- China

- /

- Electronic Equipment and Components

- /

- SZSE:000636

The three-year shareholder returns and company earnings persist lower as Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) stock falls a further 5.0% in past week

Investing in stocks inevitably means buying into some companies that perform poorly. But the long term shareholders of Guangdong Fenghua Advanced Technology (Holding) Co., Ltd. (SZSE:000636) have had an unfortunate run in the last three years. So they might be feeling emotional about the 51% share price collapse, in that time.

After losing 5.0% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Guangdong Fenghua Advanced Technology (Holding)

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

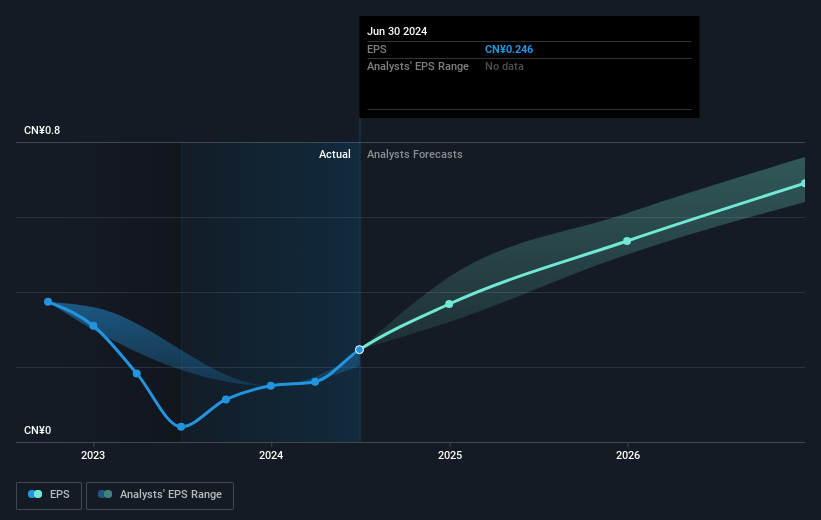

Guangdong Fenghua Advanced Technology (Holding) saw its EPS decline at a compound rate of 28% per year, over the last three years. In comparison the 21% compound annual share price decline isn't as bad as the EPS drop-off. So the market may not be too worried about the EPS figure, at the moment -- or it may have previously priced some of the drop in. This positive sentiment is also reflected in the generous P/E ratio of 51.03.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Guangdong Fenghua Advanced Technology (Holding) has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Guangdong Fenghua Advanced Technology (Holding) will grow revenue in the future.

A Different Perspective

Although it hurts that Guangdong Fenghua Advanced Technology (Holding) returned a loss of 11% in the last twelve months, the broader market was actually worse, returning a loss of 19%. Given the total loss of 1.1% per year over five years, it seems returns have deteriorated in the last twelve months. While some investors do well specializing in buying companies that are struggling (but nonetheless undervalued), don't forget that Buffett said that 'turnarounds seldom turn'. Is Guangdong Fenghua Advanced Technology (Holding) cheap compared to other companies? These 3 valuation measures might help you decide.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000636

Guangdong Fenghua Advanced Technology (Holding)

Guangdong Fenghua Advanced Technology (Holding) Co., Ltd.

Excellent balance sheet with reasonable growth potential.