February 2025's Undervalued Stock Selections For Potential Investment Opportunities

Reviewed by Simply Wall St

As global markets grapple with tariff uncertainties and mixed economic indicators, investors are closely monitoring the performance of major indices, which have shown slight declines amid these challenges. Despite a cooling labor market and fluctuating manufacturing activity in the U.S., opportunities may arise for discerning investors to explore undervalued stocks that could offer potential investment prospects in this environment. Identifying such stocks often involves looking for companies with strong fundamentals that are temporarily mispriced due to broader market volatility or sector-specific concerns.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| KG Mobilians (KOSDAQ:A046440) | ₩4445.00 | ₩8851.15 | 49.8% |

| Gilead Sciences (NasdaqGS:GILD) | US$96.14 | US$191.74 | 49.9% |

| On the Beach Group (LSE:OTB) | £2.495 | £4.94 | 49.5% |

| Aoshikang Technology (SZSE:002913) | CN¥29.12 | CN¥57.85 | 49.7% |

| Hanjaya Mandala Sampoerna (IDX:HMSP) | IDR575.00 | IDR1141.10 | 49.6% |

| Smurfit Westrock (NYSE:SW) | US$53.64 | US$107.04 | 49.9% |

| Array Technologies (NasdaqGM:ARRY) | US$6.87 | US$13.66 | 49.7% |

| RENK Group (DB:R3NK) | €24.84 | €49.52 | 49.8% |

| 29Metals (ASX:29M) | A$0.195 | A$0.39 | 49.9% |

| Barbeque-Nation Hospitality (NSEI:BARBEQUE) | ₹276.65 | ₹550.90 | 49.8% |

Let's take a closer look at a couple of our picks from the screened companies.

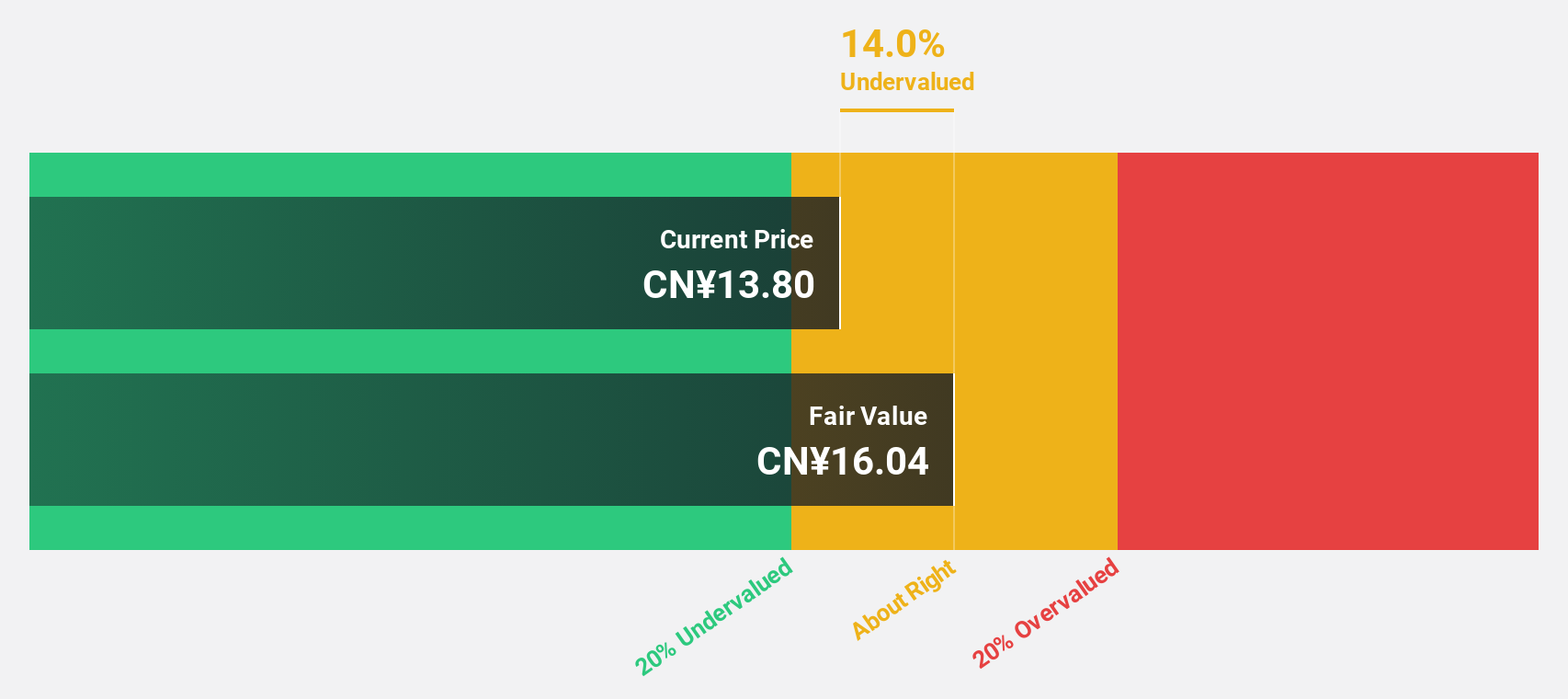

Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636)

Overview: Guangdong Fenghua Advanced Technology (Holding) Co., Ltd. operates in the electronic components industry and has a market cap of approximately CN¥17.58 billion.

Operations: The company's revenue primarily comes from its Electronic Components & Parts segment, totaling CN¥4.55 billion.

Estimated Discount To Fair Value: 48.1%

Guangdong Fenghua Advanced Technology (Holding) trades at CN¥15.56, significantly below its estimated fair value of CN¥29.99, indicating potential undervaluation based on cash flows. Despite a low forecasted return on equity of 5.6% in three years, the company benefits from robust earnings growth, expected to rise over 38% annually—outpacing the broader Chinese market's growth rate of 25.3%. Recent board changes could impact strategic direction and governance effectiveness.

- The analysis detailed in our Guangdong Fenghua Advanced Technology (Holding) growth report hints at robust future financial performance.

- Navigate through the intricacies of Guangdong Fenghua Advanced Technology (Holding) with our comprehensive financial health report here.

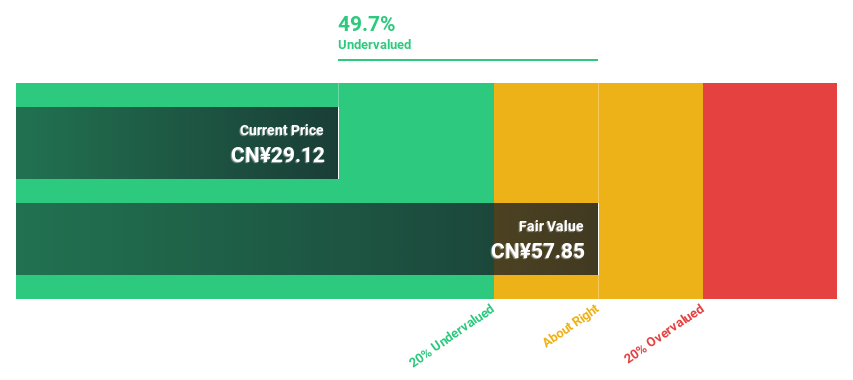

Aoshikang Technology (SZSE:002913)

Overview: Aoshikang Technology Co., Ltd. specializes in the research, development, production, and sale of printed circuit boards and has a market cap of CN¥9.12 billion.

Operations: The company's revenue is primarily derived from its printed circuit boards segment, totaling CN¥4.41 billion.

Estimated Discount To Fair Value: 49.7%

Aoshikang Technology, priced at CN¥29.12, is trading substantially below its fair value estimate of CN¥57.85, highlighting its potential undervaluation based on cash flows. Earnings are projected to grow 30.7% annually, surpassing the broader Chinese market's growth rate of 25.3%. Despite a forecasted low return on equity of 16.3% in three years, recent board changes and amendments to company bylaws could influence future strategic decisions and governance structure.

- Our earnings growth report unveils the potential for significant increases in Aoshikang Technology's future results.

- Take a closer look at Aoshikang Technology's balance sheet health here in our report.

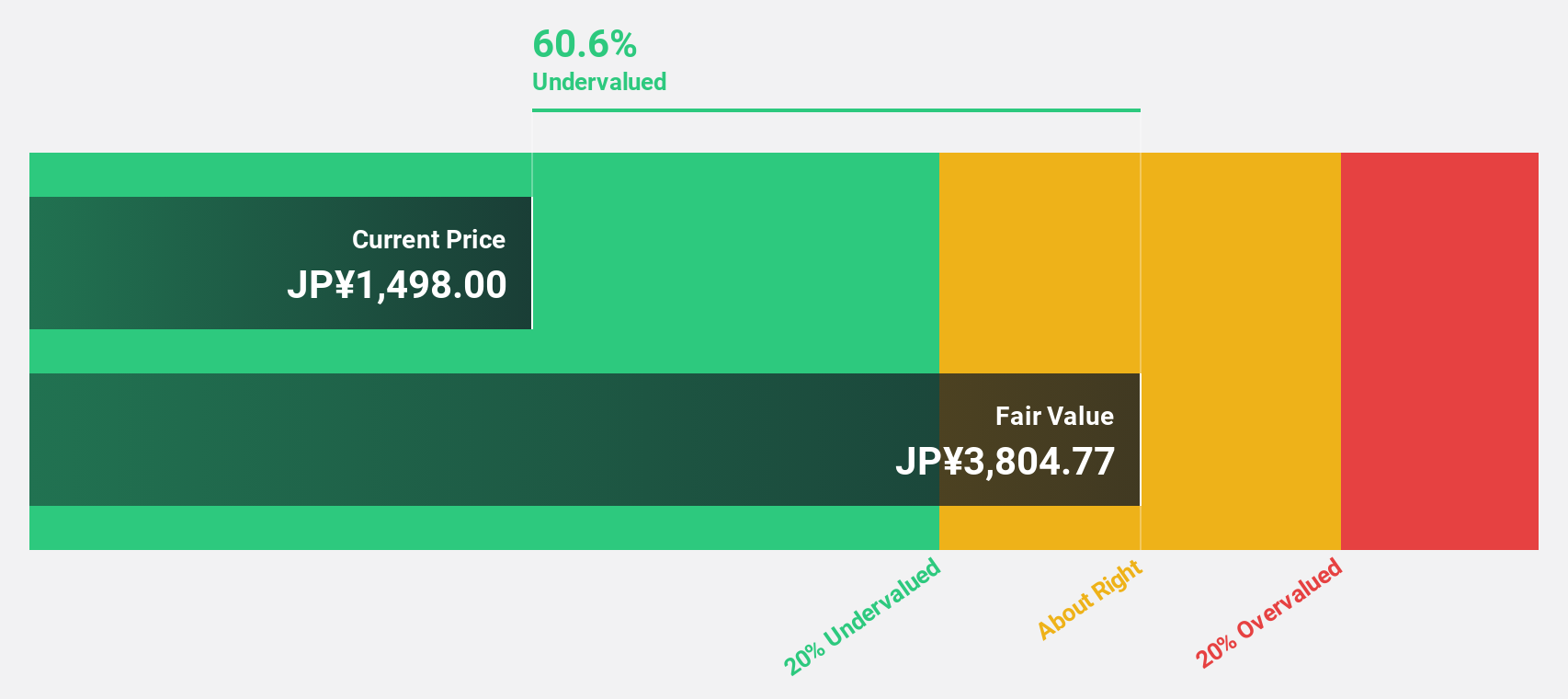

Appier Group (TSE:4180)

Overview: Appier Group, Inc. is a software-as-a-service company that offers artificial intelligence platforms to help enterprises make data-driven decisions both in Japan and internationally, with a market cap of approximately ¥171.05 billion.

Operations: The company's revenue segment consists of its AI SaaS Business, which generated ¥32.19 billion.

Estimated Discount To Fair Value: 45.4%

Appier Group, trading at ¥1757, is significantly undervalued with a fair value estimate of ¥3216.2. Earnings are expected to grow substantially at 32.1% annually, outpacing the Japanese market's growth rate of 7.7%. Despite recent share price volatility, the company has completed a substantial buyback program and initiated its first dividend since IPO, reflecting strong financial health and strategic capital management focused on enhancing shareholder returns and supporting future growth initiatives.

- Our comprehensive growth report raises the possibility that Appier Group is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Appier Group stock in this financial health report.

Seize The Opportunity

- Discover the full array of 909 Undervalued Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4180

Appier Group

Operates as AI-native SaaS company in Japan and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)