- China

- /

- Electronic Equipment and Components

- /

- SHSE:688205

High Growth Tech Stocks in Asia Featuring Three Prominent Picks

Reviewed by Simply Wall St

Amidst global market fluctuations, Asia's tech sector continues to capture attention as it navigates through economic uncertainties and evolving trade policies. In this environment, identifying promising high-growth tech stocks involves looking for companies with robust innovation capabilities, adaptability to changing regulatory landscapes, and strong market positioning.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 24.65% | 25.30% | ★★★★★★ |

| Arizon RFID Technology (Cayman) | 27.55% | 28.53% | ★★★★★★ |

| PharmaResearch | 23.41% | 26.41% | ★★★★★★ |

| giftee | 20.20% | 68.98% | ★★★★★★ |

| Ascentage Pharma Group International | 23.29% | 60.86% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Legend Holdings (SEHK:3396)

Simply Wall St Growth Rating: ★★★★☆☆

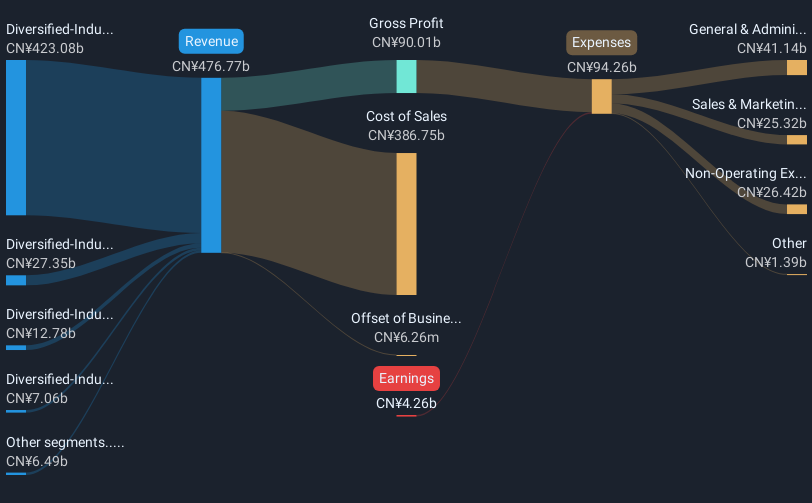

Overview: Legend Holdings Corporation, along with its subsidiaries, engages in industrial operations and industrial incubations and investments both within the People’s Republic of China and internationally, with a market capitalization of approximately HK$21.96 billion.

Operations: Legend Holdings generates revenue primarily through its diversified-industries operations, with Lenovo contributing CN¥423.08 billion, Joyvio Group CN¥27.35 billion, Levima Group CN¥7.06 billion, and Bank Internationale Luxembourg CN¥12.78 billion. The company also engages in industrial incubations and investments, adding CN¥4.65 billion to its revenue streams.

Legend Holdings' trajectory in the tech sector is marked by significant financial dynamics and strategic operations. With an anticipated annual revenue growth of 11.3%, the company outpaces Hong Kong's market average of 7.8%. This growth is bolstered by a robust forecast in earnings, expected to surge by 124% annually. A recent corporate update highlighted a potential swing from a substantial net loss in 2023 to either a net loss of RMB 800 million or a profit of RMB 300 million for 2024, primarily driven by strong performance in its subsidiary, Lenovo Group Limited, and reduced investment losses. Despite these gains, Legend faces challenges with low forecasted return on equity at just 6.7% over three years and struggles with covering interest payments effectively, reflecting areas needing strategic focus as it navigates its future in high-growth tech markets across Asia.

- Click here and access our complete health analysis report to understand the dynamics of Legend Holdings.

Explore historical data to track Legend Holdings' performance over time in our Past section.

Wuxi Taclink Optoelectronics Technology (SHSE:688205)

Simply Wall St Growth Rating: ★★★★★☆

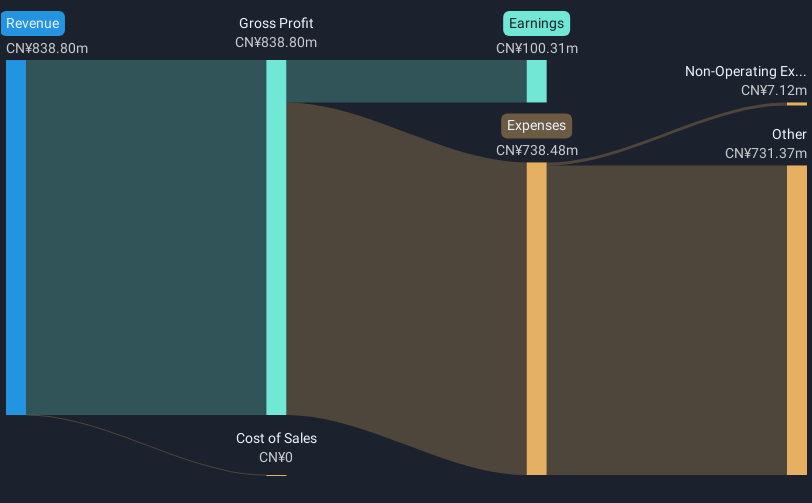

Overview: Wuxi Taclink Optoelectronics Technology Co., Ltd. operates in the optoelectronics industry, focusing on the development and production of optical communication devices, with a market cap of CN¥9.20 billion.

Operations: The company specializes in optical communication devices, generating revenue primarily through the sale of these products. The cost structure is heavily influenced by manufacturing and R&D expenses. Gross profit margin trends show fluctuations over recent periods, indicating variability in production efficiency or pricing strategies.

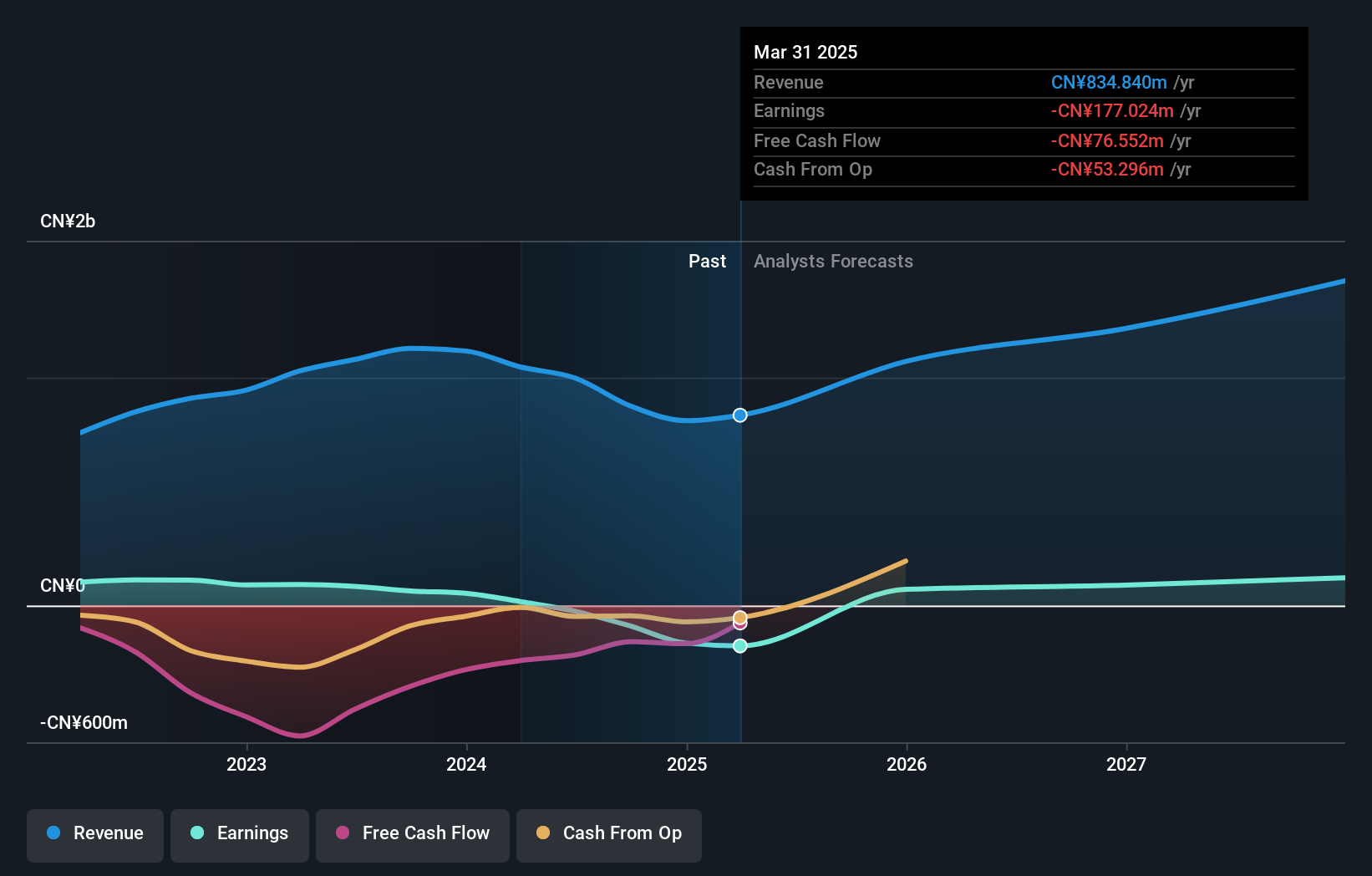

Wuxi Taclink Optoelectronics Technology Co., Ltd. has demonstrated robust financial performance, with revenue soaring by 31.3% annually and earnings growth outpacing at 36.4%. This growth trajectory is underpinned by significant R&D investments, totaling CNY 120 million in the latest fiscal year, accounting for approximately 14.3% of their total revenue. The firm's strategic focus on enhancing optical communication technologies has positioned it well within the competitive tech landscape of Asia, particularly as demand for advanced communication solutions escalates regionally. Recent results underscore this momentum, with a yearly sales increase to CNY 838.8 million and net income rising to CNY 100.31 million, reflecting a solid operational execution aligned with market needs.

Zhejiang Hechuan Technology (SHSE:688320)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Hechuan Technology Co., Ltd. focuses on the research and development, manufacturing, sale, and application integration of industrial automation products, with a market cap of CN¥7.58 billion.

Operations: Hechuan Technology generates revenue primarily through the sale and integration of industrial automation products. The company's operations encompass research and development, manufacturing, and sales within this sector.

Zhejiang Hechuan Technology, amidst a challenging year, reported a significant revenue drop to CNY 815.14 million from CNY 1.116 billion, transitioning from a net profit to a loss of CNY 157.23 million. Despite these setbacks, the company's commitment to innovation remains evident with an aggressive R&D stance; however, specific spending figures are not disclosed in the provided data. The tech firm also completed a share repurchase program, buying back shares worth CNY 62.13 million, signaling confidence in its future prospects despite recent volatility and removal from the S&P Global BMI Index. This scenario underlines the volatile nature of high-growth tech sectors in Asia but also highlights resilience through strategic financial maneuvers and ongoing investment in technological advancement.

- Take a closer look at Zhejiang Hechuan Technology's potential here in our health report.

Learn about Zhejiang Hechuan Technology's historical performance.

Turning Ideas Into Actions

- Navigate through the entire inventory of 521 Asian High Growth Tech and AI Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Wuxi Taclink Optoelectronics Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wuxi Taclink Optoelectronics Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688205

Wuxi Taclink Optoelectronics Technology

Wuxi Taclink Optoelectronics Technology Co., Ltd.

Flawless balance sheet with high growth potential.