- China

- /

- Tech Hardware

- /

- SZSE:000977

Inspur Electronic Information Industry Co., Ltd.'s (SZSE:000977) Shares Climb 29% But Its Business Is Yet to Catch Up

Inspur Electronic Information Industry Co., Ltd. (SZSE:000977) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 98% in the last year.

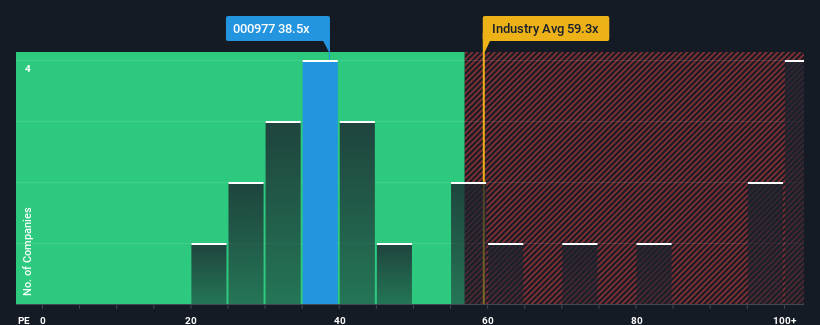

In spite of the firm bounce in price, it's still not a stretch to say that Inspur Electronic Information Industry's price-to-earnings (or "P/E") ratio of 38.5x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 36x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been pleasing for Inspur Electronic Information Industry as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Inspur Electronic Information Industry

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Inspur Electronic Information Industry's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 92%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 9.6% during the coming year according to the twelve analysts following the company. That's shaping up to be materially lower than the 38% growth forecast for the broader market.

In light of this, it's curious that Inspur Electronic Information Industry's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Bottom Line On Inspur Electronic Information Industry's P/E

Its shares have lifted substantially and now Inspur Electronic Information Industry's P/E is also back up to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Inspur Electronic Information Industry currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You always need to take note of risks, for example - Inspur Electronic Information Industry has 2 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000977

Inspur Electronic Information Industry

Inspur Electronic Information Industry Co., Ltd.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives