- China

- /

- Electronic Equipment and Components

- /

- SHSE:688610

Solid Earnings Reflect Hefei I-TEK OptoElectronics' (SHSE:688610) Strength As A Business

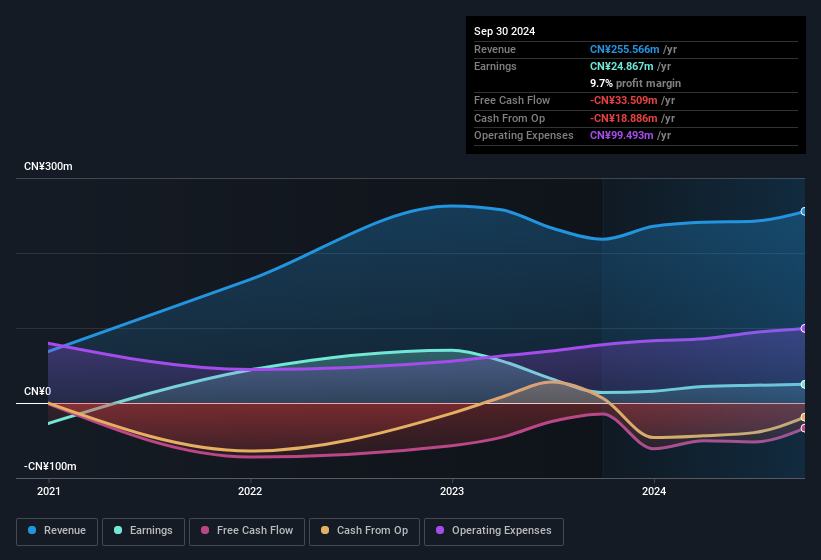

Hefei I-TEK OptoElectronics Co., Ltd.'s (SHSE:688610) earnings announcement last week was disappointing for investors, despite the decent profit numbers. We have done some analysis and have found some comforting factors beneath the profit numbers.

View our latest analysis for Hefei I-TEK OptoElectronics

How Do Unusual Items Influence Profit?

To properly understand Hefei I-TEK OptoElectronics' profit results, we need to consider the CN¥241k expense attributed to unusual items. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. Hefei I-TEK OptoElectronics took a rather significant hit from unusual items in the year to September 2024. All else being equal, this would likely have the effect of making the statutory profit look worse than its underlying earnings power.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Hefei I-TEK OptoElectronics.

An Unusual Tax Situation

Just as we noted the unusual items, we must inform you that Hefei I-TEK OptoElectronics received a tax benefit which contributed CN¥378k to the bottom line. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! The receipt of a tax benefit is obviously a good thing, on its own. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal.

Our Take On Hefei I-TEK OptoElectronics' Profit Performance

In its last report Hefei I-TEK OptoElectronics received a tax benefit which might make its profit look better than it really is on a underlying level. Having said that, it also had a unusual item reducing its profit. Given the contrasting considerations, we don't have a strong view as to whether Hefei I-TEK OptoElectronics's profits are an apt reflection of its underlying potential for profit. While it's very important to consider the profit and loss statement, you can also learn a lot about a company by looking at its balance sheet. If you're interested we have a graphic representation of Hefei I-TEK OptoElectronics' balance sheet.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hefei I-TEK OptoElectronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688610

Hefei I-TEK OptoElectronics

Designs, develops, manufactures, and markets industrial imaging, high precision optics, and opto-electrical equipment in China.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)