- China

- /

- Electronic Equipment and Components

- /

- SHSE:688401

Top Chinese Growth Stocks With High Insider Ownership September 2024

Reviewed by Simply Wall St

As Chinese equities experience a retreat amid weak corporate earnings and economic data, investors are increasingly looking for resilient opportunities in the market. In this environment, growth companies with high insider ownership can offer unique advantages, as they often demonstrate strong commitment from their leadership and potential for sustained performance.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 18% | 28.7% |

| Jiayou International LogisticsLtd (SHSE:603871) | 22.9% | 24.6% |

| Western Regions Tourism DevelopmentLtd (SZSE:300859) | 13.9% | 39.2% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 29.9% |

| Eoptolink Technology (SZSE:300502) | 26.7% | 36.5% |

| Quick Intelligent EquipmentLtd (SHSE:603203) | 34.4% | 33.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 67.5% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 41.7% |

| UTour Group (SZSE:002707) | 23% | 28.7% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

Underneath we present a selection of stocks filtered out by our screen.

Quectel Wireless Solutions (SHSE:603236)

Simply Wall St Growth Rating: ★★★★☆☆

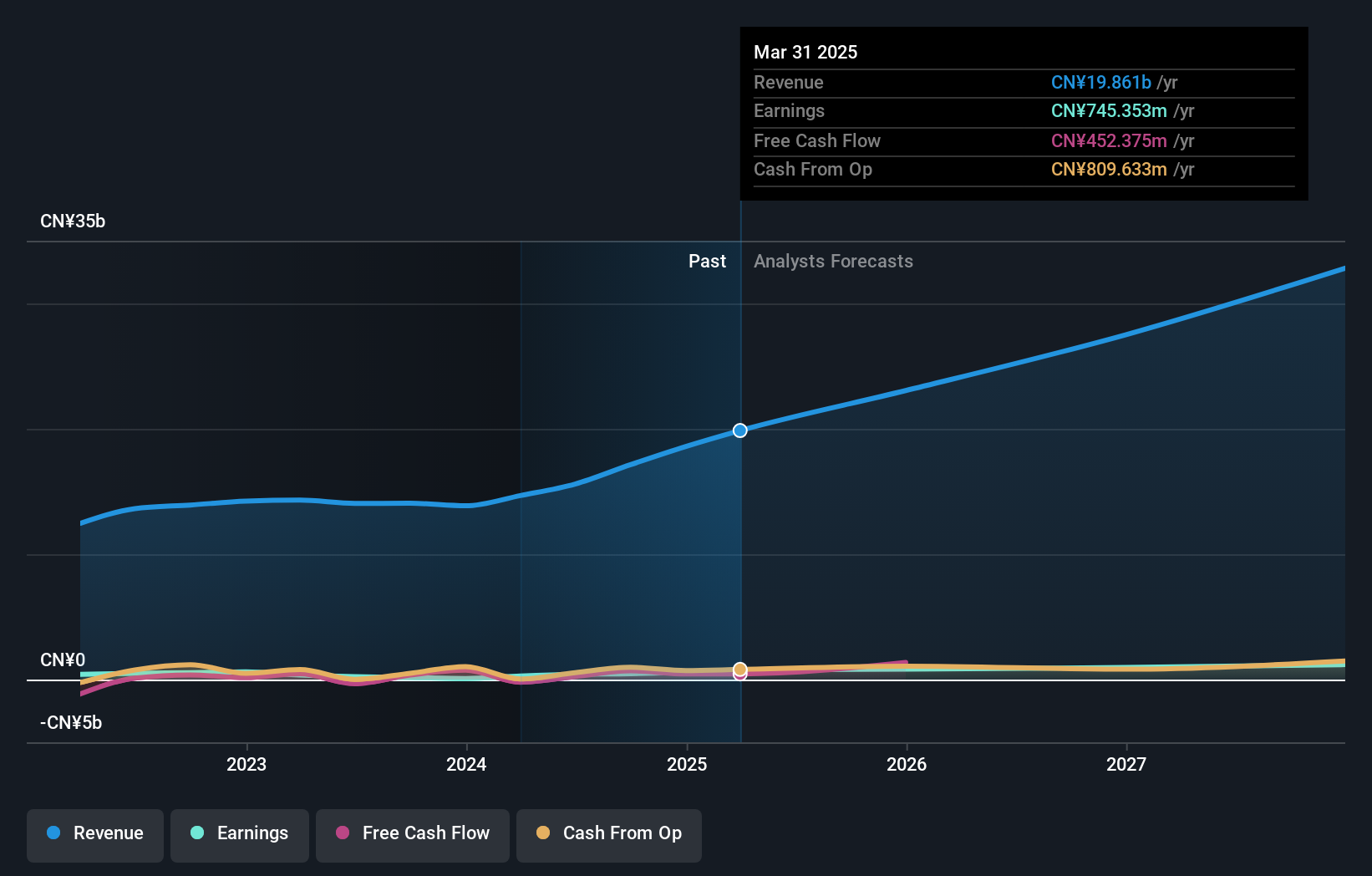

Overview: Quectel Wireless Solutions Co., Ltd. engages in the research, design, production, and sales of wireless communication modules and solutions globally, with a market cap of CN¥11.27 billion.

Operations: Quectel Wireless Solutions generates revenue through the development, design, manufacturing, and distribution of wireless communication modules and solutions on a global scale.

Insider Ownership: 24.4%

Quectel Wireless Solutions, a growth company with high insider ownership in China, has shown significant earnings growth, reporting sales of CNY 8.25 billion for the first half of 2024 and turning a net loss into a net income of CNY 209.38 million. Despite its lower-than-industry-average P/E ratio (27.1x), Quectel is forecasted to grow earnings annually by 32.46%, outpacing the Chinese market's expected growth rate. Recent product innovations like the LG290P GNSS module underscore its commitment to technological advancement and market expansion.

- Unlock comprehensive insights into our analysis of Quectel Wireless Solutions stock in this growth report.

- Our valuation report here indicates Quectel Wireless Solutions may be undervalued.

Rigol Technologies (SHSE:688337)

Simply Wall St Growth Rating: ★★★★★☆

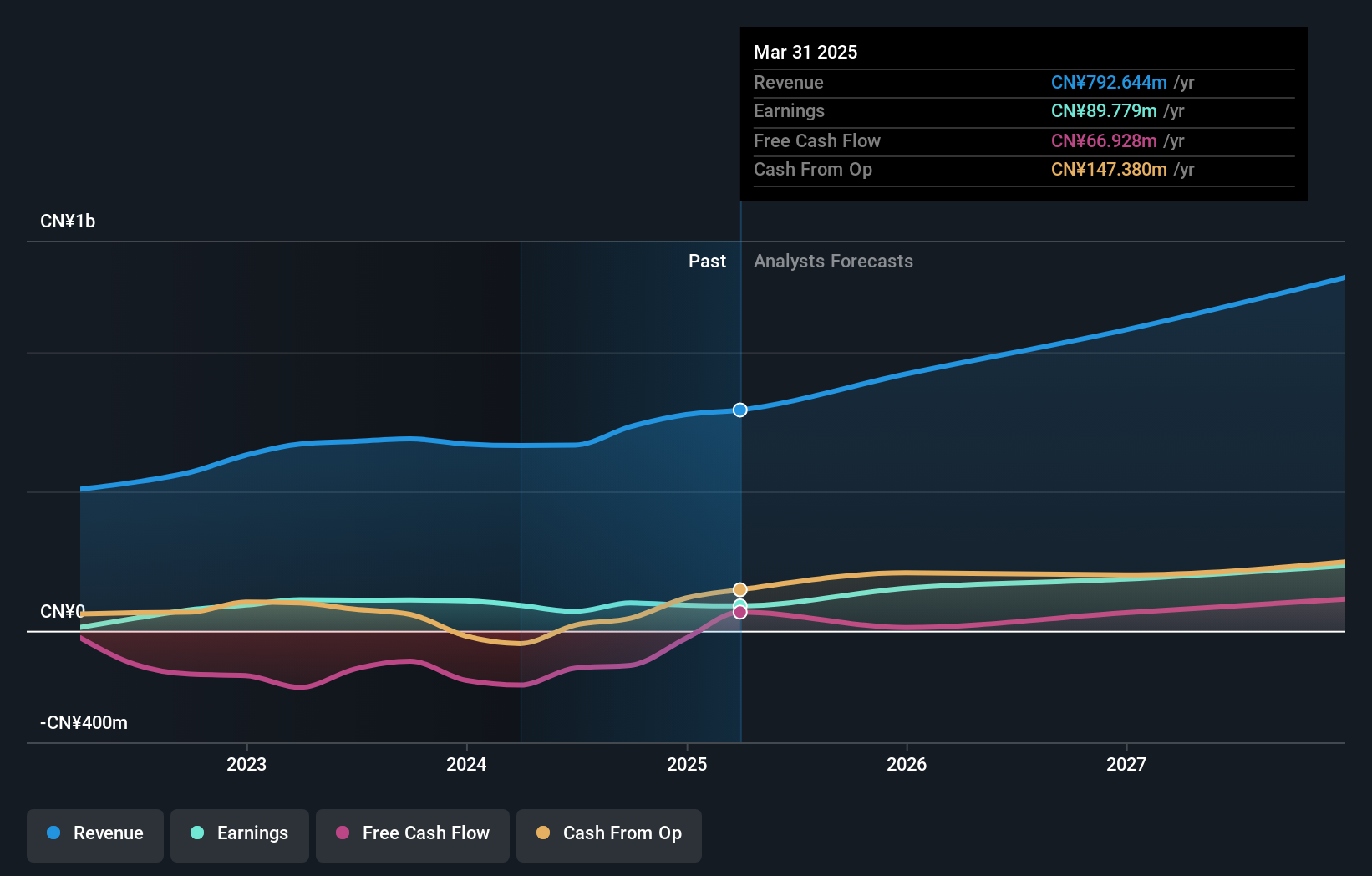

Overview: Rigol Technologies Co., Ltd. manufactures and sells test and measurement instruments worldwide, with a market cap of CN¥4.89 billion.

Operations: Revenue from electronic test and measurement instruments amounts to CN¥665 million.

Insider Ownership: 23%

Rigol Technologies, with substantial insider ownership, is forecasted to achieve impressive revenue growth of 27.7% per year and earnings growth of 36% annually, both outpacing the Chinese market averages. Despite a recent share buyback totaling CNY 30.01 million and trading at a significant discount to its fair value estimate, concerns include low return on equity forecasts (6.8%) and unsustainable dividend coverage by earnings or free cash flows.

- Get an in-depth perspective on Rigol Technologies' performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Rigol Technologies implies its share price may be too high.

Shenzhen Newway Photomask Making (SHSE:688401)

Simply Wall St Growth Rating: ★★★★★☆

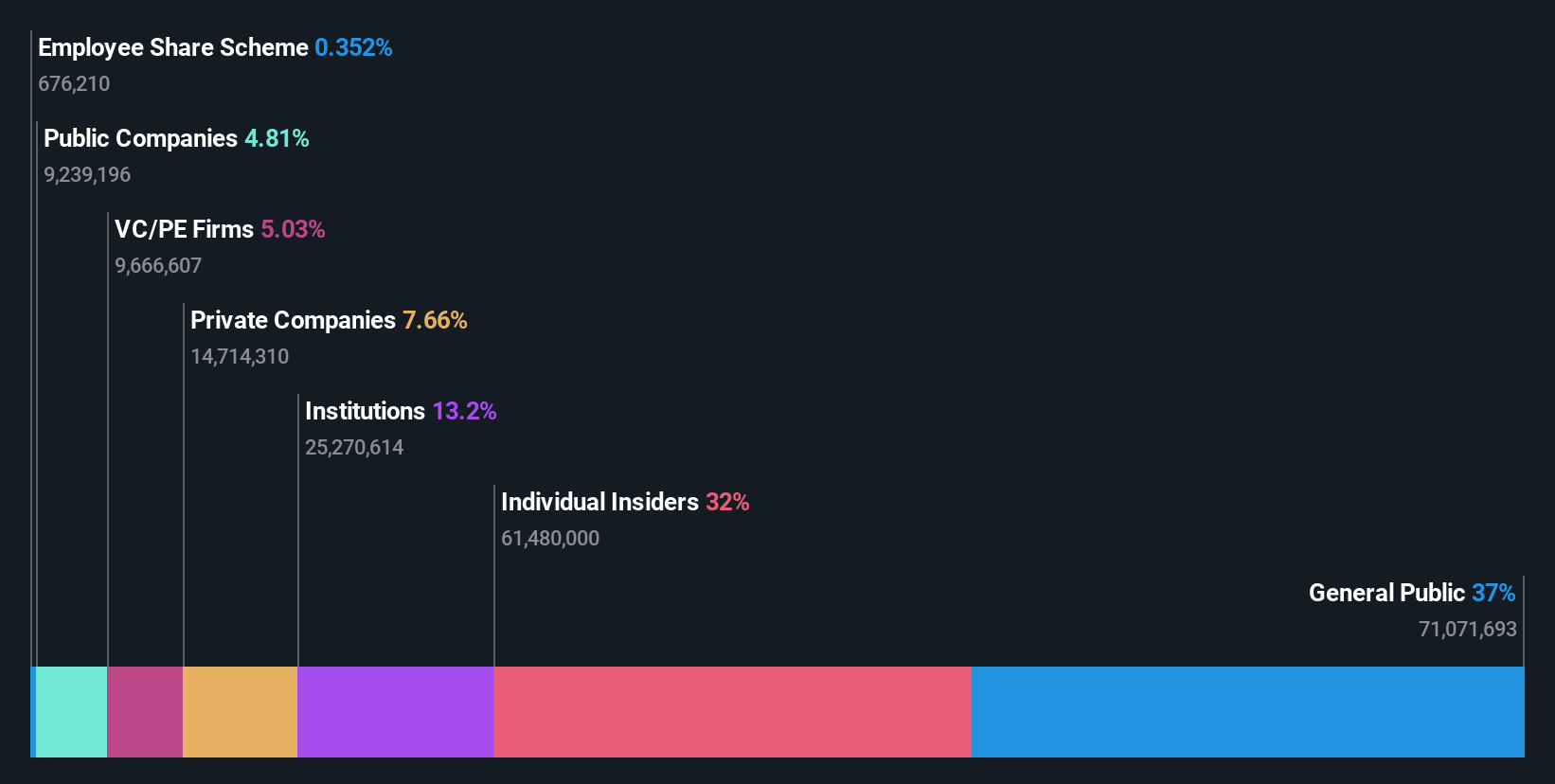

Overview: Shenzhen Newway Photomask Making Co., Ltd (ticker: SHSE:688401) is a lithography company in China that focuses on the design, development, and production of mask products, with a market cap of CN¥3.94 billion.

Operations: The company's revenue segments include the design, development, and production of mask products in China.

Insider Ownership: 32.1%

Shenzhen Newway Photomask Making, with substantial insider ownership, reported half-year sales of CNY 395.72 million and net income of CNY 82.42 million. The company's earnings are expected to grow significantly at 29.1% annually over the next three years, outpacing the Chinese market average. Despite a recent share buyback worth CNY 50.65 million and a favorable P/E ratio of 24.5x, concerns include low forecasted return on equity (15.4%) and unsustainable dividend coverage by free cash flows.

- Navigate through the intricacies of Shenzhen Newway Photomask Making with our comprehensive analyst estimates report here.

- The analysis detailed in our Shenzhen Newway Photomask Making valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Dive into all 381 of the Fast Growing Chinese Companies With High Insider Ownership we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688401

Shenzhen Newway Photomask Making

A lithography company, engages in the design, development, and production of mask products in China.

Flawless balance sheet with high growth potential.