- China

- /

- Semiconductors

- /

- SHSE:688525

Cambricon Technologies And 2 Other Asian Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

Amidst a backdrop of mixed performances in global markets, Asia's stock exchanges have shown resilience, with indices like Japan's Nikkei 225 gaining traction and China's benchmarks advancing during holiday-shortened weeks. As investors navigate these fluctuating conditions, growth companies with high insider ownership often stand out as promising contenders due to the alignment of interests between management and shareholders. In this context, Cambricon Technologies and two other Asian growth stocks merit attention for their strong insider ownership, which can be an indicator of confidence in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Samyang Foods (KOSE:A003230) | 11.7% | 28.6% |

| PharmaResearch (KOSDAQ:A214450) | 35% | 30.9% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 104.1% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 34% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.7% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

We're going to check out a few of the best picks from our screener tool.

Cambricon Technologies (SHSE:688256)

Simply Wall St Growth Rating: ★★★★★★

Overview: Cambricon Technologies Corporation Limited focuses on researching, developing, designing, and selling core chips for cloud servers, edge computing, and terminal equipment in China with a market cap of approximately CN¥557.57 billion.

Operations: The company's revenue is derived from the research, development, design, and sale of core chips for cloud servers, edge computing, and terminal equipment in China.

Insider Ownership: 28.6%

Earnings Growth Forecast: 62.8% p.a.

Cambricon Technologies has shown remarkable growth, becoming profitable this year with a net income of CNY 1.04 billion for H1 2025, compared to a net loss last year. Its revenue surged to CNY 2.88 billion, indicating strong market performance. Despite high share price volatility recently, the company's earnings and revenue are forecasted to grow significantly above the market average over the next few years. The company also completed a minor share buyback recently without substantial insider trading activity reported in the past three months.

- Navigate through the intricacies of Cambricon Technologies with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Cambricon Technologies implies its share price may be too high.

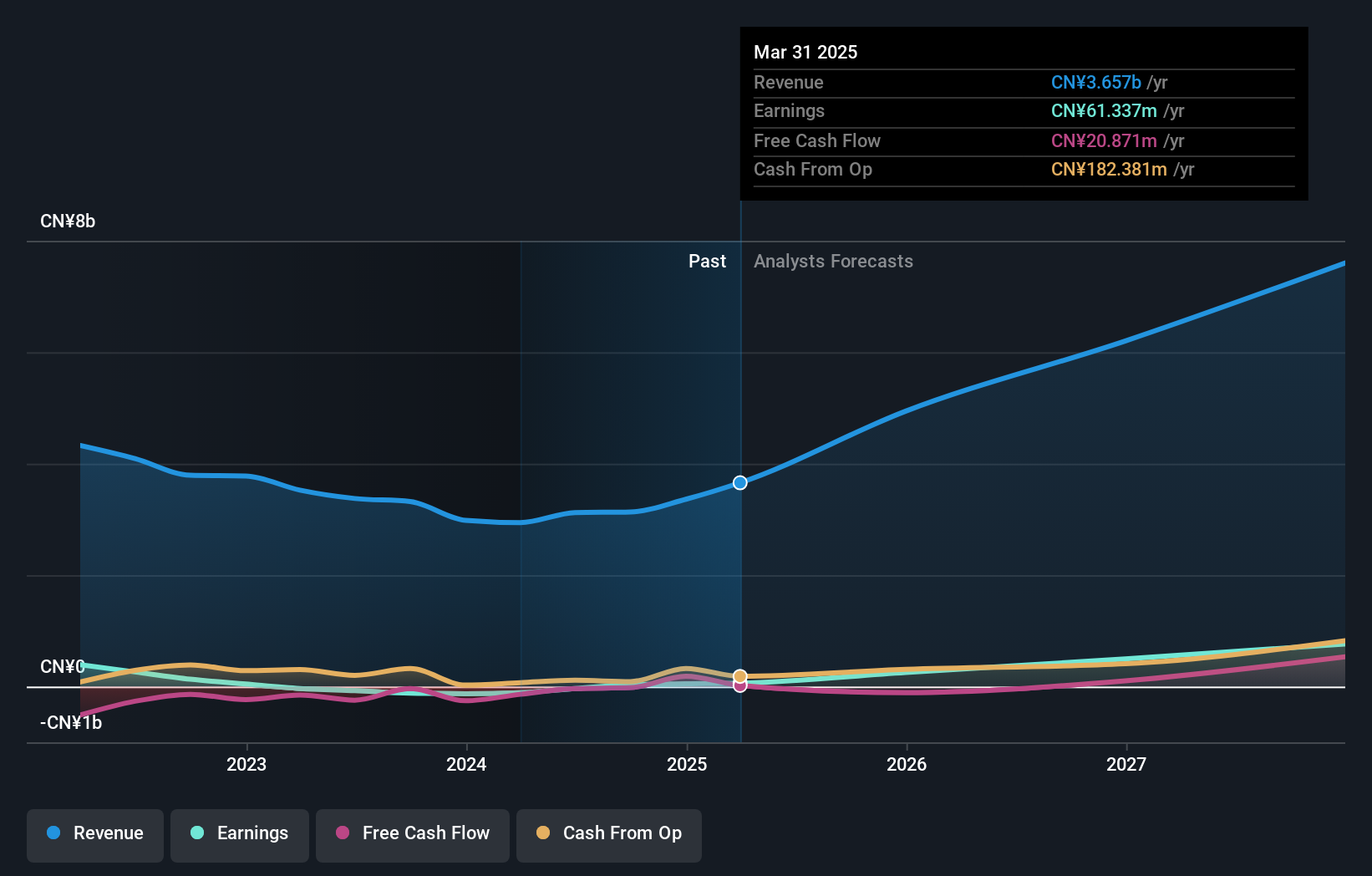

Nanya New Material TechnologyLtd (SHSE:688519)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nanya New Material Technology Co., Ltd is involved in the manufacturing, design, development, and sale of composite materials and has a market cap of CN¥17.74 billion.

Operations: Nanya New Material Technology Co., Ltd generates its revenue through the manufacturing, design, development, and sale of composite materials.

Insider Ownership: 19%

Earnings Growth Forecast: 67% p.a.

Nanya New Material Technology Ltd. is experiencing significant growth, with revenue forecasted to increase by 24.4% annually, outpacing the Chinese market average. The company became profitable this year, reporting H1 2025 net income of CNY 87.19 million and a revenue rise to CNY 2.31 billion from the previous year's CNY 1.61 billion. Despite high share price volatility recently and low future return on equity projections, its earnings are expected to grow significantly above market averages in coming years without substantial recent insider trading activity reported.

- Unlock comprehensive insights into our analysis of Nanya New Material TechnologyLtd stock in this growth report.

- Our valuation report unveils the possibility Nanya New Material TechnologyLtd's shares may be trading at a discount.

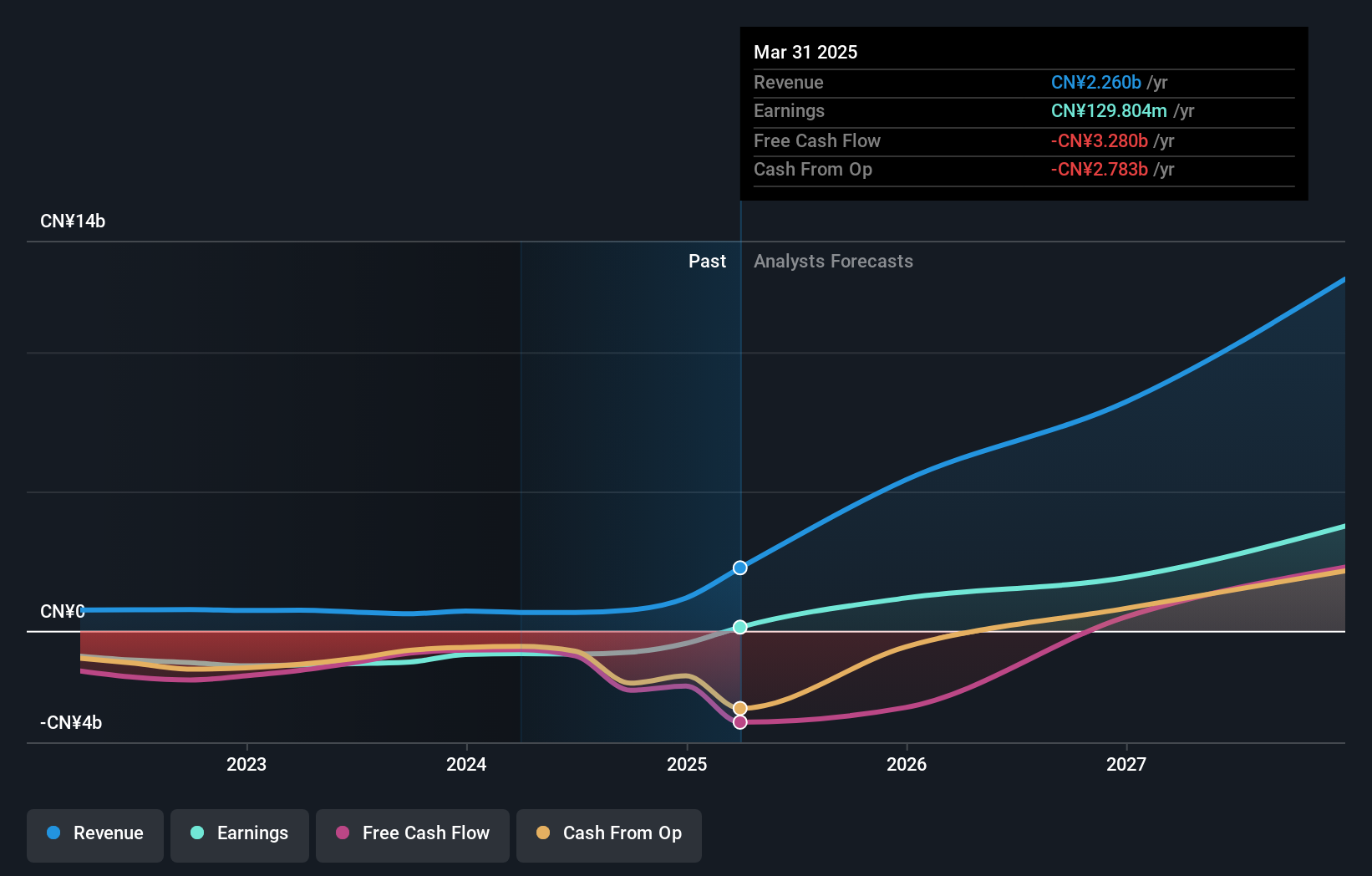

BIWIN Storage Technology (SHSE:688525)

Simply Wall St Growth Rating: ★★★★★☆

Overview: BIWIN Storage Technology Co., Ltd. is involved in the research, development, design, packaging, testing, production, and sale of semiconductor memories with a market cap of CN¥49.82 billion.

Operations: BIWIN Storage Technology's revenue from semiconductor sales amounts to CN¥7.17 billion.

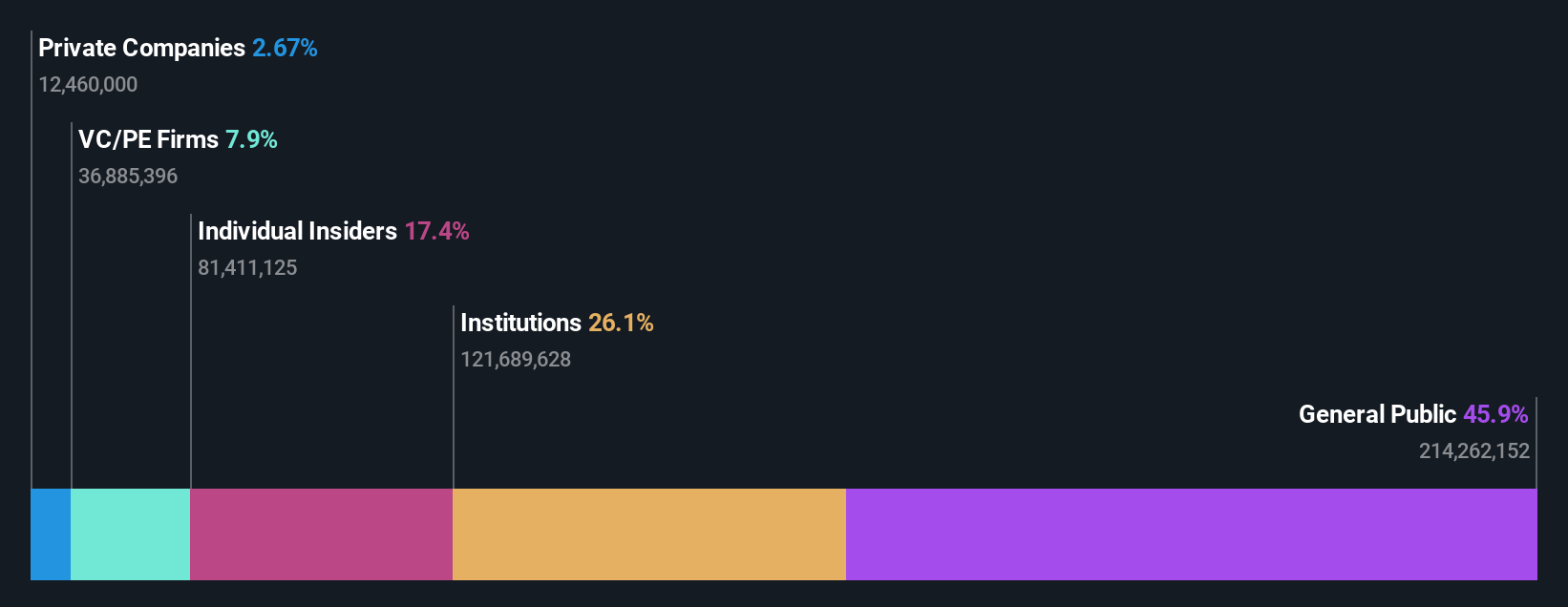

Insider Ownership: 17.4%

Earnings Growth Forecast: 77.4% p.a.

BIWIN Storage Technology is poised for substantial growth, with revenue expected to rise 23.3% annually, surpassing the Chinese market average. Despite recent losses and share price volatility, the company is forecasted to achieve profitability within three years. A CNY 40 million share buyback program aims to enhance shareholder value by reducing registered capital. Although insider trading activity isn't reported recently, these strategic moves underscore a focus on long-term growth amidst financial challenges.

- Click to explore a detailed breakdown of our findings in BIWIN Storage Technology's earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of BIWIN Storage Technology shares in the market.

Taking Advantage

- Discover the full array of 617 Fast Growing Asian Companies With High Insider Ownership right here.

- Curious About Other Options? AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BIWIN Storage Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688525

BIWIN Storage Technology

Researches, develops, designs, packs, tests, produces, and sells semiconductor memory.

High growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)