- China

- /

- Communications

- /

- SHSE:688387

3 Asian Stocks Estimated To Be Undervalued By 13.3% To 48.2%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious optimism and economic uncertainties, Asia's stock markets have shown resilience amid mixed economic signals. In this environment, identifying undervalued stocks can be a strategic approach for investors seeking potential opportunities, as these equities may offer value relative to their intrinsic worth despite broader market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥154.08 | CN¥302.65 | 49.1% |

| Xi'an International Medical Investment (SZSE:000516) | CN¥4.73 | CN¥9.38 | 49.6% |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥81.57 | CN¥161.77 | 49.6% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.05 | CN¥26.06 | 49.9% |

| Meitu (SEHK:1357) | HK$7.51 | HK$14.61 | 48.6% |

| JUSUNG ENGINEERINGLtd (KOSDAQ:A036930) | ₩29250.00 | ₩56972.54 | 48.7% |

| Japan Eyewear Holdings (TSE:5889) | ¥1975.00 | ¥3843.99 | 48.6% |

| East Buy Holding (SEHK:1797) | HK$20.42 | HK$40.27 | 49.3% |

| China Ruyi Holdings (SEHK:136) | HK$2.45 | HK$4.84 | 49.4% |

| Beijing Beimo High-tech Frictional MaterialLtd (SZSE:002985) | CN¥28.28 | CN¥55.83 | 49.3% |

Let's review some notable picks from our screened stocks.

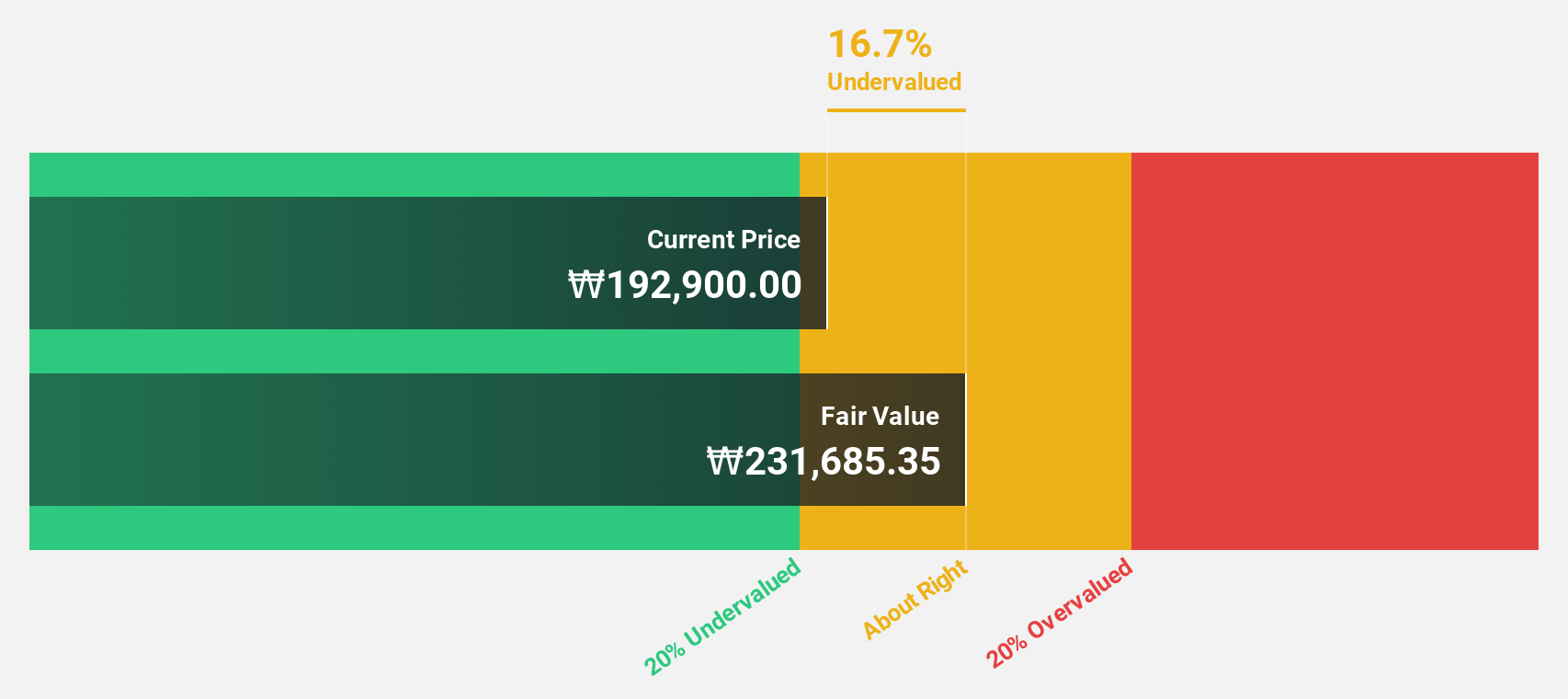

Hyundai Rotem (KOSE:A064350)

Overview: Hyundai Rotem Company manufactures and sells railway vehicles, defense systems, and plants and machinery in South Korea and internationally, with a market cap of ₩19.86 trillion.

Operations: Revenue segments for Hyundai Rotem include railway vehicles, defense systems, and plants and machinery.

Estimated Discount To Fair Value: 42.9%

Hyundai Rotem's recent earnings report shows substantial growth, with net income rising from ₩261.7 billion to ₩547.5 billion over the past year. The stock appears undervalued, trading 42.9% below its estimated fair value of ₩318,817.38 and is expected to grow earnings significantly at 28.4% annually, outpacing market averages. Its addition to the FTSE All-World Index highlights its increasing global recognition amidst strong revenue forecasts of 17.7% annual growth.

- The growth report we've compiled suggests that Hyundai Rotem's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Hyundai Rotem's balance sheet health report.

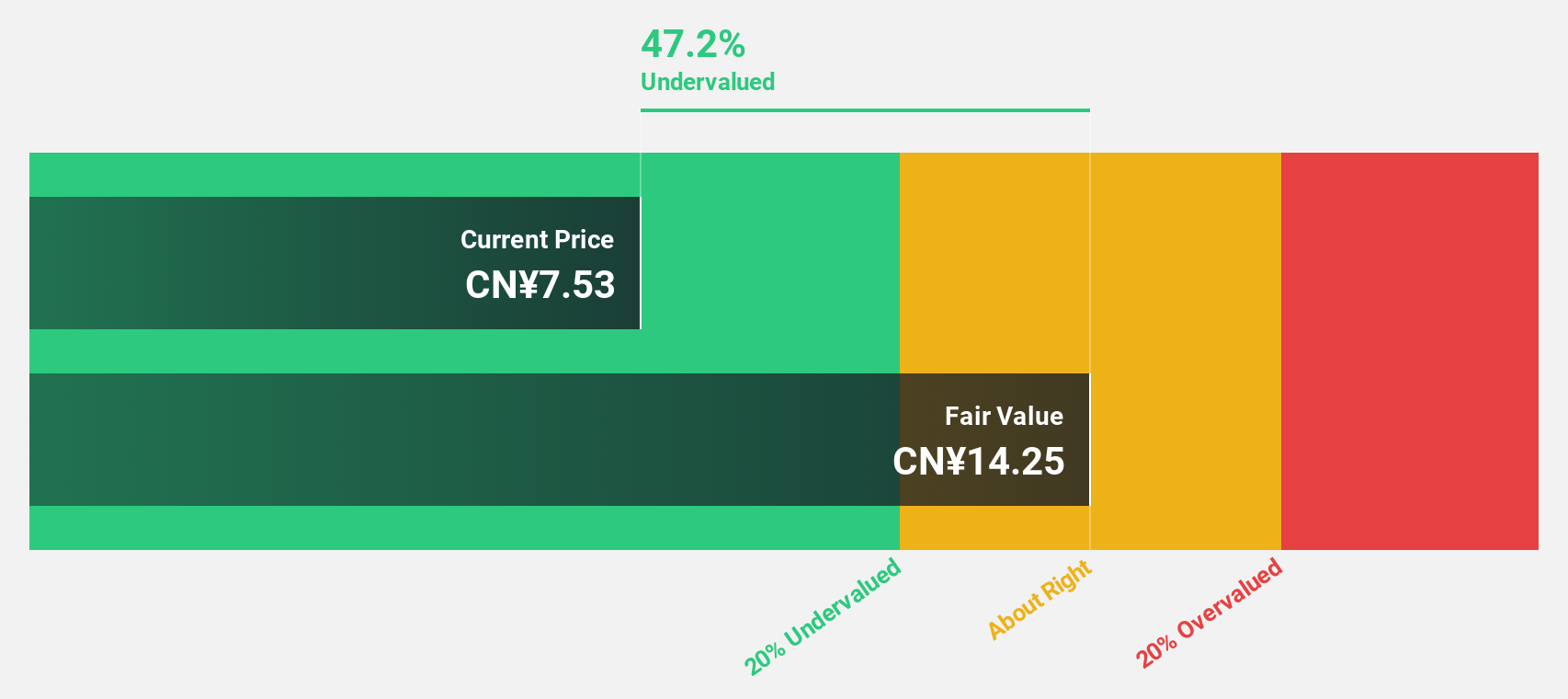

CICT Mobile Communication Technology (SHSE:688387)

Overview: CICT Mobile Communication Technology Co., Ltd. (SHSE:688387) focuses on mobile communication technology operations and has a market cap of CN¥25.23 billion.

Operations: CICT Mobile Communication Technology Co., Ltd. generates revenue from its mobile communication technology operations.

Estimated Discount To Fair Value: 48.2%

CICT Mobile Communication Technology is trading at CN¥7.38, significantly below its estimated fair value of CN¥14.25, suggesting it is undervalued based on cash flows. Despite reporting a net loss of CN¥165.01 million for the first nine months of 2025, earnings have grown 42.5% annually over the past five years and are expected to become profitable within three years with a forecasted revenue growth rate surpassing the Chinese market average at 17.5% per year.

- According our earnings growth report, there's an indication that CICT Mobile Communication Technology might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of CICT Mobile Communication Technology.

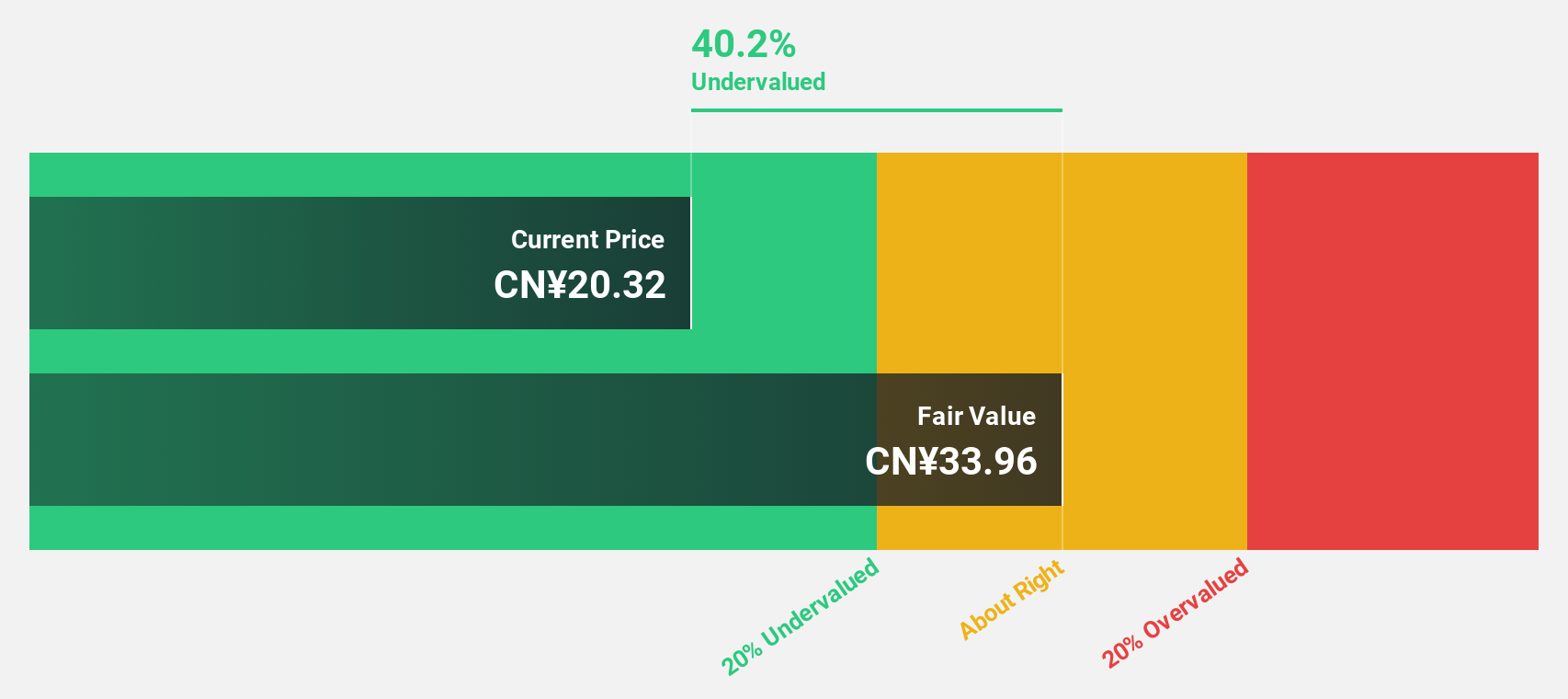

Tongyu Communication (SZSE:002792)

Overview: Tongyu Communication Inc. is engaged in the research, development, manufacturing, sales, and servicing of mobile communication antennas, RF devices, optical modules, and other products globally with a market cap of CN¥15.45 billion.

Operations: Tongyu Communication's revenue is primarily derived from its mobile communication antennas, RF devices, and optical modules sold globally.

Estimated Discount To Fair Value: 13.3%

Tongyu Communication is trading at CN¥29.47, below its estimated fair value of CN¥34.01, indicating it may be undervalued based on cash flows. Earnings are forecast to grow significantly at 74.92% annually over the next three years, outpacing the Chinese market's growth rate of 27.2%. However, recent financial results show a decline in profit margins from last year and a decrease in net income for the nine months ended September 2025 compared to the previous year.

- Upon reviewing our latest growth report, Tongyu Communication's projected financial performance appears quite optimistic.

- Take a closer look at Tongyu Communication's balance sheet health here in our report.

Key Takeaways

- Explore the 276 names from our Undervalued Asian Stocks Based On Cash Flows screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688387

CICT Mobile Communication Technology

CICT Mobile Communication Technology Co., Ltd.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026