- South Korea

- /

- Entertainment

- /

- KOSDAQ:A078340

Top Three High Growth Tech Stocks To Watch For Potential Expansion

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, with major indices like the Russell 2000 and S&P 500 experiencing significant gains, investors are closely monitoring the potential impact of policy changes on economic growth and inflation. In this dynamic environment, identifying high-growth tech stocks requires a focus on companies that can leverage favorable regulatory conditions and demonstrate resilience amidst evolving market trends.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.65% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.66% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

Click here to see the full list of 1280 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Com2uS (KOSDAQ:A078340)

Simply Wall St Growth Rating: ★★★★☆☆

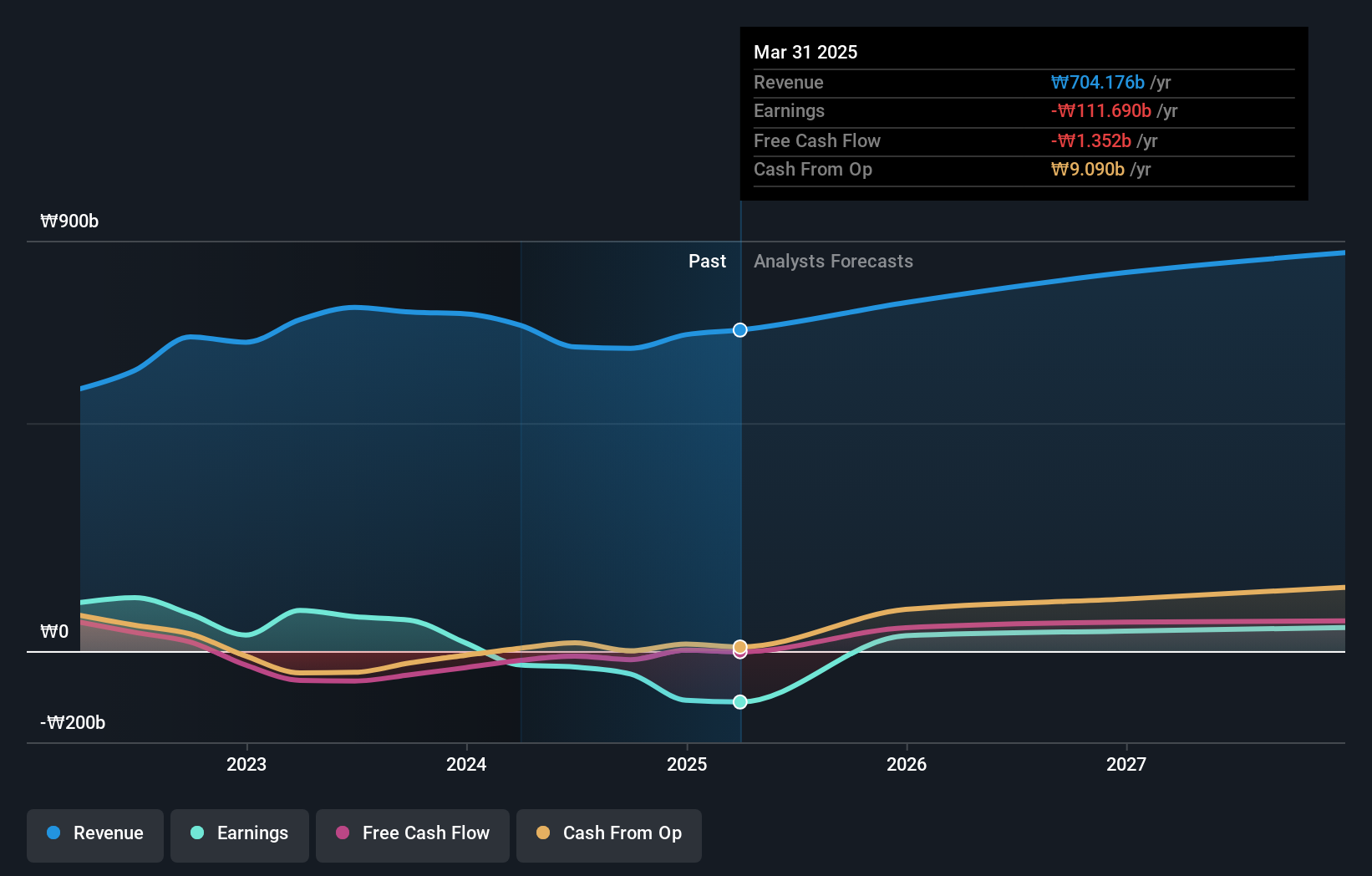

Overview: Com2uS Corporation is a global developer and publisher of mobile games, operating in regions including South Korea, the United States, China, Japan, Taiwan, Southeast Asia, and Europe with a market cap of ₩479.71 billion.

Operations: The company generates revenue primarily through the development and publishing of mobile games across various international markets. Its operations span several regions, contributing to its significant presence in the global gaming industry.

Com2uS, amidst a challenging landscape, is navigating with a strategic focus on R&D, which is pivotal in the tech sector. Despite being unprofitable currently, its revenue growth forecast at 11.8% per year outpaces the Korean market's 10.1%, highlighting potential for future profitability within three years. The firm's commitment to innovation is evident from its substantial R&D investments aimed at driving above-market profit growth. Recently, Com2uS announced upcoming Q3 results and presented at the Korea Capital Market Conference, signaling active engagement with investors and dedication to transparency in its operational strategies. This approach could bolster investor confidence as it transitions towards profitability, underscored by an anticipated significant earnings growth of 99.83% annually.

- Dive into the specifics of Com2uS here with our thorough health report.

Gain insights into Com2uS' historical performance by reviewing our past performance report.

Hunan Kylinsec Technology (SHSE:688152)

Simply Wall St Growth Rating: ★★★★★☆

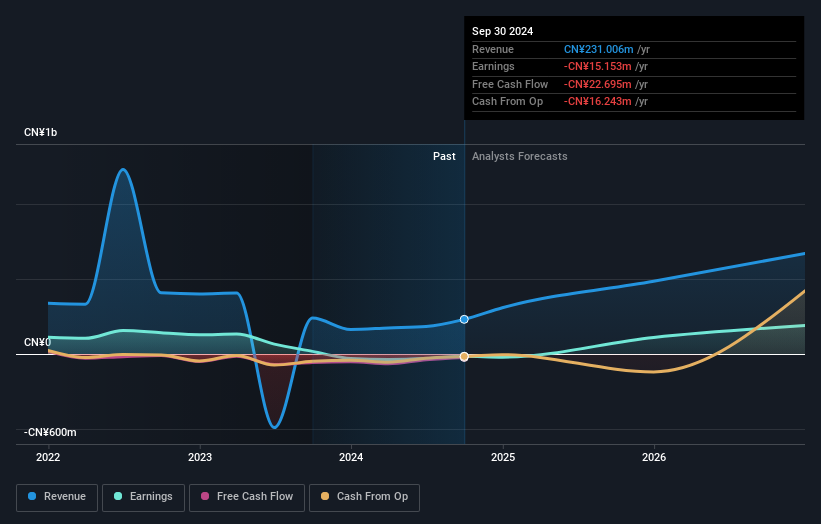

Overview: Hunan Kylinsec Technology Co., Ltd. is a company that supplies software products and has a market capitalization of CN¥6.63 billion.

Operations: Kylinsec Technology focuses on providing software solutions, with its primary revenue derived from these products. The company has a market capitalization of CN¥6.63 billion.

Hunan Kylinsec Technology, amidst a volatile market, is demonstrating robust revenue growth at 44.9% annually, outpacing the Chinese market's average of 14.1%. This surge is supported by significant R&D investments which have grown to align with its innovative drive in the tech sector. Despite current unprofitability, earnings are projected to soar by 117% per year, positioning the company for potential profitability within three years. Recent financial results show a reduction in net losses from CNY 37.9 million to CNY 22.94 million year-over-year, reflecting operational improvements and cost management efficiencies that could enhance future financial stability.

- Unlock comprehensive insights into our analysis of Hunan Kylinsec Technology stock in this health report.

Gain insights into Hunan Kylinsec Technology's past trends and performance with our Past report.

Wuxi Taclink Optoelectronics Technology (SHSE:688205)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuxi Taclink Optoelectronics Technology Co., Ltd. is a company engaged in the development and manufacturing of optoelectronic products, with a market capitalization of CN¥9.38 billion.

Operations: Wuxi Taclink Optoelectronics Technology focuses on the production of optoelectronic products, with its operations generating significant revenue. The company's financial performance is characterized by a notable gross profit margin trend.

Wuxi Taclink Optoelectronics Technology has shown a promising trajectory with its recent earnings growth of 19% over the past year, outstripping the electronics industry average of 1.7%. The firm's commitment to innovation is evident in its R&D spending, which significantly contributes to its dynamic performance in the tech sector. With revenue expected to climb by 23.4% annually and earnings forecasted to surge by 33.1%, Wuxi Taclink is strategically positioned above market expectations, reflecting a robust potential for sustained growth amidst technological advancements and market demands.

Taking Advantage

- Explore the 1280 names from our High Growth Tech and AI Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A078340

Com2uS

Develops and publishes mobile games in South Korea, the United States, China, Japan, Taiwan, Southeast Asia, Europe, and internationally.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives