Exploring High Growth Tech And 2 Other Leading Stocks with Potential Expansion

Reviewed by Simply Wall St

As global markets recently experienced mixed performance, with the S&P 500 and Nasdaq Composite marking significant annual gains despite some year-end volatility, investors continue to navigate a landscape shaped by fluctuating economic indicators such as the Chicago PMI and GDP forecasts. In this environment, identifying high-growth tech stocks requires a focus on those companies that demonstrate resilience and adaptability in response to both market challenges and opportunities for expansion.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1258 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Kexing Biopharm (SHSE:688136)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kexing Biopharm Co., Ltd. focuses on the research, development, production, and sale of recombinant protein drugs and microbial preparations both in China and internationally, with a market cap of approximately CN¥4.15 billion.

Operations: Kexing Biopharm Co., Ltd. generates revenue primarily from pharmaceutical manufacturing, amounting to approximately CN¥1.33 billion. The company's operations are centered on recombinant protein drugs and microbial preparations, catering to both domestic and international markets.

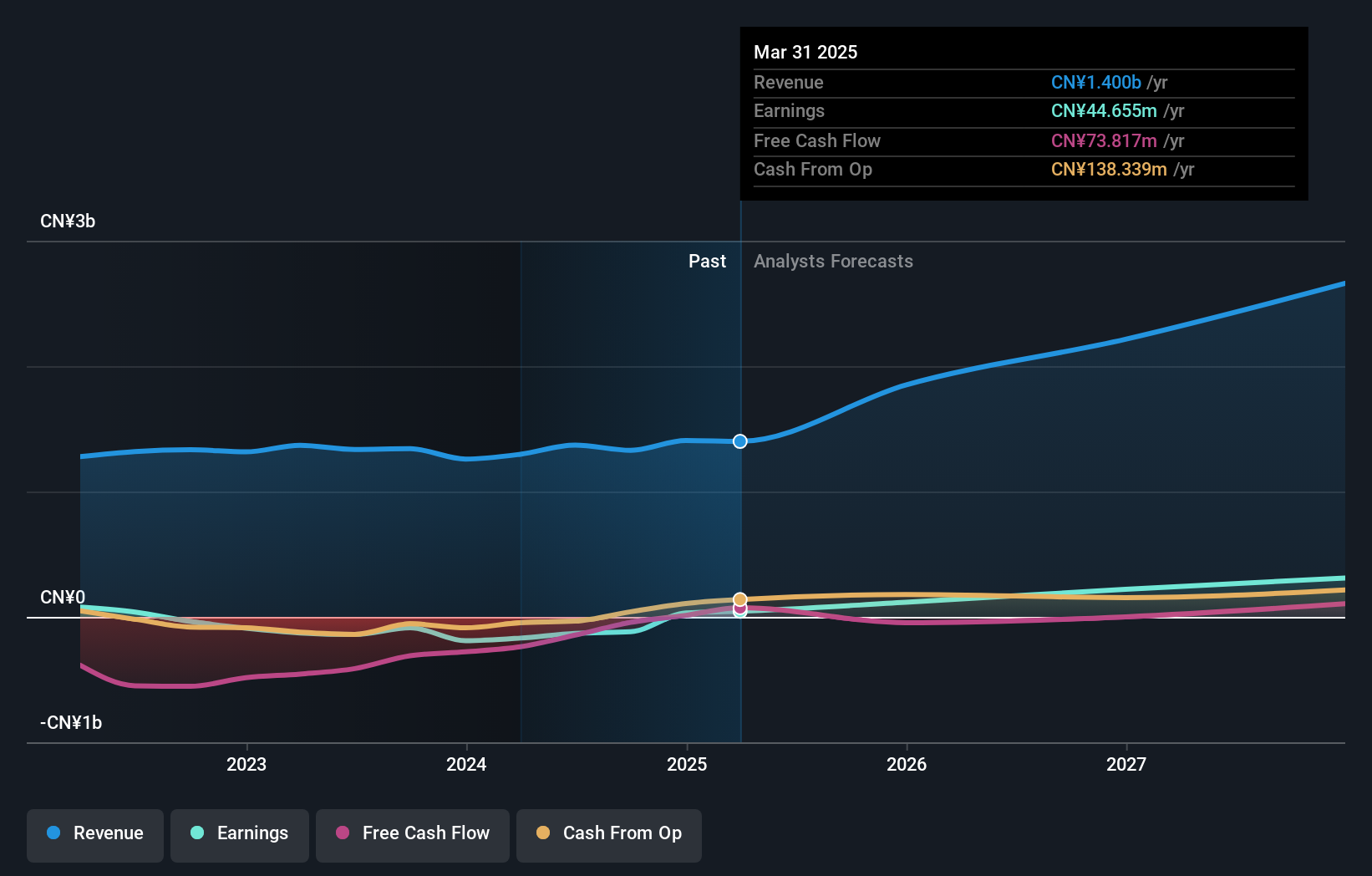

Kexing Biopharm, amidst a challenging landscape for biotech firms, has showcased remarkable resilience and growth. The company's recent earnings report highlights a significant turnaround with revenues climbing to CNY 1.04 billion from last year’s CNY 969 million, coupled with a shift to net income of CNY 17.18 million from a previous net loss of CNY 54.31 million. This performance is underpinned by an aggressive R&D strategy which is not just maintaining pace but accelerating, with expectations set on an annual revenue growth rate of 27.9%, outstripping the Chinese market average of 13.6%. Moreover, Kexing Biopharm’s strategic focus on innovative biotechnologies is expected to drive its earnings up by an impressive 103% annually over the next three years, positioning it well above its industry peers in terms of growth trajectory and market adaptation.

- Click to explore a detailed breakdown of our findings in Kexing Biopharm's health report.

Evaluate Kexing Biopharm's historical performance by accessing our past performance report.

3onedata (SHSE:688618)

Simply Wall St Growth Rating: ★★★★★☆

Overview: 3onedata Co., Ltd. offers industrial communication solutions and services globally, with a market capitalization of CN¥2.17 billion.

Operations: The company specializes in industrial communication solutions and services, generating revenue primarily from the sale of networking products and related services. The business focuses on expanding its product offerings to cater to diverse industrial applications worldwide.

