Exploring Three High Growth Tech Stocks With Promising Potential

Reviewed by Simply Wall St

As global markets show resilience with U.S. indexes nearing record highs and smaller-cap stocks outperforming larger counterparts, investors are keeping a keen eye on economic indicators such as jobless claims and home sales that suggest a strong labor market and stabilizing mortgage rates. In this environment, identifying high growth tech stocks with promising potential involves looking for companies that can leverage technological advancements to drive innovation and capture market share amidst broad-based gains in the tech sector.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 32.56% | 43.21% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| JNTC | 20.52% | 57.26% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

Click here to see the full list of 1288 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

CanSino Biologics (SEHK:6185)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CanSino Biologics Inc. focuses on the development, manufacturing, and commercialization of vaccines in China and has a market capitalization of approximately HK$11.69 billion.

Operations: The primary revenue stream for CanSino Biologics comes from the research and development of vaccine products for human use, generating CN¥748.53 million. The company's market capitalization is approximately HK$11.69 billion, reflecting its significant presence in the Chinese vaccine industry.

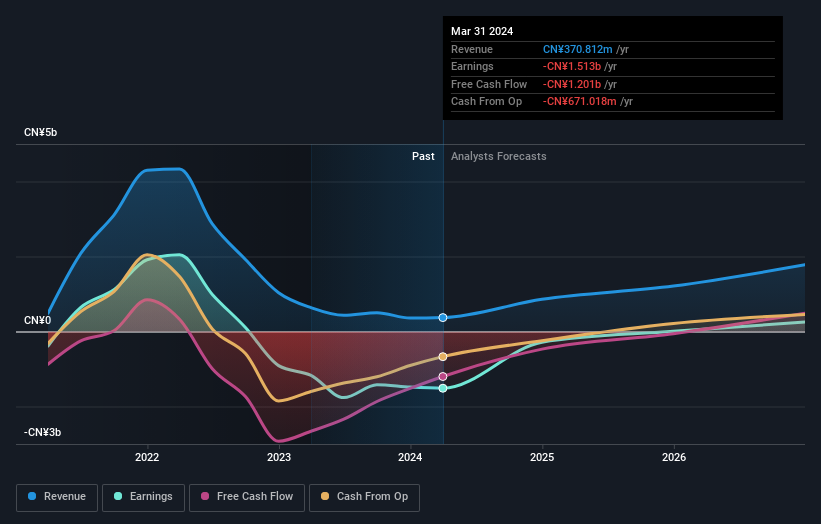

CanSino Biologics is navigating a transformative phase, underscored by its aggressive R&D spending aimed at pioneering vaccines, such as the recently trialed Hib Conjugate Vaccine. Despite a net loss of CNY 222.41 million for the nine months ending September 2024, improvements are evident compared to last year's CNY 985.03 million loss, signaling effective cost management and potential future profitability. The company's revenue surge to CNY 567.08 million from CNY 175.63 million highlights its rapid growth trajectory with an impressive annual forecast of 33.3%. Moreover, earnings are expected to skyrocket by approximately 141.4% annually over the next three years, reflecting CanSino's robust pipeline and market expansion strategies that could reshape its financial landscape and fortify its standing in the high-growth biotech sector.

Rigol Technologies (SHSE:688337)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rigol Technologies Co., Ltd. is a global manufacturer and seller of test and measurement instruments, with a market capitalization of CN¥8.60 billion.

Operations: Rigol Technologies focuses on the production and global sale of electronic test and measurement instruments, generating revenue primarily from this segment, which amounts to CN¥732.68 million.

Rigol Technologies is distinguishing itself in the tech landscape with a notable 22.2% projected annual revenue growth, surpassing industry norms significantly. This growth trajectory is bolstered by its recent product launches, including the DHO/MHO5000 Series Oscilloscopes and DG5000 Pro Series Generators, which enhance its competitive edge in electronic measurement solutions. Additionally, Rigol's commitment to innovation is evident from its R&D spending trends which are strategically aligned with expanding its technological capabilities and market reach. Expected earnings growth of 40.1% annually further underscores the company's potential to capitalize on increasing demand within tech sectors reliant on sophisticated testing and measurement equipment.

- Delve into the full analysis health report here for a deeper understanding of Rigol Technologies.

Assess Rigol Technologies' past performance with our detailed historical performance reports.

Sichuan Jiuyuan Yinhai Software.Co.Ltd (SZSE:002777)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sichuan Jiuyuan Yinhai Software Co., Ltd specializes in offering medical insurance, digital government affairs, and smart cities services to government departments and industry ecological entities in China, with a market cap of CN¥8.56 billion.

Operations: The company generates revenue by providing specialized services in medical insurance, digital government affairs, and smart city solutions to governmental and industry clients across China. It operates with a market capitalization of CN¥8.56 billion, reflecting its established presence in the technology sector focused on public administration and urban development initiatives.

Sichuan Jiuyuan Yinhai Software.Co.Ltd, amidst a challenging period, reported a significant drop in sales to CNY 668.15 million from CNY 803.4 million year-over-year, reflecting broader market dynamics. Despite this downturn, the company's commitment to innovation remains robust with R&D expenses maintaining a strategic focus; this is critical as they navigate through the tech sector's evolving landscape. Notably, their earnings are projected to surge by 39.3% annually, outpacing the CN market's growth rate of 26.1%, showcasing potential resilience and adaptability in recovering from current setbacks. The firm’s future prospects hinge on leveraging its R&D investments which have consistently aligned with industry needs—evidenced by an aggressive growth forecast in revenue at an annual rate of 18.6%. This strategic emphasis on development can catalyze advancements in their software solutions, potentially leading to regained momentum and improved financial performance despite recent earnings contraction and a volatile share price over the past three months.

Key Takeaways

- Get an in-depth perspective on all 1288 High Growth Tech and AI Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6185

CanSino Biologics

Develops, manufactures, and commercializes vaccines in the People’s Republic of China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives