- Mexico

- /

- Food and Staples Retail

- /

- BMV:FRAGUA B

December 2024's Noteworthy Stocks Estimated Below Intrinsic Value

Reviewed by Simply Wall St

As December 2024 unfolds, global markets have experienced a mixed bag of economic signals, with U.S. consumer confidence dipping and major indices showing moderate gains despite some mid-week reversals. In such an environment, identifying stocks that are estimated to be trading below their intrinsic value can present opportunities for investors seeking potential value plays amidst fluctuating market conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Corporativo Fragua. de (BMV:FRAGUA B) | MX$631.28 | MX$1257.07 | 49.8% |

| SKS Technologies Group (ASX:SKS) | A$1.935 | A$3.85 | 49.7% |

| Shenzhen Lifotronic Technology (SHSE:688389) | CN¥15.45 | CN¥30.82 | 49.9% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1130.65 | ₹2253.01 | 49.8% |

| Lindab International (OM:LIAB) | SEK228.20 | SEK452.08 | 49.5% |

| S Foods (TSE:2292) | ¥2757.00 | ¥5472.35 | 49.6% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| Infomart (TSE:2492) | ¥290.00 | ¥574.47 | 49.5% |

| Surgical Science Sweden (OM:SUS) | SEK159.60 | SEK317.20 | 49.7% |

| SkyCity Entertainment Group (NZSE:SKC) | NZ$1.45 | NZ$2.90 | 49.9% |

Let's uncover some gems from our specialized screener.

Corporativo Fragua. de (BMV:FRAGUA B)

Overview: Corporativo Fragua, S.A.B. de C.V. operates pharmacy stores under the Superfarmacia name in Mexico with a market cap of MX$60.44 billion.

Operations: The company generates revenue of MX$117.71 billion from its retail drug segment.

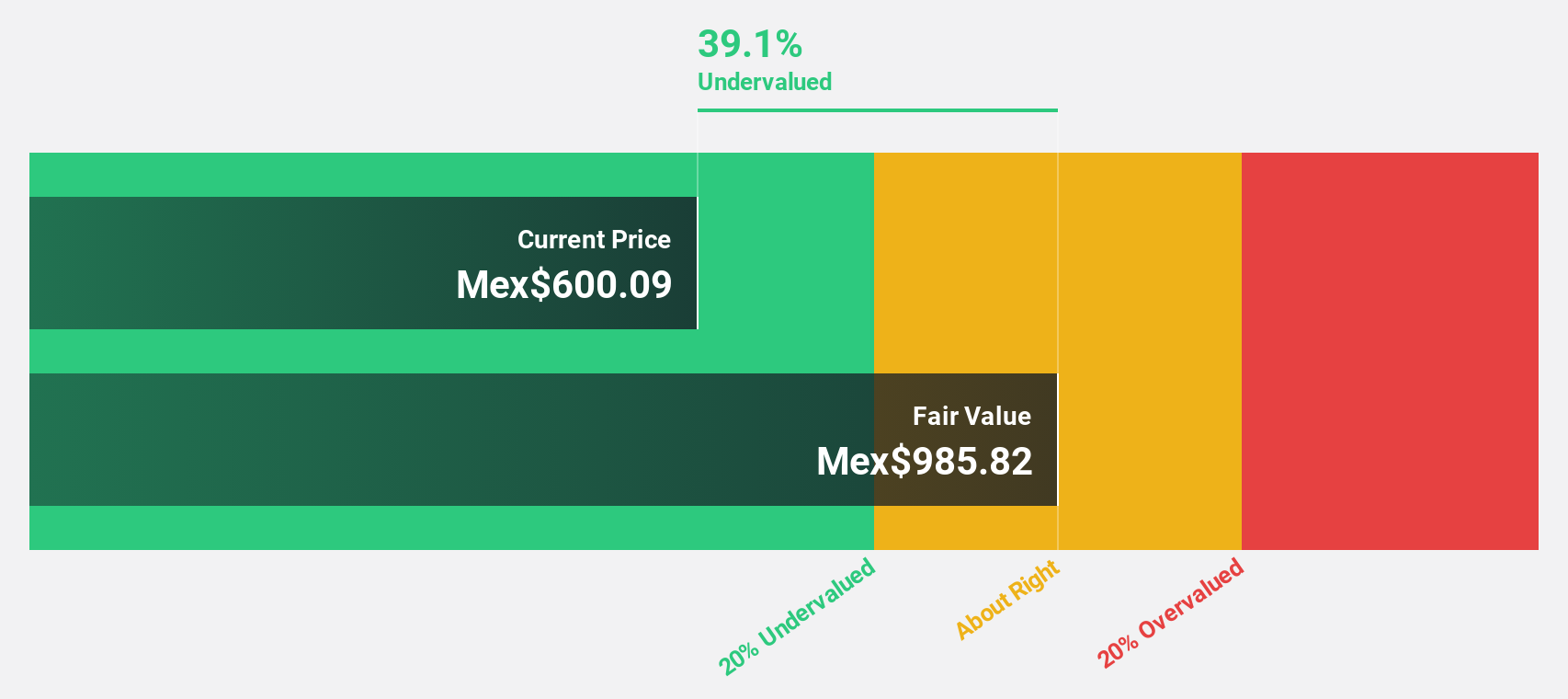

Estimated Discount To Fair Value: 49.8%

Corporativo Fragua appears undervalued, trading at approximately 49.8% below its estimated fair value of MX$1,257.07, with a current price around MX$631.28. Despite recent earnings showing a slight decline in net income for Q3 2024 compared to the previous year, profit growth is forecasted at 13.9% annually—outpacing the broader Mexican market's expected growth of 12.6%. However, share price volatility remains high over the past three months.

- The analysis detailed in our Corporativo Fragua. de growth report hints at robust future financial performance.

- Get an in-depth perspective on Corporativo Fragua. de's balance sheet by reading our health report here.

Jonhon Optronic Technology (SZSE:002179)

Overview: Jonhon Optronic Technology Co., Ltd. focuses on the research and development of optical, electrical, and fluid connection technologies and equipment in China, with a market cap of CN¥84.34 billion.

Operations: Jonhon Optronic Technology Co., Ltd. generates revenue through its development and provision of advanced optical, electrical, and fluid connection technologies and equipment within China.

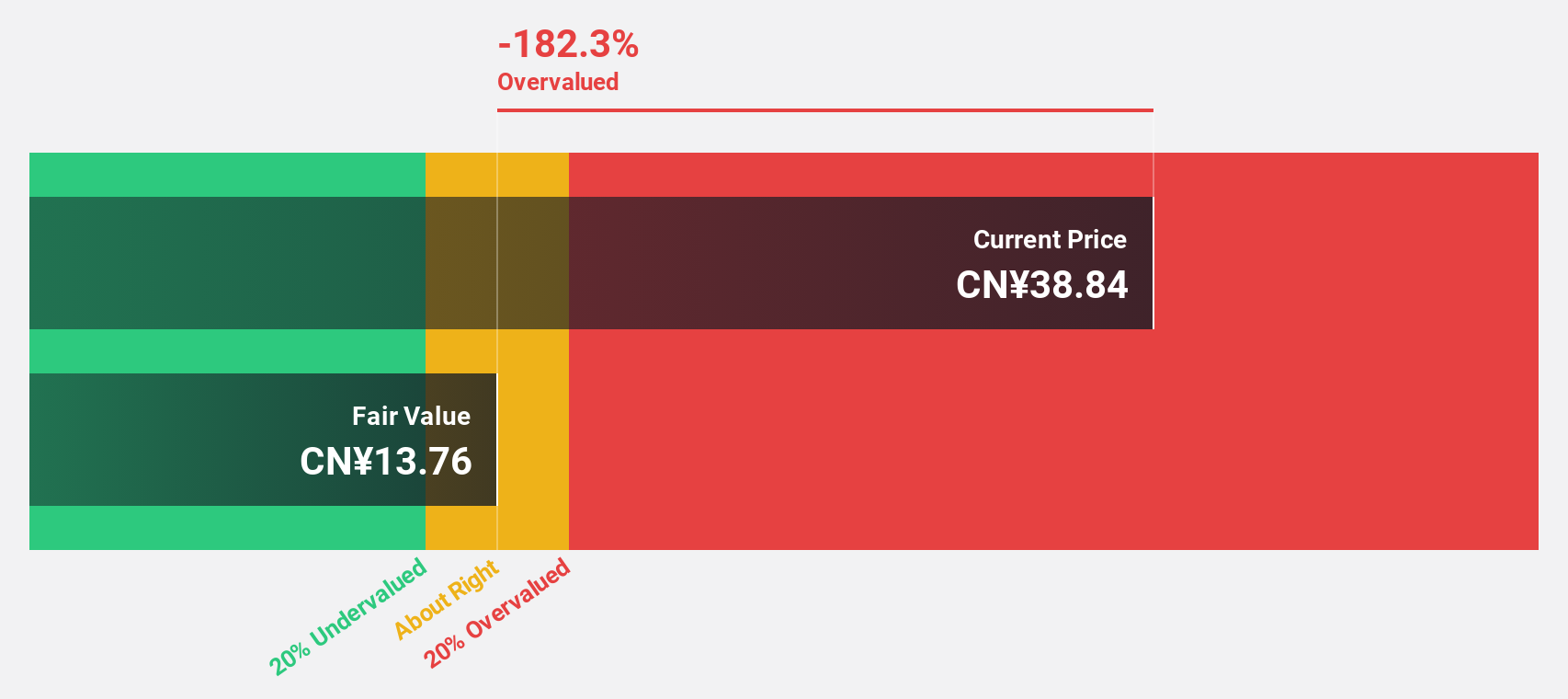

Estimated Discount To Fair Value: 26.9%

Jonhon Optronic Technology is trading at approximately 26.9% below its estimated fair value of CN¥54.41, with a current price around CN¥39.8. Despite a decline in revenue and net income for the first nine months of 2024 compared to the previous year, revenue is forecasted to grow at 22.2% annually—surpassing the Chinese market average of 13.7%. However, earnings growth slightly lags behind market expectations and dividend stability remains uncertain.

- Insights from our recent growth report point to a promising forecast for Jonhon Optronic Technology's business outlook.

- Take a closer look at Jonhon Optronic Technology's balance sheet health here in our report.

Schaeffler (XTRA:SHA0)

Overview: Schaeffler AG, along with its subsidiaries, specializes in the development, manufacturing, and sale of components and systems for industrial applications across Europe, the Americas, China, and the Asia Pacific regions, with a market cap of approximately €4.01 billion.

Operations: The company's revenue segments include Automotive Technologies at €9.73 billion, Vehicle Lifetime Solutions at €2.50 billion, and Bearings & Industrial Solutions at €3.99 billion.

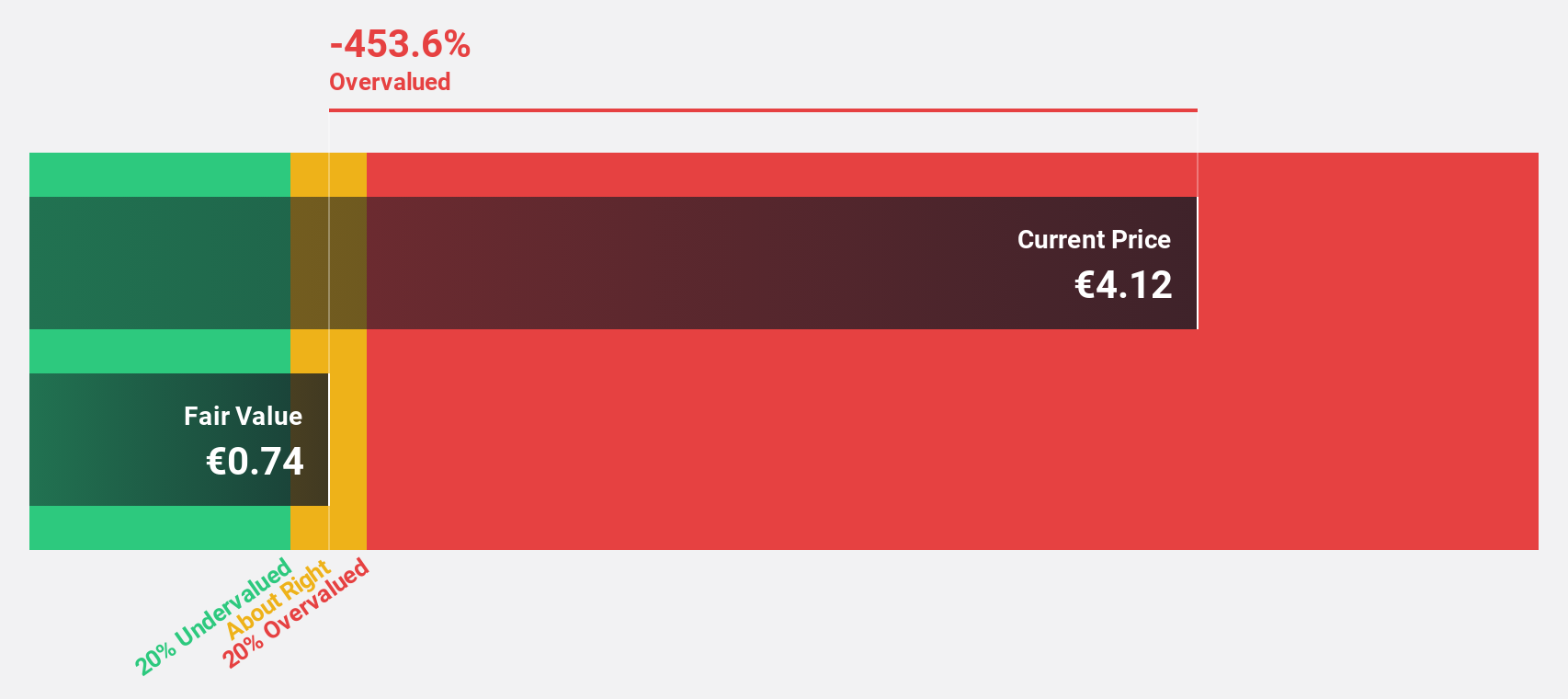

Estimated Discount To Fair Value: 40.6%

Schaeffler is trading 40.6% below its estimated fair value of €7.14, with a current price around €4.24, highlighting potential undervaluation based on cash flows. Despite significant forecasted earnings growth of over 70% annually, recent financial results show challenges: Q3 sales dropped to €3.96 billion from €4.06 billion year-on-year, and net income shifted to a loss of €13 million from a profit of €150 million last year.

- According our earnings growth report, there's an indication that Schaeffler might be ready to expand.

- Unlock comprehensive insights into our analysis of Schaeffler stock in this financial health report.

Key Takeaways

- Get an in-depth perspective on all 871 Undervalued Stocks Based On Cash Flows by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:FRAGUA B

Corporativo Fragua. de

Operates pharmacy stores under the Superfarmacia name in Mexico.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives