- China

- /

- Electronic Equipment and Components

- /

- SHSE:688768

Investors Appear Satisfied With Anhui Ronds Science & Technology Incorporated Company's (SHSE:688768) Prospects As Shares Rocket 31%

Anhui Ronds Science & Technology Incorporated Company (SHSE:688768) shareholders are no doubt pleased to see that the share price has bounced 31% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 67% share price decline over the last year.

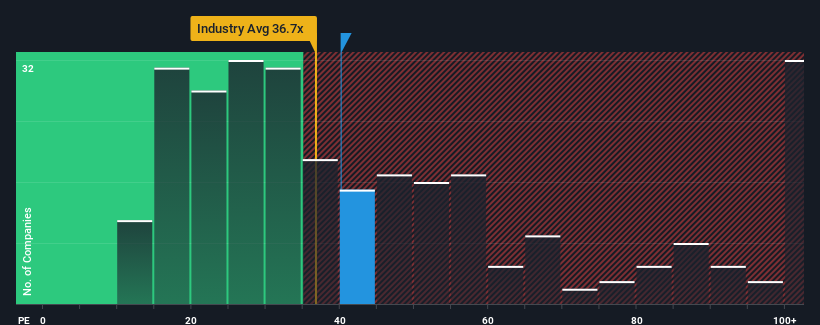

Following the firm bounce in price, Anhui Ronds Science & Technology may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 40.1x, since almost half of all companies in China have P/E ratios under 29x and even P/E's lower than 18x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Anhui Ronds Science & Technology has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Anhui Ronds Science & Technology

Is There Enough Growth For Anhui Ronds Science & Technology?

Anhui Ronds Science & Technology's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Retrospectively, the last year delivered a frustrating 46% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 37% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 137% during the coming year according to the three analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 41%, which is noticeably less attractive.

With this information, we can see why Anhui Ronds Science & Technology is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

The large bounce in Anhui Ronds Science & Technology's shares has lifted the company's P/E to a fairly high level. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Anhui Ronds Science & Technology maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about these 3 warning signs we've spotted with Anhui Ronds Science & Technology.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688768

Anhui Ronds Science & Technology

Provides solutions for machinery condition monitoring in the predictive maintenance field in China.

Undervalued with high growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)