In the current global market landscape, major stock indices have shown moderate gains despite a decline in U.S. consumer confidence and mixed economic indicators, with the technology-heavy Nasdaq Composite leading earlier in the week before giving back some of its gains. As investors navigate this environment, identifying high-growth tech stocks requires careful consideration of factors such as innovation potential, market demand for technology solutions, and resilience to economic fluctuations.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1263 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Suzhou TZTEK Technology (SHSE:688003)

Simply Wall St Growth Rating: ★★★★★☆

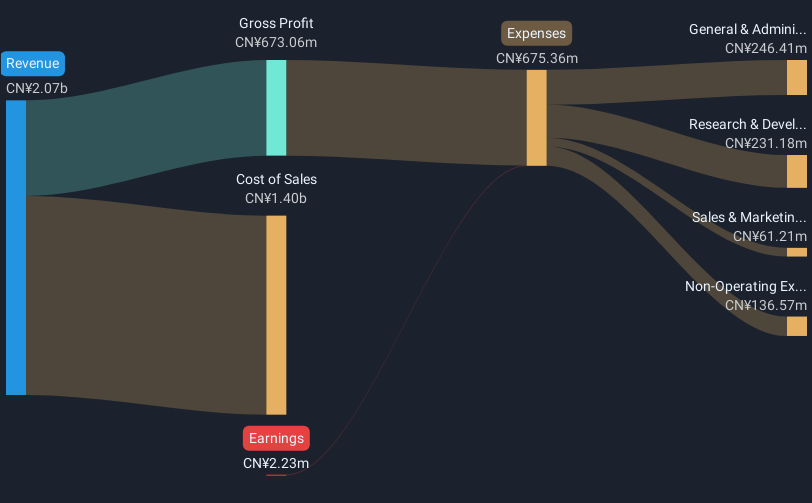

Overview: Suzhou TZTEK Technology Co., Ltd specializes in the design, development, assembly, and debugging of industrial vision equipment in China with a market cap of CN¥8.01 billion.

Operations: Suzhou TZTEK Technology focuses on industrial vision equipment, generating revenue through designing, developing, assembling, and debugging these systems. The company operates primarily within China and has a market capitalization of CN¥8.01 billion.

Suzhou TZTEK Technology, despite a challenging fiscal period with a net loss of CNY 13.67 million compared to last year's net income of CNY 41.05 million, shows promise with its strategic focus on research and development (R&D). The company’s commitment to innovation is evident from its R&D expenses, crucial for staying competitive in the high-tech industry. Interestingly, while recent share buyback initiatives have not significantly reduced outstanding shares, the company's forecasted earnings growth at an impressive rate of 35.4% annually outpaces the broader Chinese market's average of 25.1%. This aggressive growth trajectory coupled with a revenue increase expectation of 22.3% annually suggests that Suzhou TZTEK is positioning itself robustly for future advancements and market demands.

- Take a closer look at Suzhou TZTEK Technology's potential here in our health report.

Assess Suzhou TZTEK Technology's past performance with our detailed historical performance reports.

UniTTECLtd (SZSE:000925)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: UniTTEC Co., Ltd offers integrated solutions for rail transit and energy saving and environmental protection in China, with a market capitalization of CN¥5.39 billion.

Operations: UniTTEC Co., Ltd focuses on providing integrated solutions for rail transit and energy-saving environmental protection within China. The company generates revenue through these specialized sectors, contributing to its market presence.

UniTTECLtd, navigating a challenging fiscal landscape with a reported net loss of CNY 87.21 million for the nine months ending September 2024, contrasts sharply with its previous year's performance. Despite these financial setbacks, the company's dedication to innovation remains steadfast, marked by an aggressive investment in R&D which is crucial for maintaining competitiveness in the tech sector. This strategic focus on development is underscored by an annualized revenue growth rate of 16.4%, positioning UniTTECLtd to potentially outpace the broader market's growth. Moreover, its recent dividend affirmation reflects a commitment to shareholder returns amidst financial recalibrations, suggesting an optimistic outlook for recovery and future profitability.

- Navigate through the intricacies of UniTTECLtd with our comprehensive health report here.

Review our historical performance report to gain insights into UniTTECLtd's's past performance.

Guangzhou Sie Consulting (SZSE:300687)

Simply Wall St Growth Rating: ★★★★☆☆

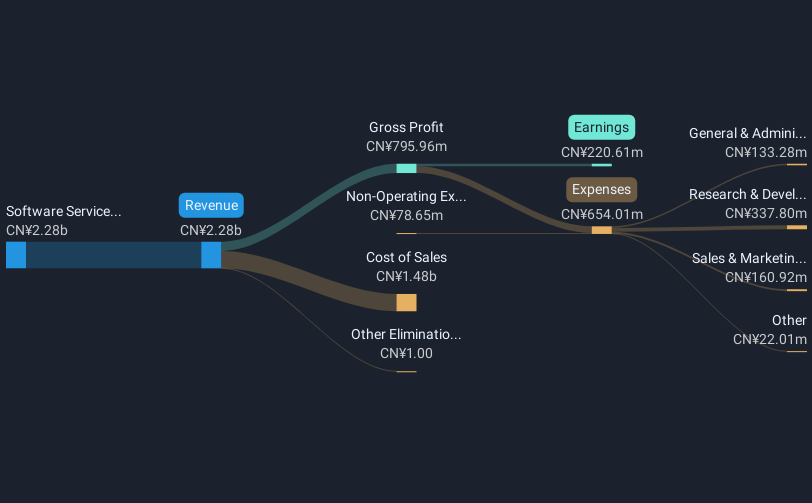

Overview: Guangzhou Sie Consulting Co., Ltd. is a solution provider specializing in industrial Internet and intelligent manufacturing, core ERP, and business operation centers in China with a market cap of CN¥7.09 billion.

Operations: The company generates revenue primarily from software services, amounting to CN¥2.28 billion. The focus is on providing solutions in industrial Internet, intelligent manufacturing, and core ERP systems within China.

Guangzhou Sie Consulting has demonstrated resilience with a 1.4% increase in revenue year-over-year, reaching CNY 1.71 billion for the nine months ending September 2024, despite a dip in net income to CNY 94.66 million from CNY 128.45 million previously. This performance is underpinned by strategic share repurchases totaling CNY 19.84 million, reinforcing shareholder value amidst market fluctuations. The firm's commitment to growth is evident in its projected annual revenue and earnings increases of 13.8% and 28.4%, respectively, outpacing broader market expectations and positioning it favorably within the competitive tech landscape.

Taking Advantage

- Delve into our full catalog of 1263 High Growth Tech and AI Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300687

Guangzhou Sie Consulting

Operates as solution provider in the fields of industrial Internet and intelligent manufacturing, core ERP, and business operation center in China.

Reasonable growth potential with adequate balance sheet.