Amidst heightened global trade tensions and recent tariff announcements that have sent shockwaves through markets, Asian tech stocks are navigating a challenging landscape with the potential for both risks and opportunities. In such volatile conditions, identifying high-growth tech stocks involves looking for companies with innovative solutions, strong market positions, and resilience to external economic pressures.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 34.26% | 32.15% | ★★★★★★ |

| Zhongji Innolight | 28.26% | 28.30% | ★★★★★★ |

| Xi'an NovaStar Tech | 30.60% | 36.56% | ★★★★★★ |

| Shanghai Baosight SoftwareLtd | 21.43% | 27.67% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| PharmaResearch | 20.39% | 27.65% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Essex Bio-Technology (SEHK:1061)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Essex Bio-Technology Limited is an investment holding company that develops, manufactures, distributes, and sells bio-pharmaceutical products in the People's Republic of China, Hong Kong, and internationally with a market capitalization of HK$2.35 billion.

Operations: Essex Bio-Technology generates revenue primarily from its surgical and ophthalmology segments, with contributions of approximately HK$879.90 million and HK$771.49 million, respectively. The company also engages in the provision of services, adding HK$18.42 million to its revenue stream.

Essex Bio-Technology has demonstrated a robust trajectory in the biotech sector, underscored by a 10.2% annual revenue growth and an 11.99% forecasted earnings increase per year. Recent pivotal phase 3 clinical results from its AURA-1 trial show promising efficacy for its HLX04-O treatment, potentially bolstering its market position against competitors like ranibizumab. Despite a volatile share price, the company’s strategic amendments to align with new regulatory requirements suggest proactive governance, positioning it favorably for future industry shifts and sustained growth in Asia's high-tech landscape.

Sky ICT (SET:SKY)

Simply Wall St Growth Rating: ★★★★☆☆

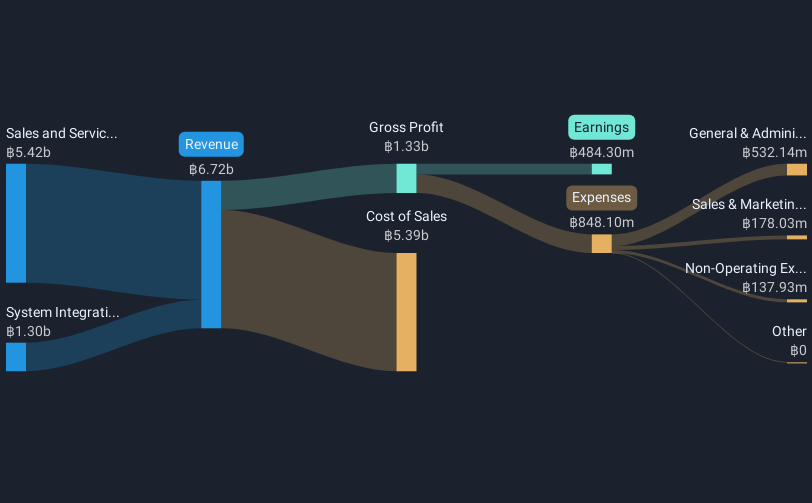

Overview: Sky ICT Public Company Limited operates in the information and communication technology and system integration sectors in Thailand, with a market capitalization of THB11.88 billion.

Operations: Sky ICT focuses on system integration services and sales, generating THB1.30 billion and THB5.42 billion respectively from these segments. The company operates in the ICT sector in Thailand, leveraging its expertise to offer comprehensive technology solutions.

Sky ICT, despite a recent dip in net income from THB 533.38 million to THB 484.3 million, continues to show promising revenue growth, up significantly to THB 6.72 billion from THB 4.12 billion previously. This reflects an annualized revenue increase of 15.8%, outpacing the Thai market's average of 5.4%. The company's proactive stance is evident in its strategic moves like the significant capital increase and private placements aimed at fueling further expansion, alongside securing a major project with National Telecom for Thailand’s central healthcare cloud system valued at nearly THB 992 million, which underscores its pivotal role in advancing national healthcare infrastructure and technology integration in Asia’s tech landscape.

- Dive into the specifics of Sky ICT here with our thorough health report.

Evaluate Sky ICT's historical performance by accessing our past performance report.

Chengdu Zhimingda Electronics (SHSE:688636)

Simply Wall St Growth Rating: ★★★★★☆

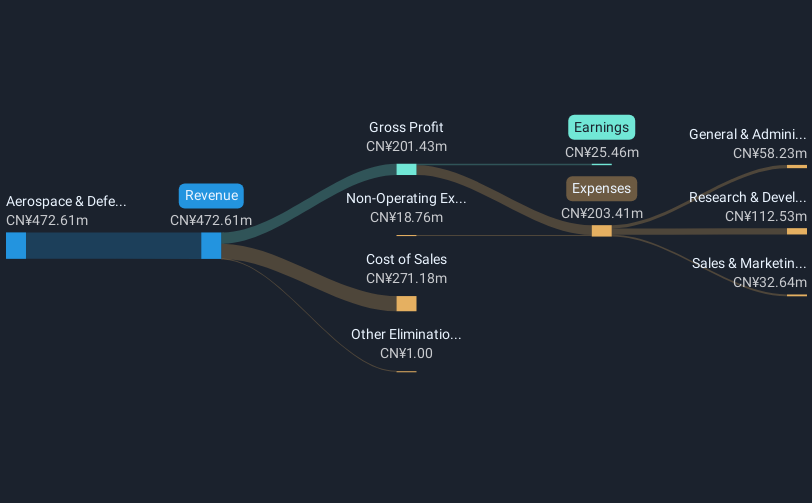

Overview: Chengdu Zhimingda Electronics Co., Ltd. specializes in providing customized embedded modules and solutions in China, with a market cap of CN¥4.18 billion.

Operations: Zhimingda Electronics focuses on delivering customized embedded modules primarily for the Aerospace & Defense sector, generating revenue of CN¥437.93 million.

Chengdu Zhimingda Electronics, navigating a challenging fiscal year, reported a significant reduction in sales to CNY 437.93 million from the previous CNY 663 million and saw net income decrease to CNY 19.25 million from CNY 96.26 million. Despite these setbacks, the company's revenue growth forecast stands robust at an annual rate of 33.3%, outstripping the Chinese market's average of 12.8%. This growth trajectory is underpinned by substantial R&D investments aimed at pioneering advancements in electronics technology, positioning Zhimingda potentially as a vital player in Asia’s tech evolution despite current financial volatilities.

Make It Happen

- Access the full spectrum of 497 Asian High Growth Tech and AI Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:SKY

Sky ICT

Engages in information and communication technology (ICT), and system integration businesses in Thailand.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)