High Growth Tech Stocks in Asia Featuring Three Promising Picks

Reviewed by Simply Wall St

Amid escalating trade tensions and fluctuating consumer sentiment, Asian markets have been navigating a complex economic landscape, with key indices reflecting both challenges and opportunities. In this environment, high growth tech stocks in Asia are drawing attention for their potential to capitalize on technological advancements and regional economic dynamics. Identifying promising stocks often involves evaluating their ability to innovate, adapt to market changes, and leverage emerging technologies effectively.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Zhongji Innolight | 28.24% | 28.10% | ★★★★★★ |

| Xi'an NovaStar Tech | 30.60% | 36.56% | ★★★★★★ |

| Shanghai Baosight SoftwareLtd | 20.81% | 26.05% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 26.94% | 24.43% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| PharmaResearch | 20.73% | 27.75% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Dmall (SEHK:2586)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dmall Inc. is an investment holding company that offers retail digitalization solutions to retailers across several countries, including China and Southeast Asia, with a market capitalization of HK$10.88 billion.

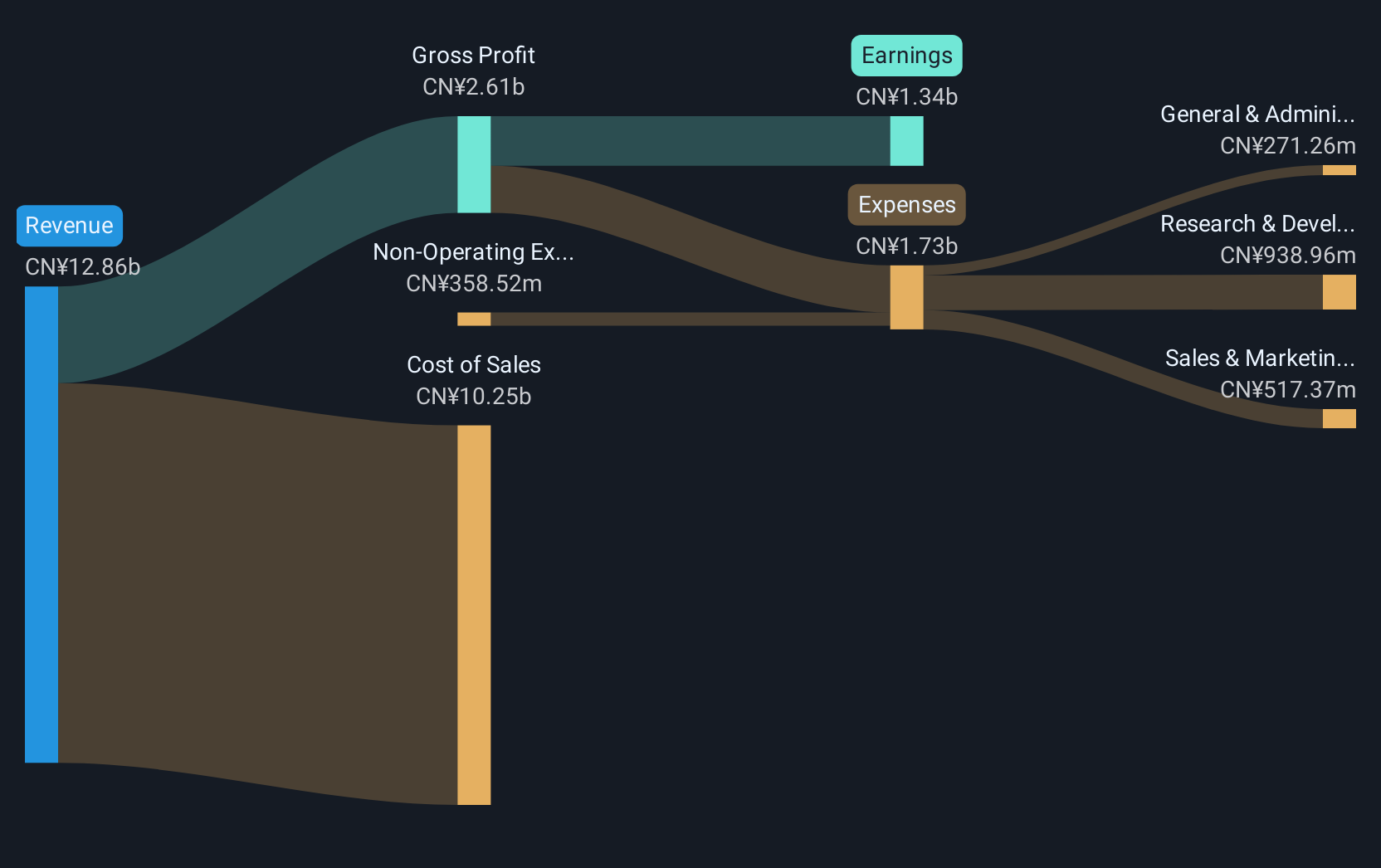

Operations: Dmall Inc. generates revenue primarily through its Retail Core Service Cloud, contributing CN¥1.81 billion, while the E-Commerce Service Cloud adds CN¥4.28 million. The company focuses on providing digital solutions to retailers across multiple regions, including China and Southeast Asia.

Dmall, navigating through a challenging fiscal year, reported a significant net loss of CNY 2.2 billion in 2024, deepening from CNY 592.36 million the previous year, despite a revenue increase to CNY 1.86 billion from CNY 1.59 billion. This contrast highlights aggressive expansion efforts amidst tough market conditions. The company is poised for recovery with projected annual earnings growth of 107.34% and revenue growth outpacing the Hong Kong market at 15.1% annually versus an average of 8.2%. These figures suggest Dmall is investing heavily in future capabilities, potentially setting the stage for a turnaround if it can streamline costs and enhance operational efficiency.

- Navigate through the intricacies of Dmall with our comprehensive health report here.

Review our historical performance report to gain insights into Dmall's's past performance.

Huagong Tech (SZSE:000988)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Huagong Tech Company Limited operates in the manufacturing and sale of laser equipment, hologram products, optical communication devices, and electronic components globally, with a market capitalization of CN¥37.91 billion.

Operations: Huagong Tech generates revenue primarily from the production and sales of optoelectronic devices (CN¥3.99 billion), laser processing equipment, and intelligent manufacturing (CN¥3.58 billion). The company also earns from sensitive components (CN¥3.67 billion) and laser holographic film production and sales (CN¥437.24 million).

Huagong Tech has demonstrated robust financial health, with its revenue climbing to CNY 11.71 billion, up from CNY 10.31 billion last year, and net income increasing to CNY 1.22 billion from CNY 1.01 billion in the previous period. This growth is underpinned by a significant R&D commitment, evidenced by a notable increase in annualized revenue growth of 20.3% and earnings growth of 23%. The company's strategic focus on innovation is further highlighted by its latest dividend proposal, suggesting confidence in sustained profitability and cash flow generation. As Huagong continues to expand its technological capabilities in a competitive market, these financial metrics suggest it is well-positioned to leverage industry trends favorably.

- Click here to discover the nuances of Huagong Tech with our detailed analytical health report.

Understand Huagong Tech's track record by examining our Past report.

OMRON (TSE:6645)

Simply Wall St Growth Rating: ★★★★☆☆

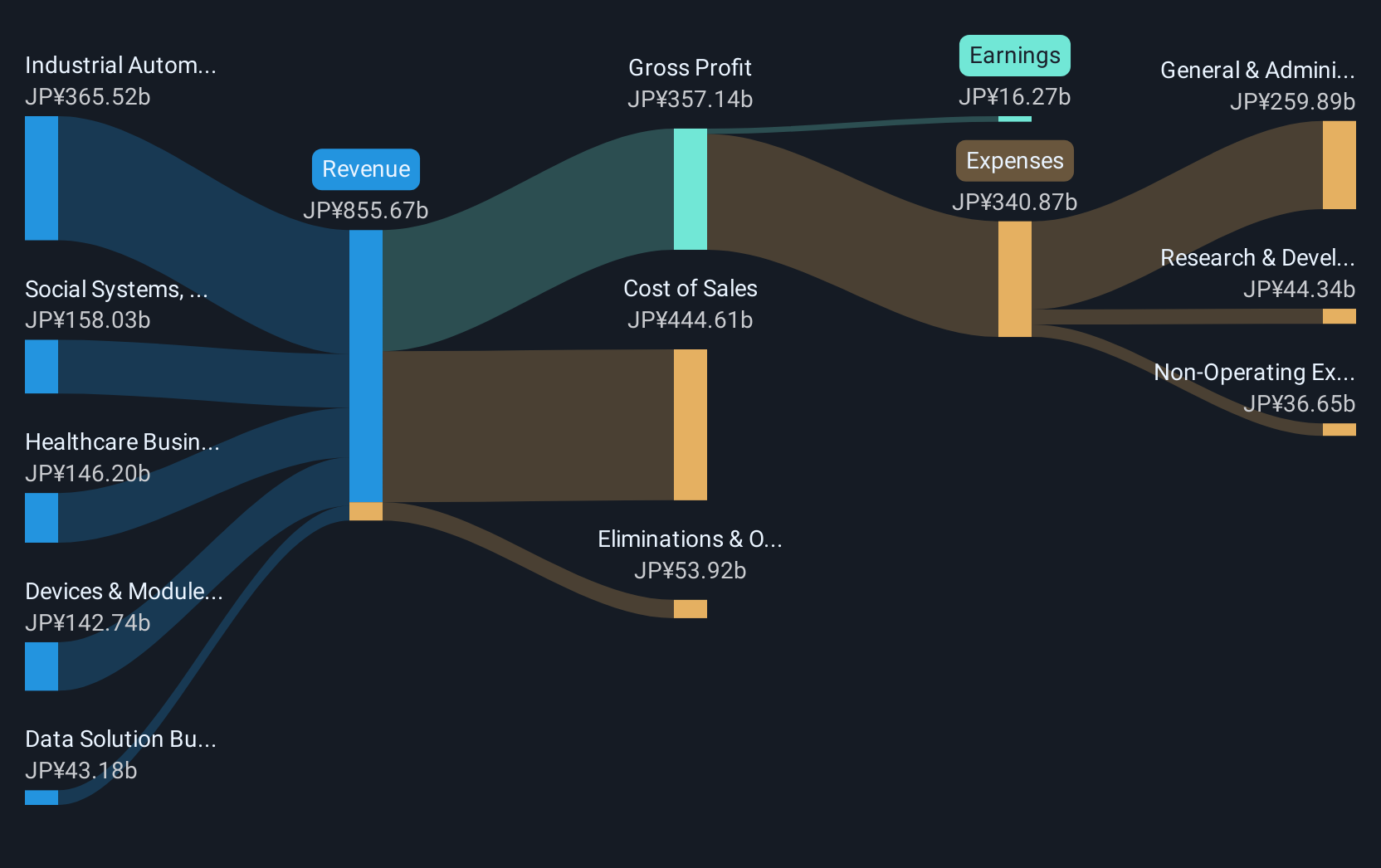

Overview: OMRON Corporation operates globally in industrial automation, device and module solutions, social systems, and healthcare sectors with a market capitalization of approximately ¥811.60 billion.

Operations: OMRON's primary revenue stream is the Industrial Automation Business, generating ¥362.48 billion, followed by Social Systems at ¥156.33 billion and Healthcare at ¥144.60 billion. The Devices & Module Solutions sector contributes ¥140.41 billion, while the Data Solution Business adds ¥40.81 billion to its revenue mix.

OMRON's recent upward revision in its earnings guidance reflects a positive trajectory, with expected net income rising to JPY 12.5 billion from an earlier forecast of JPY 11 billion. This adjustment, indicative of stronger operational performance, aligns with a notable annualized earnings growth projection of 41.3%. Despite challenges such as a modest revenue growth rate at 5.5% per year and lower profit margins at 0.9%, the company is actively leveraging R&D investments to innovate and stay competitive in the high-tech industry landscape in Asia. These strategic efforts are underscored by substantial fixed-income offerings aimed at bolstering long-term financial stability and fueling future growth initiatives.

- Unlock comprehensive insights into our analysis of OMRON stock in this health report.

Explore historical data to track OMRON's performance over time in our Past section.

Key Takeaways

- Click this link to deep-dive into the 493 companies within our Asian High Growth Tech and AI Stocks screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Dmall, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2586

Dmall

An investment holding company, provides retail digitalization solutions to retailers in China, Hong Kong, Cambodia, Singapore, Malaysia, Poland, Macau, Indonesia, the Philippines, and Brunei.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives