- China

- /

- Interactive Media and Services

- /

- SZSE:300494

Exploring Three Prominent High Growth Tech Stocks

Reviewed by Simply Wall St

As global markets navigate a mixed economic landscape marked by declining consumer confidence and fluctuating indices, the technology sector continues to capture investor interest with its potential for high growth. In this environment, identifying promising tech stocks involves assessing their resilience and adaptability to market shifts, making them well-positioned to capitalize on technological advancements and changing consumer trends.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1263 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

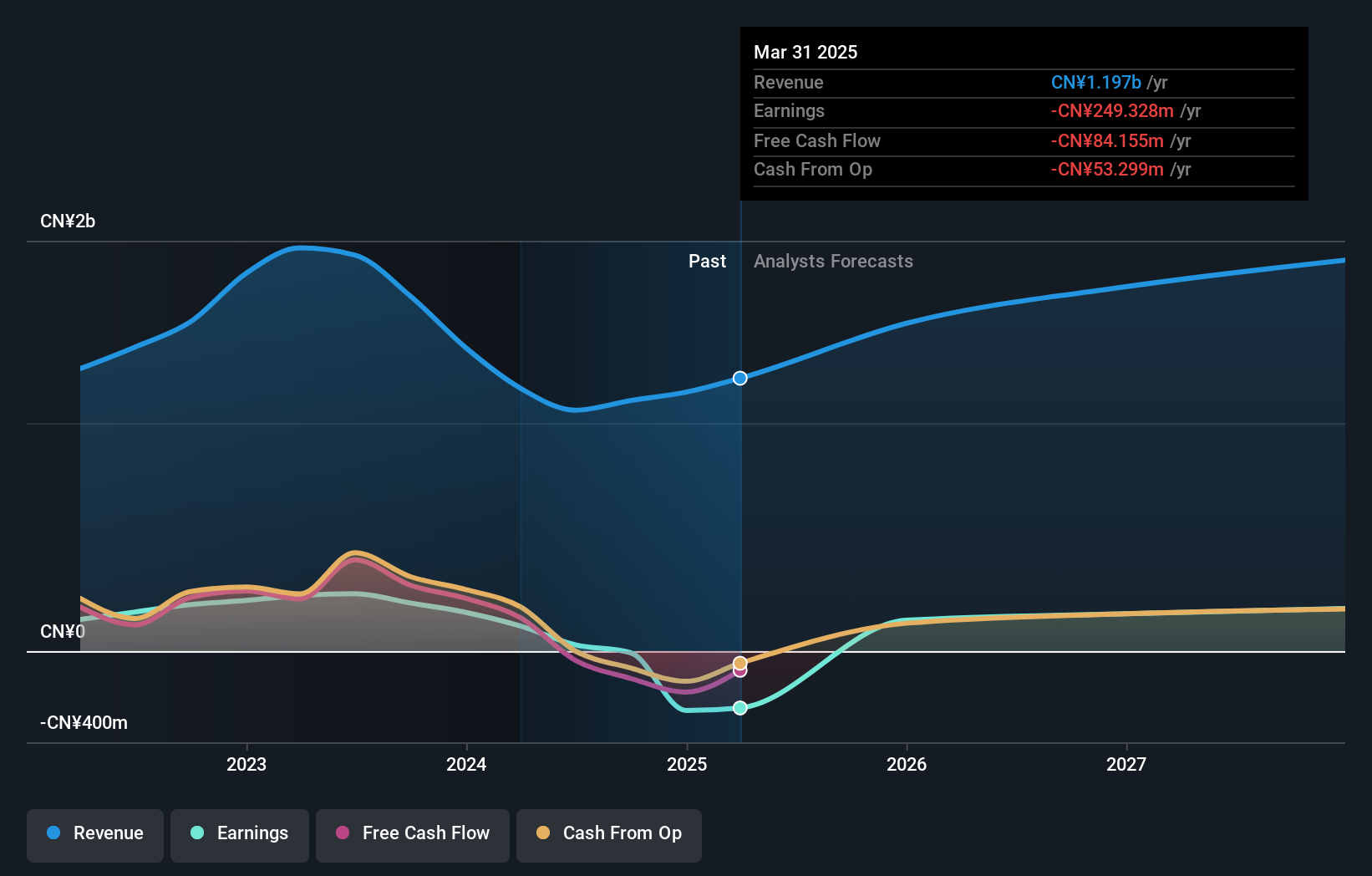

Suzhou UIGreen Micro&Nano TechnologiesLtd (SHSE:688661)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou UIGreen Micro&Nano Technologies Co., Ltd focuses on the R&D, production, and sale of MEMS fine components and semiconductor test probe products both in China and internationally, with a market cap of CN¥3.61 billion.

Operations: UIGreen specializes in developing and manufacturing MEMS fine components and semiconductor test probe products, catering to both domestic and international markets. The company leverages its expertise in micro-electromechanical systems to serve a diverse client base, contributing to its market presence.

Suzhou UIGreen Micro&Nano TechnologiesLtd has demonstrated a robust trajectory in the tech sector, with an anticipated annual revenue growth rate of 47.1%, significantly outpacing the CN market's average of 13.6%. Despite current unprofitability, the company is expected to shift towards profitability within three years, forecasting an impressive earnings growth rate of 148.59% annually. Recent financials reveal a reduction in net losses to CNY 10.6 million from CNY 22.37 million year-over-year and nearly doubling revenues to CNY 373.64 million, underscoring potential resilience and adaptability in its operational strategies. These figures not only reflect UIGreen's aggressive pursuit of growth but also highlight its capacity to refine and scale operations amidst challenging market conditions.

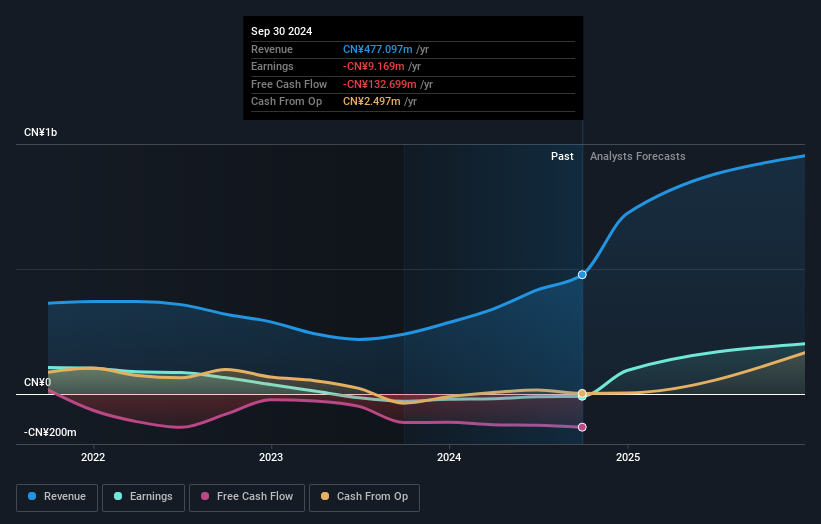

Hubei Century Network Technology (SZSE:300494)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hubei Century Network Technology Inc. operates an online entertainment platform in China and internationally, with a market cap of CN¥5.40 billion.

Operations: The company generates revenue primarily through its online entertainment platform, catering to both domestic and international markets. Its operations focus on delivering digital content and services, leveraging technology to enhance user engagement.

Despite a challenging year, Hubei Century Network Technology has maintained a robust growth trajectory with an anticipated revenue increase of 22.7% annually, outstripping the Chinese market's average of 13.6%. However, recent financials indicate a significant drop in net income to CNY 2.45 million from CNY 178.96 million and a decrease in sales to CNY 852.41 million from CNY 1,082.67 million year-over-year, reflecting volatility and potential operational hurdles. The company's commitment to innovation is underscored by its R&D investments aimed at reversing the recent downturn and capturing future growth opportunities in the tech sector.

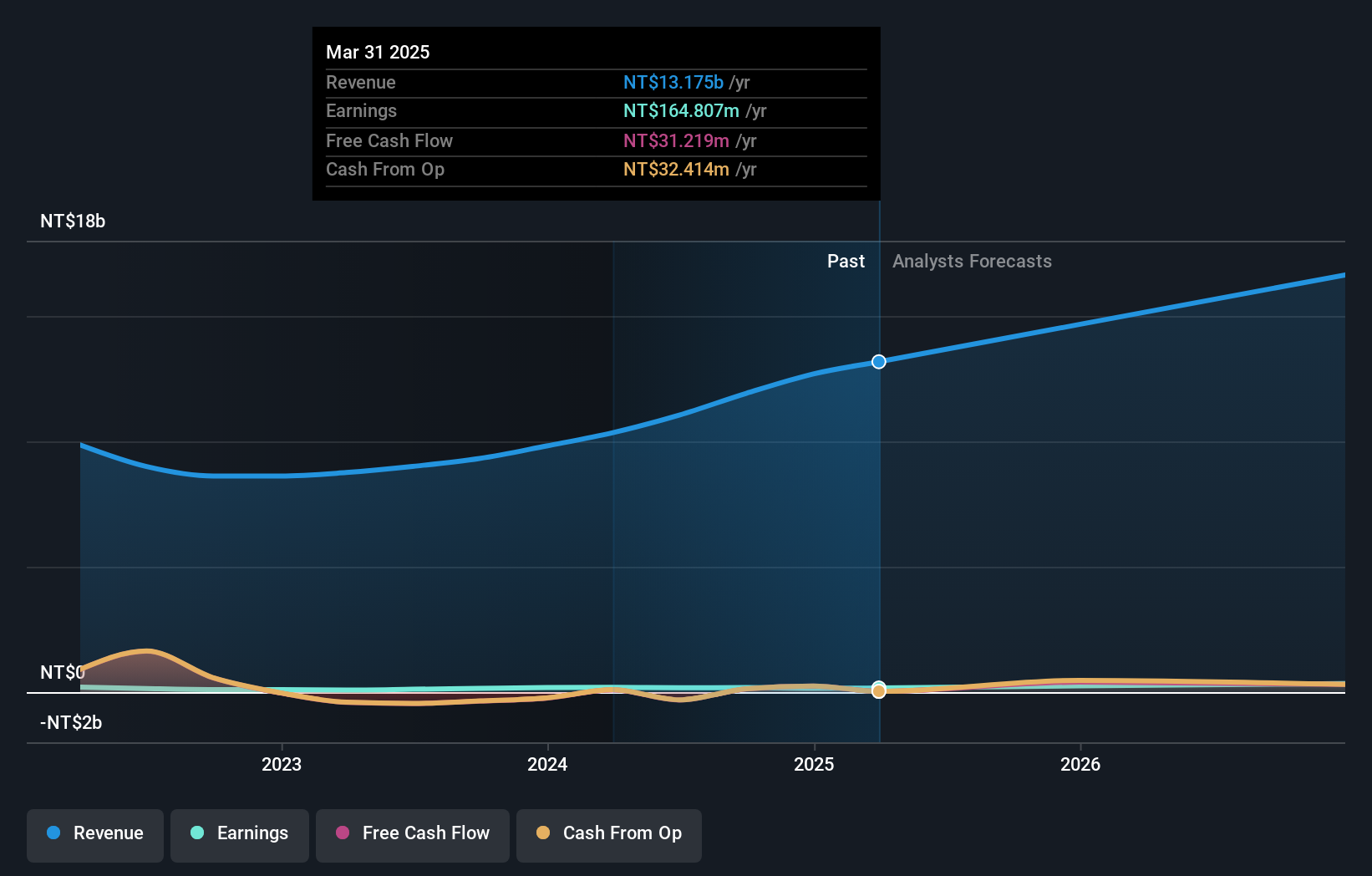

eCloudvalley Digital Technology (TWSE:6689)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: eCloudvalley Digital Technology Co., Ltd. is a company with a market cap of NT$8.54 billion, focusing on providing digital and cloud technology solutions.

Operations: eCloudvalley Digital Technology generates revenue primarily through digital and cloud technology solutions, catering to various business needs. The company's market cap stands at NT$8.54 billion, reflecting its presence in the tech industry.

eCloudvalley Digital Technology has demonstrated a notable performance trajectory, with a 15% annual revenue growth outpacing the broader Taiwanese market's 12.2%. This growth is complemented by an impressive 28.3% expected annual earnings increase, signaling robust future prospects. The firm's commitment to innovation is evident from its substantial R&D investments, which have been strategically aligned to bolster its competitive edge in cloud computing and digital transformation solutions. Recent financial reports highlight this momentum, with third-quarter sales rising to TWD 3.34 billion from TWD 2.47 billion year-over-year and net income increasing to TWD 59.9 million from TWD 47.73 million in the same period, reflecting effective operational execution and market expansion strategies.

Turning Ideas Into Actions

- Take a closer look at our High Growth Tech and AI Stocks list of 1263 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hubei Century Network Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300494

Hubei Century Network Technology

Operates an online entertainment platform in China and internationally.

Flawless balance sheet very low.

Market Insights

Community Narratives