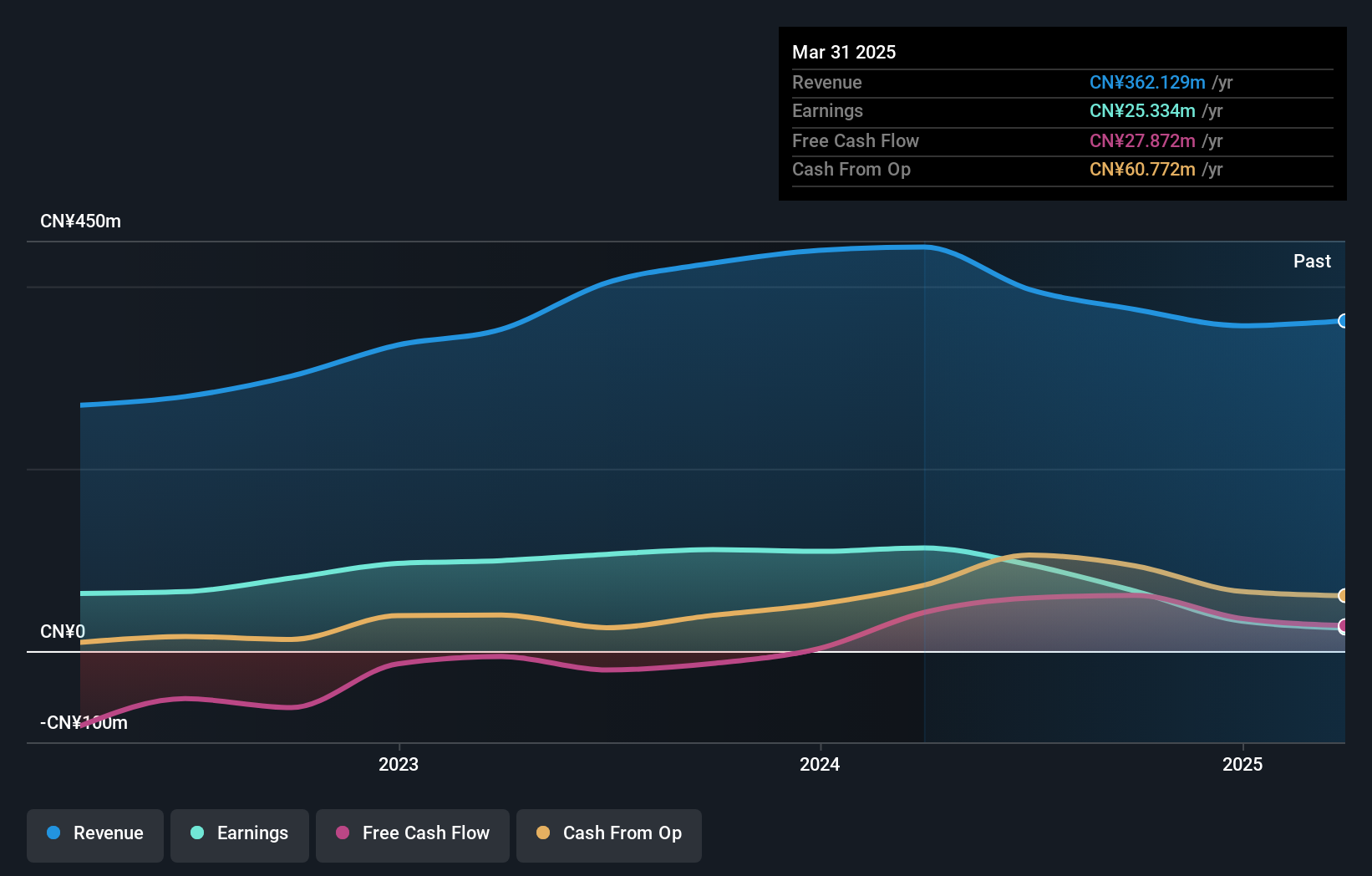

3onedata, in its recent fiscal disclosures, revealed a challenging period with revenue sliding to CNY 244.54 million from the previous year's CNY 309.32 million, alongside a net income drop to CNY 33.28 million from CNY 76.81 million. Despite these hurdles, the company is poised for robust future growth with projected annual revenue and earnings increases of 28.5% and 38.2%, respectively—outpacing the broader Chinese market forecasts of 13.6% and 25.1%. This optimism is underlined by their commitment to innovation as evidenced by substantial R&D investments aimed at driving technological advancements in communications—a sector where they are set to redefine standards despite current financial volatilities.

- Dive into the specifics of 3onedata here with our thorough health report.

Review our historical performance report to gain insights into 3onedata's's past performance.

Beijing SDL TechnologyLtd (SZSE:002658)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing SDL Technology Co., Ltd., along with its subsidiaries, specializes in developing and selling environmental monitoring equipment and solutions both in China and internationally, with a market cap of CN¥3.78 billion.

Operations: The company focuses on producing and distributing environmental monitoring equipment and solutions, serving both domestic and international markets.

Despite a recent drop from the S&P Global BMI Index, Beijing SDL TechnologyLtd. remains resilient with a revenue forecast to outpace the CN market at 16.5% annually, compared to the broader market's 13.6%. This growth is bolstered by an anticipated earnings increase of 27.1% per year, surpassing market expectations of 25.1%. The company's commitment to innovation is evident in its R&D spending, crucial for maintaining competitiveness in its sector despite past earnings challenges and current index adjustments.

Next Steps

- Click here to access our complete index of 1258 High Growth Tech and AI Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kexing Biopharm might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688136

Kexing Biopharm

Engages in the research and development, production, and sale of recombinant protein drugs and microbial preparations in China and internationally.

High growth potential and good value.

Market Insights

Community Narratives