- China

- /

- Electronic Equipment and Components

- /

- SHSE:688337

High Growth Tech Stocks to Watch in April 2025

Reviewed by Simply Wall St

As global markets grapple with the steepest weekly stock declines in five years, driven by unexpected tariffs and heightened trade tensions, small-cap stocks have notably underperformed, with the Russell 2000 Index losing about 10% amid broader market uncertainty. In this challenging environment, identifying high growth tech stocks requires a focus on companies that demonstrate resilience through innovation and adaptability to shifting economic landscapes.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.43% | 26.56% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 26.94% | 24.31% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| Arabian Contracting Services | 21.29% | 30.65% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

TianJin 712 Communication & Broadcasting (SHSE:603712)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TianJin 712 Communication & Broadcasting Co., Ltd. operates in the communication and broadcasting industry, with a market cap of CN¥13.71 billion.

Operations: The company generates revenue primarily from its operations in the communication and broadcasting sector. With a market cap of CN¥13.71 billion, it plays a significant role in this industry.

TianJin 712 Communication & Broadcasting, despite a challenging year with earnings shrinking by 86.6%, is positioned for a robust recovery with projected earnings growth of 55.7% annually. This contrasts sharply with the broader Communications industry's average decline of 4.8%. The company's revenue growth at an annual rate of 31.6% significantly outpaces the Chinese market forecast of 12.5%. However, it’s crucial to note that past financial results were notably influenced by a one-off gain of CN¥56.3M, which could skew the perception of underlying performance metrics like net profit margins that have dipped from last year’s 19.1% to just 4%. Moving forward, while facing lower return on equity projections and negative free cash flow currently, TianJin’s aggressive growth in revenue and earnings may position it favorably if these trends materialize as expected.

Hunan Kylinsec Technology (SHSE:688152)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hunan Kylinsec Technology Co., Ltd. is a company that provides software products and has a market capitalization of approximately CN¥4.40 billion.

Operations: Kylinsec Technology focuses on supplying software products. The company's market capitalization stands at approximately CN¥4.40 billion.

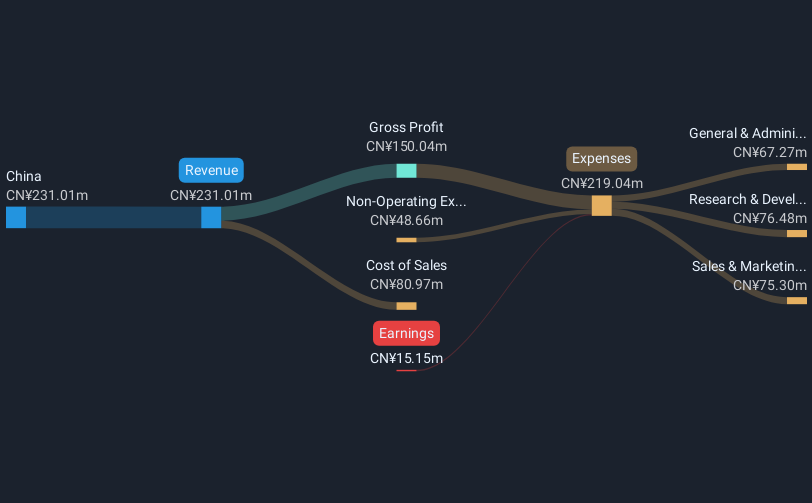

Hunan Kylinsec Technology has demonstrated a remarkable turnaround, transitioning from a net loss to reporting a net income of CNY 7.87 million in 2024, alongside a surge in sales from CNY 163.42 million to CNY 286.38 million. This growth trajectory is underscored by an annual revenue increase of 39.9% and an exceptional forecasted annual earnings growth rate of 88.6%. Despite the high volatility in its share price over the past three months, these financial metrics suggest robust internal improvements and market confidence, positioning Hunan Kylinsec favorably within the competitive tech landscape as it continues to capitalize on emerging opportunities in software innovation.

Rigol Technologies (SHSE:688337)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rigol Technologies Co., Ltd. is a global manufacturer and seller of test and measurement instruments, with a market capitalization of CN¥6.22 billion.

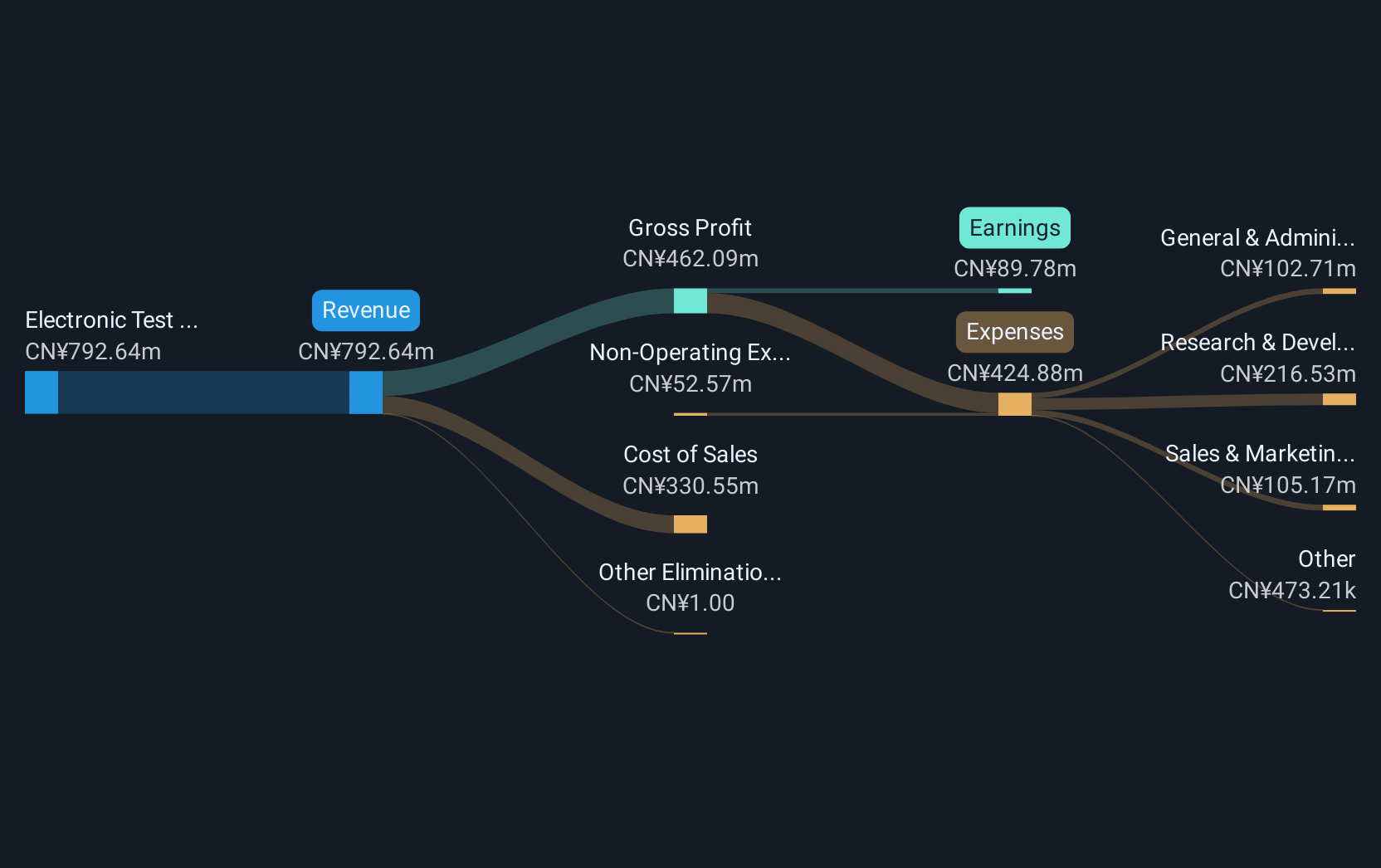

Operations: Rigol Technologies generates revenue primarily from its electronic test and measurement instruments segment, amounting to CN¥775.83 million.

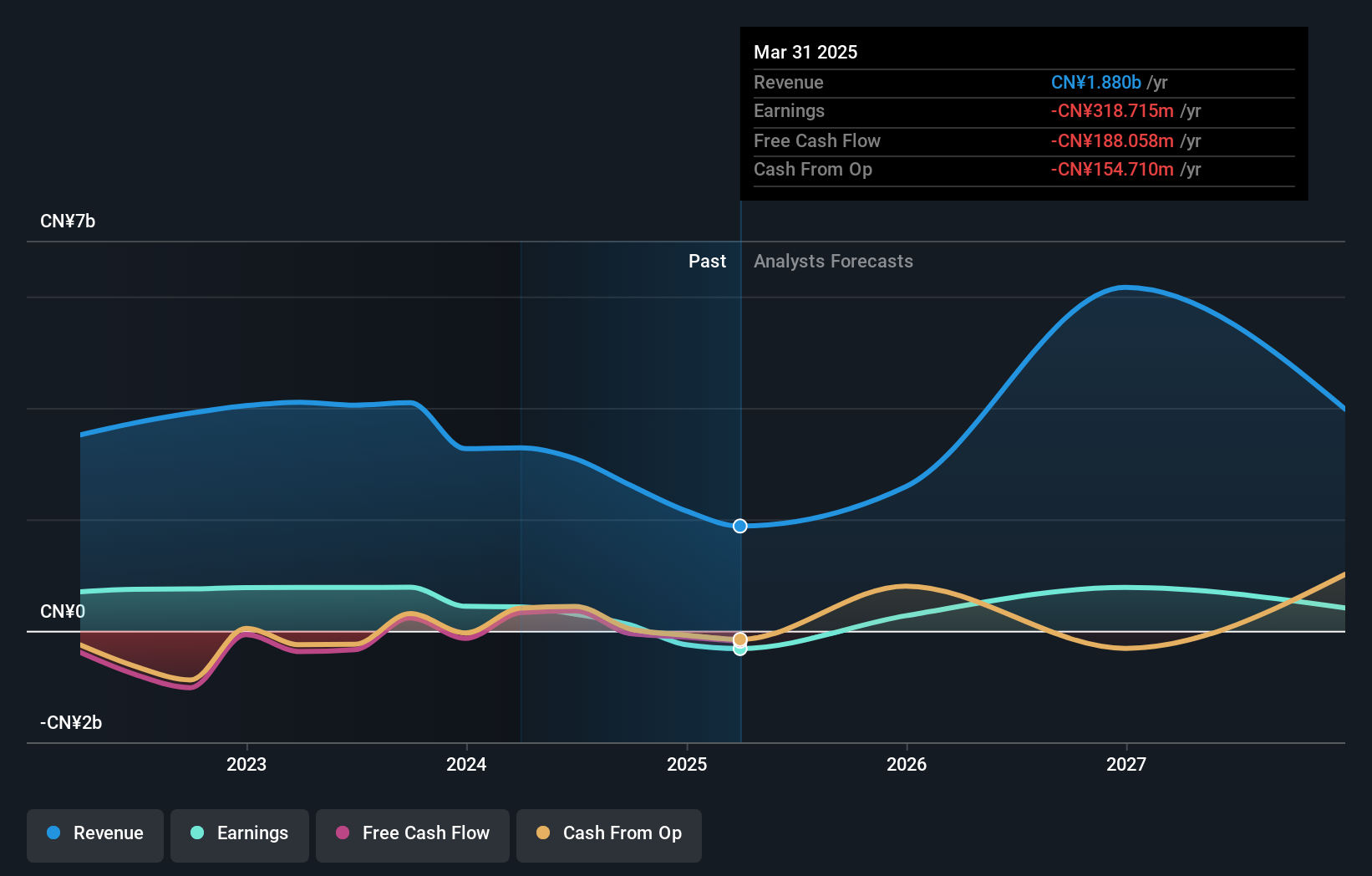

Rigol Technologies has demonstrated resilience and adaptability in the tech sector, with a notable increase in sales from CNY 670.54 million to CNY 775.83 million in 2024, although net income slightly decreased to CNY 88.91 million from CNY 107.95 million previously. This reflects an annual revenue growth of 18.9% and a robust earnings forecast growth rate of 41.2% per year, outpacing the CN market's average of 23.8%. Despite these financial fluctuations, Rigol's commitment to innovation is evident in its R&D investments, aligning with industry demands for continuous technological advancement and maintaining competitiveness in a rapidly evolving market.

- Take a closer look at Rigol Technologies' potential here in our health report.

Understand Rigol Technologies' track record by examining our Past report.

Taking Advantage

- Investigate our full lineup of 776 Global High Growth Tech and AI Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688337

Rigol Technologies

Manufactures and sells test and measurement instruments worldwide.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives