- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:314

Asian Penny Stocks To Watch In April 2025

Reviewed by Simply Wall St

Amidst a backdrop of global trade tensions and mixed performances across major indices, Asian markets have been navigating a complex economic landscape. As investors seek opportunities beyond the established giants, penny stocks—often representing smaller or newer companies—continue to capture interest due to their potential for surprising value. Despite the vintage feel of the term, these stocks can offer solid financial foundations and long-term potential; this article highlights three such examples that combine balance sheet strength with promising growth prospects.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Advice IT Infinite (SET:ADVICE) | THB4.68 | THB2.9B | ✅ 4 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.43 | SGD174.27M | ✅ 3 ⚠️ 3 View Analysis > |

| YKGI (Catalist:YK9) | SGD0.098 | SGD41.65M | ✅ 2 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.196 | SGD39.05M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.18 | SGD8.58B | ✅ 5 ⚠️ 0 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$3.91 | HK$44.76B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.07 | HK$675.12M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.09 | HK$1.82B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$1.95 | HK$1.62B | ✅ 4 ⚠️ 1 View Analysis > |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.14 | CN¥3.55B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,146 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Sipai Health Technology (SEHK:314)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sipai Health Technology Co., Ltd. is a medical technology and health management company operating in the People’s Republic of China, with a market cap of HK$3.39 billion.

Operations: The company's revenue is primarily derived from its Specialty Pharmacy Business, which generated CN¥3.97 billion, followed by the Physician Research Assistance Business at CN¥397.61 million and the Health Insurance Services Business contributing CN¥192.96 million.

