- South Korea

- /

- Entertainment

- /

- KOSE:A079160

CJ CGV And Two Other Companies That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

Amidst geopolitical tensions and economic uncertainties, global markets have experienced volatility, with major indexes like the S&P 500 and Dow Jones Industrial Average facing declines due to concerns over consumer spending and tariff implications. In such a fluctuating environment, identifying stocks that may be trading below their estimated value can present potential opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥26.26 | CN¥52.22 | 49.7% |

| Argan (NYSE:AGX) | US$133.63 | US$264.49 | 49.5% |

| CS Wind (KOSE:A112610) | ₩44350.00 | ₩88196.22 | 49.7% |

| Hibino (TSE:2469) | ¥2795.00 | ¥5546.91 | 49.6% |

| Nuvoton Technology (TWSE:4919) | NT$95.80 | NT$191.57 | 50% |

| Neosem (KOSDAQ:A253590) | ₩12050.00 | ₩23935.04 | 49.7% |

| Kinaxis (TSX:KXS) | CA$155.11 | CA$310.22 | 50% |

| Laboratorio Reig Jofre (BME:RJF) | €2.69 | €5.32 | 49.4% |

| Sandfire Resources (ASX:SFR) | A$10.53 | A$21.06 | 50% |

| Integral Diagnostics (ASX:IDX) | A$2.89 | A$5.77 | 49.9% |

Underneath we present a selection of stocks filtered out by our screen.

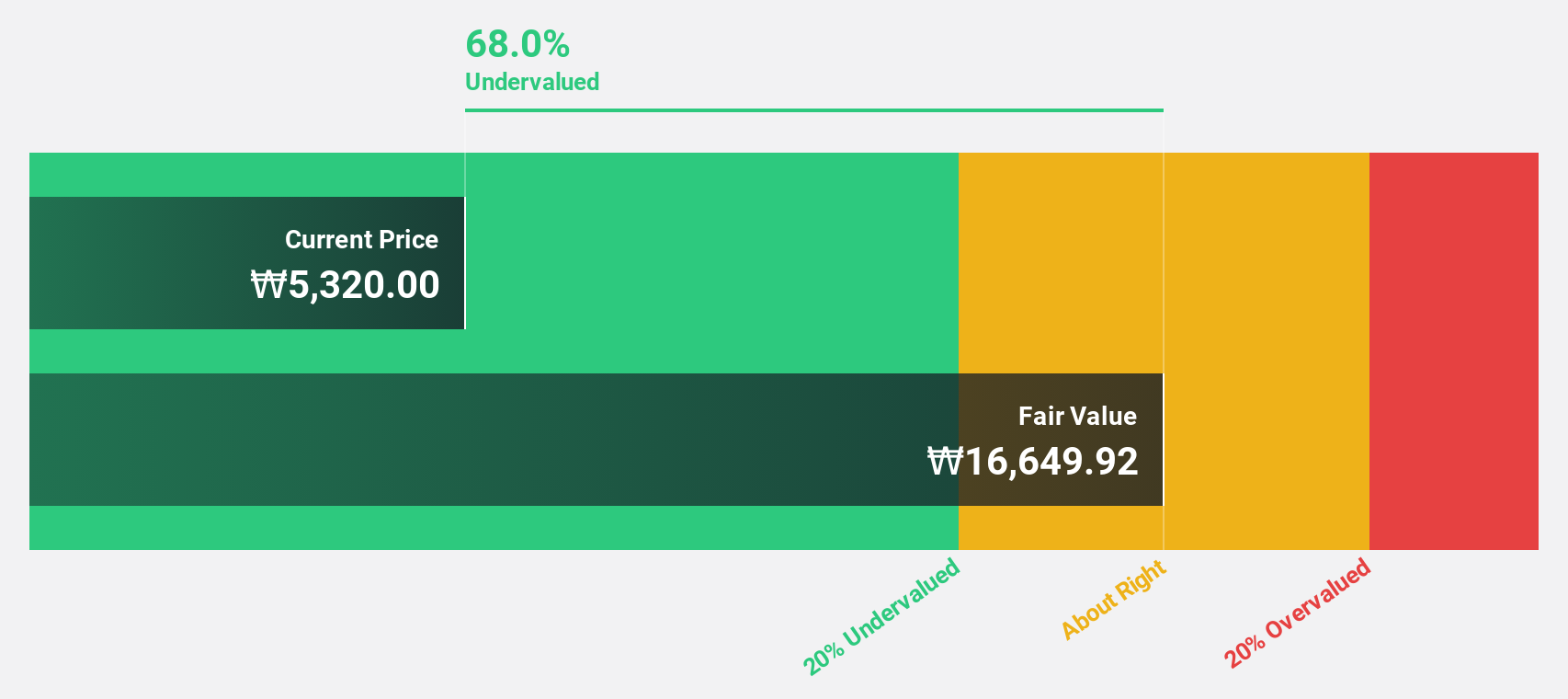

CJ CGV (KOSE:A079160)

Overview: CJ CGV Co., Ltd. operates theaters under the CJ CGV brand in South Korea, with a market cap of ₩854.39 billion.

Operations: The company generates revenue primarily from its Multiplex Operation segment, amounting to ₩1.48 billion, and its Technology Special Format and Equipment segment, contributing ₩108.28 million.

Estimated Discount To Fair Value: 41.8%

CJ CGV is trading at a significant discount, 41.8% below its estimated fair value of ₩8940.27, suggesting it may be undervalued based on cash flows. Despite recent shareholder dilution, the company is expected to become profitable within three years with earnings forecasted to grow significantly by over 100% annually. Revenue growth of 14.6% per year outpaces the Korean market's average, although return on equity remains low at a projected 4.9%.

- Our expertly prepared growth report on CJ CGV implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of CJ CGV stock in this financial health report.

