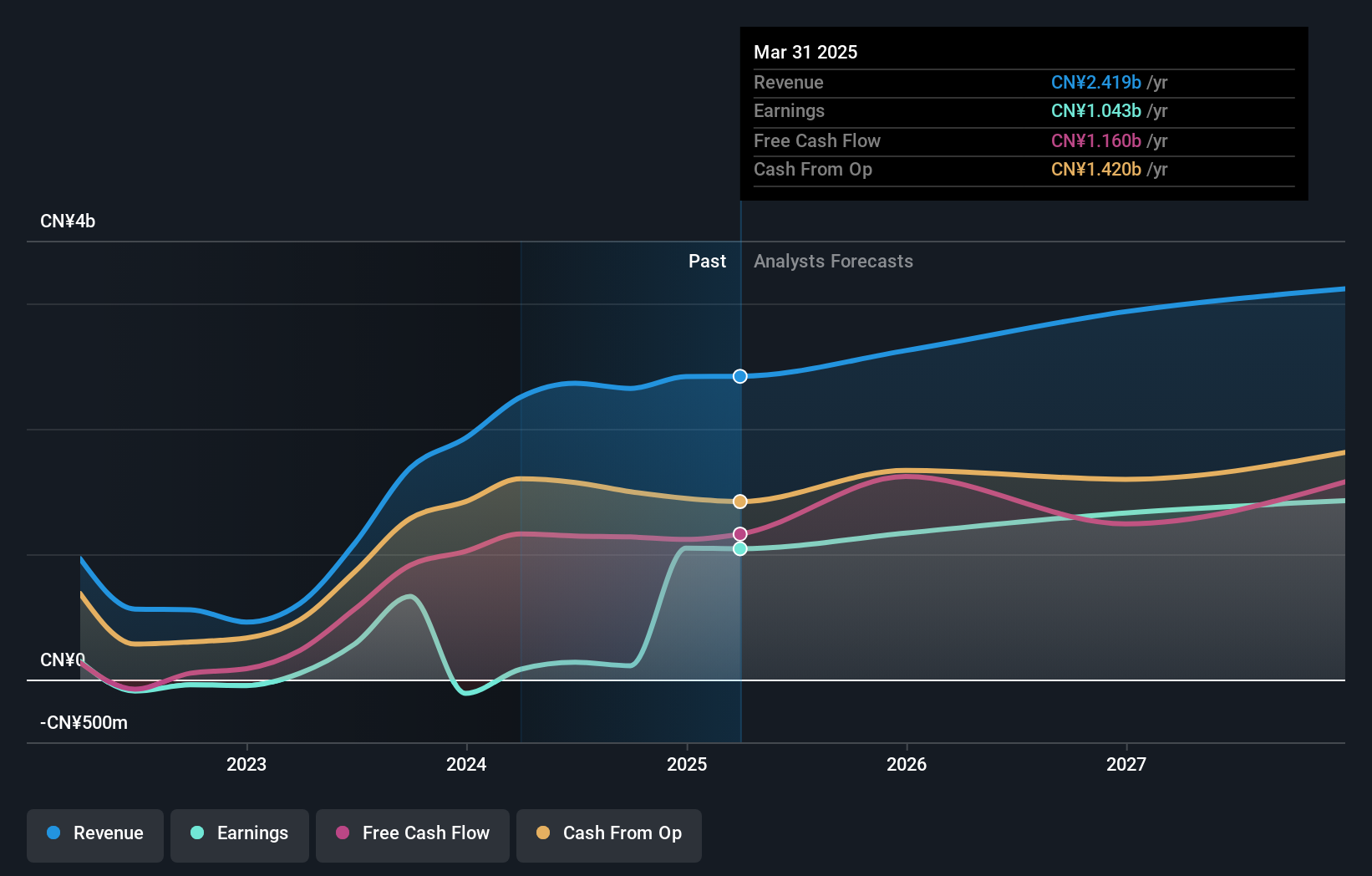

Overview: Songcheng Performance Development Co., Ltd operates in the performing arts industry in China and has a market cap of CN¥19.65 billion.

Operations: The company's revenue segments include ticket sales, which generated CN¥1.50 billion, and cultural and creative products, contributing CN¥0.75 billion.

Insider Ownership: 14.5%

Songcheng Performance Development Ltd. is projected to grow earnings at 47.72% per year, outpacing the Chinese market's 23%. Despite revenue growth of 13.3% annually being slower than desired, recent earnings showed a strong performance with net income rising to CNY 550.36 million from CNY 302.81 million a year ago. However, profit margins have declined from last year's levels and the dividend coverage remains weak, raising sustainability concerns despite trading below fair value estimates by 46.4%.

- Navigate through the intricacies of Songcheng Performance DevelopmentLtd with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Songcheng Performance DevelopmentLtd shares in the market.

Taking Advantage

- Discover the full array of 1520 Fast Growing Companies With High Insider Ownership right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:VISTA A

Vista Energy. de

Through its subsidiaries, engages in the exploration and production of oil and gas in Latin America.

Reasonable growth potential low.

Similar Companies

Market Insights

Community Narratives