Market Cap: HK$3.39B

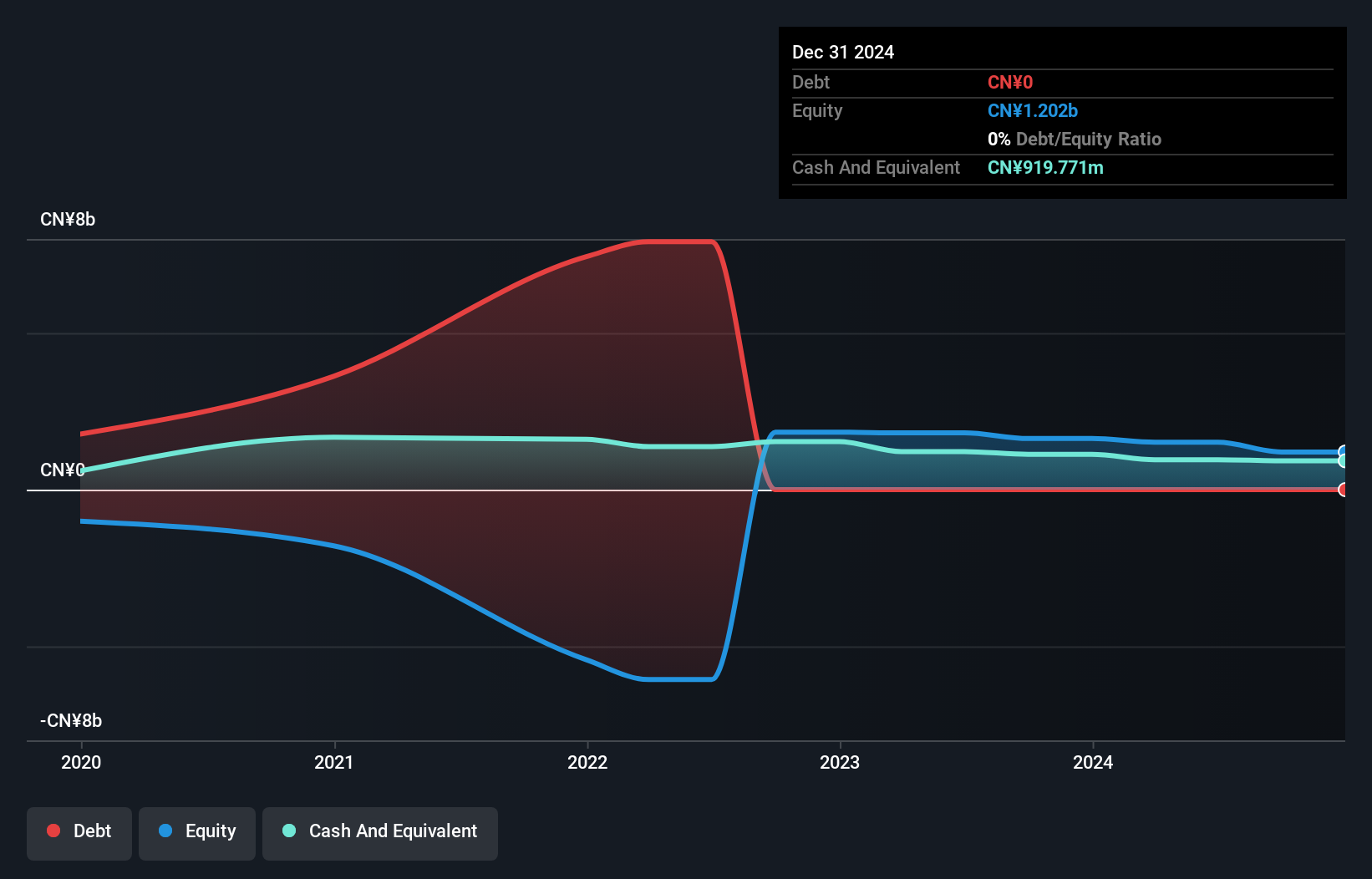

Sipai Health Technology, with a market cap of HK$3.39 billion, primarily generates revenue from its Specialty Pharmacy Business. Despite reporting sales of CN¥4.57 billion for 2024, the company remains unprofitable with a net loss of CN¥323.74 million. The board and management are experienced, averaging tenures over four years, while the company is debt-free and has short-term assets exceeding liabilities significantly. However, it faces challenges such as negative return on equity and recent delisting from OTC Equity due to inactivity, which may impact investor confidence in this volatile penny stock environment in Asia.

- Click here and access our complete financial health analysis report to understand the dynamics of Sipai Health Technology.

- Review our historical performance report to gain insights into Sipai Health Technology's track record.

Guangzhou Kingteller TechnologyLtd (SZSE:002177)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guangzhou Kingteller Technology Co., Ltd. specializes in the research, development, production, sale, and service of financial self-service equipment and software both in China and internationally, with a market cap of CN¥3.49 billion.

Operations: No specific revenue segments are reported for Guangzhou Kingteller Technology Co., Ltd.