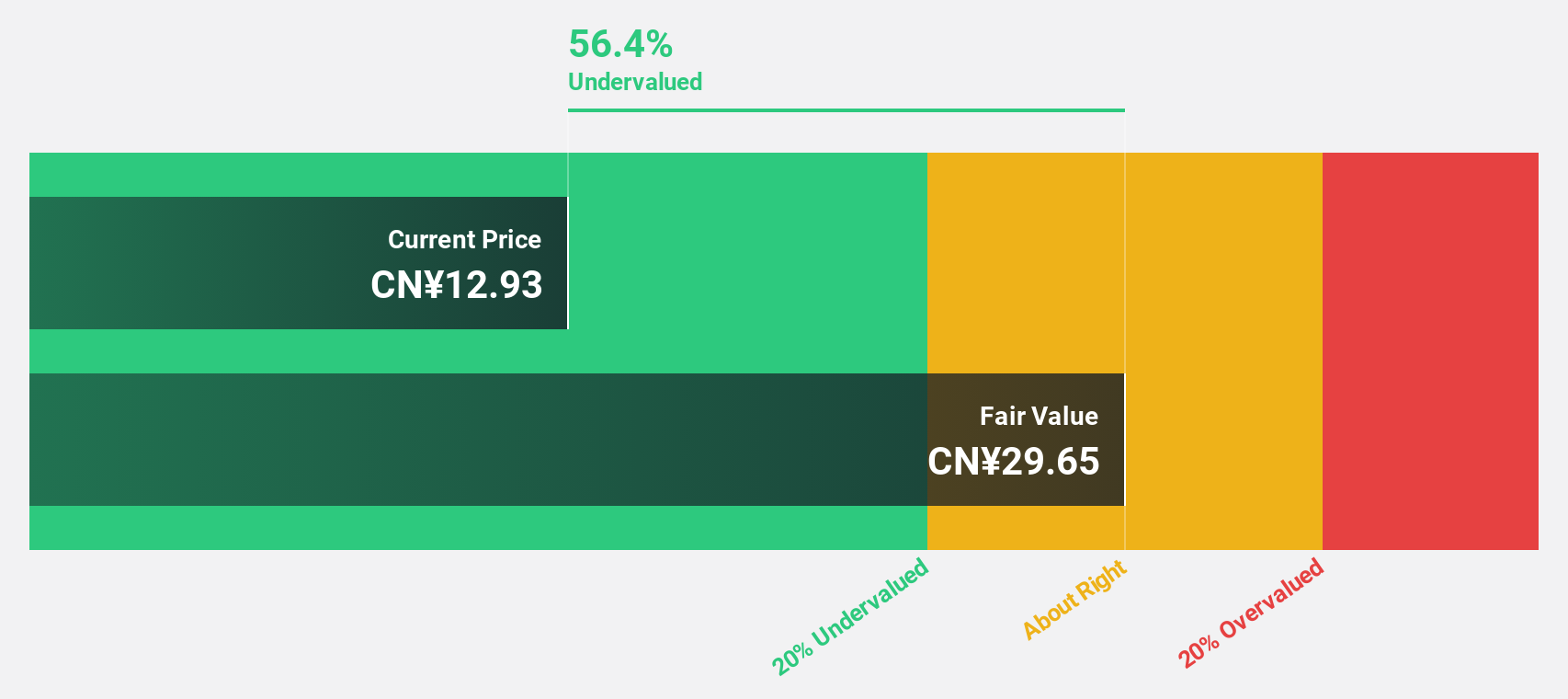

Shenzhen Lifotronic Technology (SHSE:688389)

Overview: Shenzhen Lifotronic Technology Co., Ltd. is a Chinese company that researches, develops, manufactures, and markets medical devices for diagnostics, clinical medicine, skin care, and human health purposes with a market cap of CN¥6.42 billion.

Operations: Shenzhen Lifotronic Technology Co., Ltd. generates revenue through its activities in research, development, manufacturing, and marketing of medical devices focused on diagnostics, clinical medicine, skin care, and human health within China.

Estimated Discount To Fair Value: 45.7%

Shenzhen Lifotronic Technology is trading at a considerable discount, 45.7% below its estimated fair value of CNY 28.71, highlighting potential undervaluation based on cash flows. The company's earnings are projected to grow significantly at 26% annually, outpacing the Chinese market's average growth rate. Recent earnings showed modest improvement with net income rising to CNY 346.72 million from CNY 328.58 million, while revenue is expected to grow faster than the market at 22.5% per year.

- Our growth report here indicates Shenzhen Lifotronic Technology may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Shenzhen Lifotronic Technology's balance sheet health report.

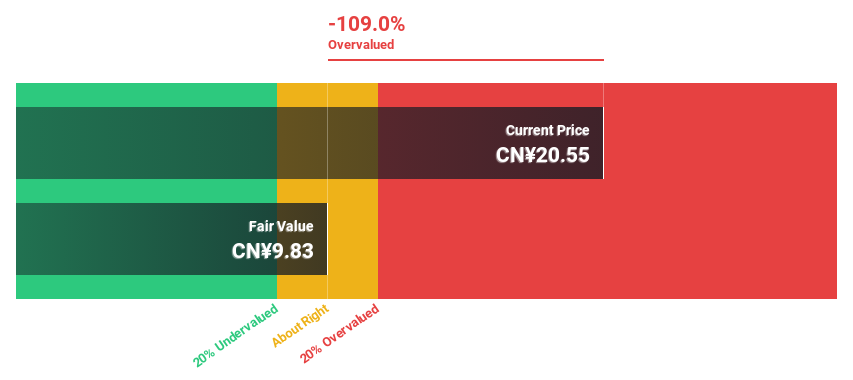

3onedata (SHSE:688618)

Overview: 3onedata Co., Ltd. offers industrial communication solutions and services globally, with a market capitalization of CN¥2.71 billion.

Operations: The company's revenue segments, measured in millions of CN¥, are not specified in the provided text.

Estimated Discount To Fair Value: 48.1%

3onedata is trading at a significant discount, 48.1% below its estimated fair value of CN¥49, suggesting undervaluation based on cash flows. The company's earnings are anticipated to grow substantially at 38.2% annually, surpassing the Chinese market's growth rate. Despite lower profit margins this year (17.6%), revenue is projected to increase rapidly at 28.5% per year, outpacing the market average and highlighting strong future potential despite current challenges in profitability metrics like Return on Equity forecasts.

- Upon reviewing our latest growth report, 3onedata's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of 3onedata.

Next Steps

- Access the full spectrum of 909 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A079160

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)