Market Cap: CN¥3.49B

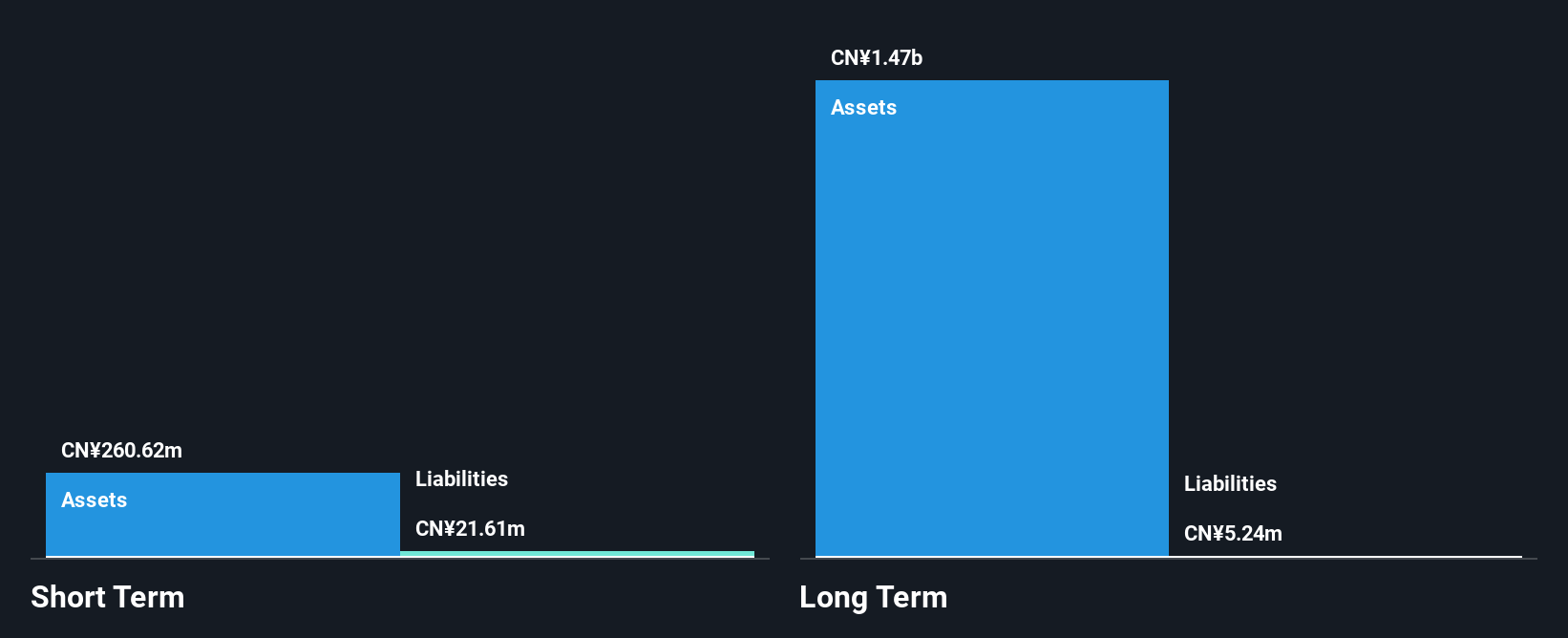

Guangzhou Kingteller Technology Co., Ltd. has a market cap of CN¥3.49 billion and reported first-quarter sales of CN¥15.34 million, down from the previous year, but net income rose to CN¥6.57 million. The company is debt-free with short-term assets significantly exceeding liabilities, which provides financial stability in the volatile penny stock landscape. However, its return on equity is low at 0.7%, and recent earnings growth has been negative compared to industry averages, impacted by a significant one-off loss of CN¥10.1 million over the past year, affecting overall profitability assessments.

- Take a closer look at Guangzhou Kingteller TechnologyLtd's potential here in our financial health report.

- Learn about Guangzhou Kingteller TechnologyLtd's historical performance here.

Zhejiang Zhongcheng Packing Material (SZSE:002522)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Zhongcheng Packing Material Co., Ltd. (SZSE:002522) operates in the packaging materials industry and has a market cap of CN¥4.09 billion.

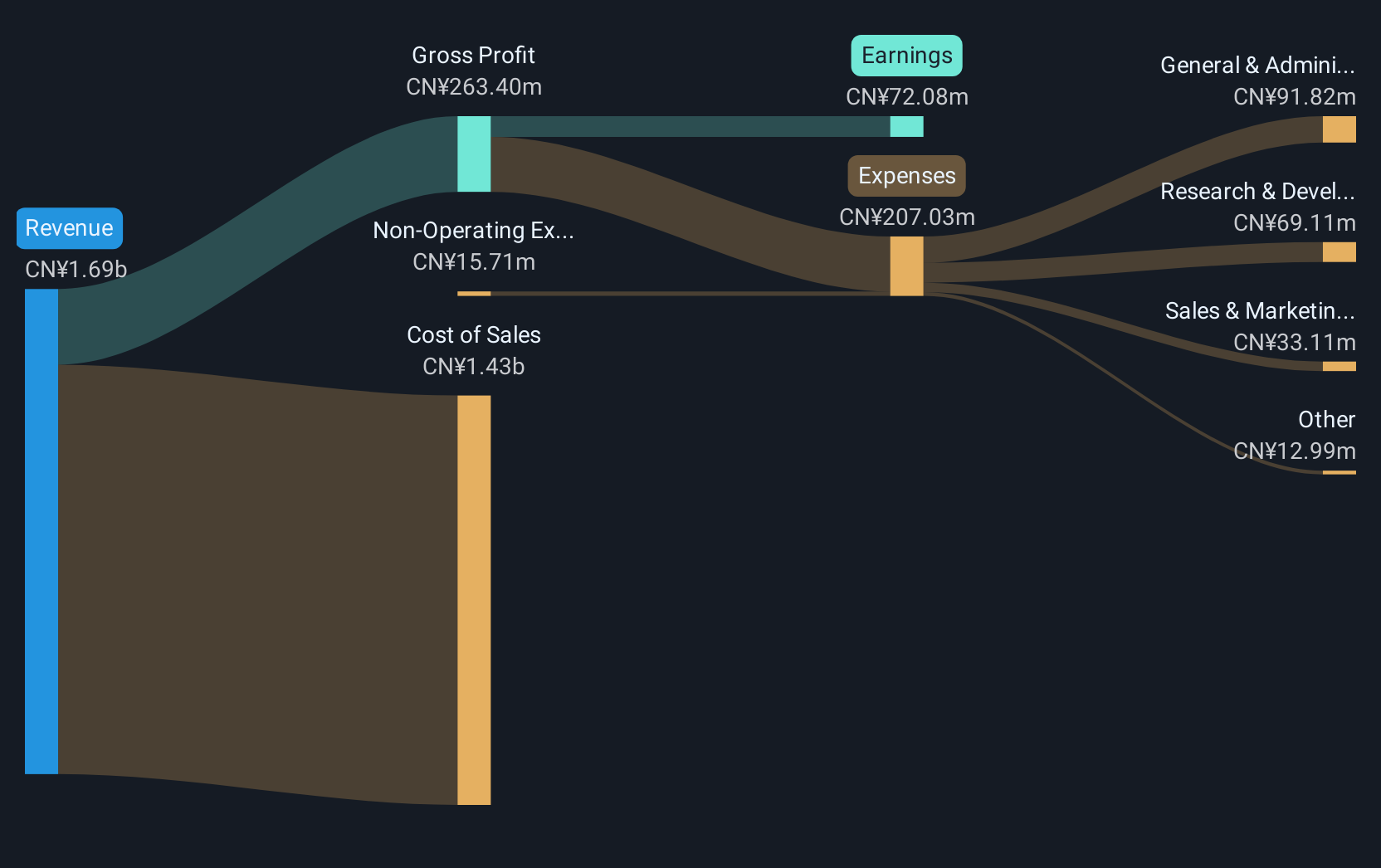

Operations: The company's revenue is primarily derived from two segments: Plastic Products, contributing CN¥880.12 million, and Synthetic Rubber Manufacturing, generating CN¥766.52 million.

Market Cap: CN¥4.09B

Zhejiang Zhongcheng Packing Material Co., Ltd. has a market cap of CN¥4.09 billion, with revenue primarily from plastic products and synthetic rubber manufacturing, totaling CN¥1.71 billion for 2024. Despite stable weekly volatility, the company faces challenges with declining earnings growth and reduced net profit margins from 6% to 4.3%. The management team is experienced with an average tenure of over four years, and its debt is well-covered by operating cash flow at 27%, indicating financial prudence in managing liabilities despite a volatile share price recently impacting investor sentiment in the penny stock sector.

- Navigate through the intricacies of Zhejiang Zhongcheng Packing Material with our comprehensive balance sheet health report here.

- Explore historical data to track Zhejiang Zhongcheng Packing Material's performance over time in our past results report.

Taking Advantage

- Unlock more gems! Our Asian Penny Stocks screener has unearthed 1,143 more companies for you to explore.Click here to unveil our expertly curated list of 1,146 Asian Penny Stocks.

- Seeking Other Investments? We've found 24 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:314

Sipai Health Technology

Operates as a medical technology and health management company in the People’s Republic of China.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives