- China

- /

- Electronic Equipment and Components

- /

- SHSE:688195

Exploring Three High Growth Tech Stocks In Asia

Reviewed by Simply Wall St

Amidst the global market dynamics, Asia's technology sector is capturing attention with its robust growth potential, particularly as investor enthusiasm for tech and AI-related stocks in China continues to rise, even as concerns about broader economic slowdowns persist. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation capabilities and resilience in adapting to shifting market conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Suzhou TFC Optical Communication | 35.80% | 36.87% | ★★★★★★ |

| Zhongji Innolight | 34.82% | 35.50% | ★★★★★★ |

| Knowmerce | 42.51% | 33.23% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Optowide Technologies (SHSE:688195)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Optowide Technologies Co., Ltd. specializes in the research, development, production, and sale of precision optics and fiber components both in China and internationally, with a market cap of CN¥20.51 billion.

Operations: Optowide Technologies focuses on precision optics and fiber components, catering to both domestic and international markets.

Optowide Technologies has demonstrated robust growth with a 28.8% annual increase in revenue, outpacing the Chinese market average of 14.6%. This performance is underpinned by a significant 34.3% forecast in earnings growth over the next three years, suggesting strong future potential. Recent financial results reflect this upward trajectory; for the nine months ending September 2025, sales surged to CNY 425.13 million from CNY 331.85 million year-over-year, with net income also rising to CNY 63.8 million from CNY 55.48 million. Despite its highly volatile share price and low forecasted Return on Equity at just 13.7%, Optowide's inclusion in the S&P Global BMI Index highlights its growing relevance in the tech sector, particularly within high-growth markets in Asia.

Zhejiang Century Huatong GroupLtd (SZSE:002602)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Century Huatong Group Co., Ltd operates in the auto parts, Internet games, and artificial intelligence cloud data sectors both domestically and internationally, with a market capitalization of CN¥127.30 billion.

Operations: Zhejiang Century Huatong Group Co., Ltd generates revenue through its diversified operations in the auto parts, Internet games, and artificial intelligence cloud data sectors. The company leverages its international presence to expand its market reach across these industries.

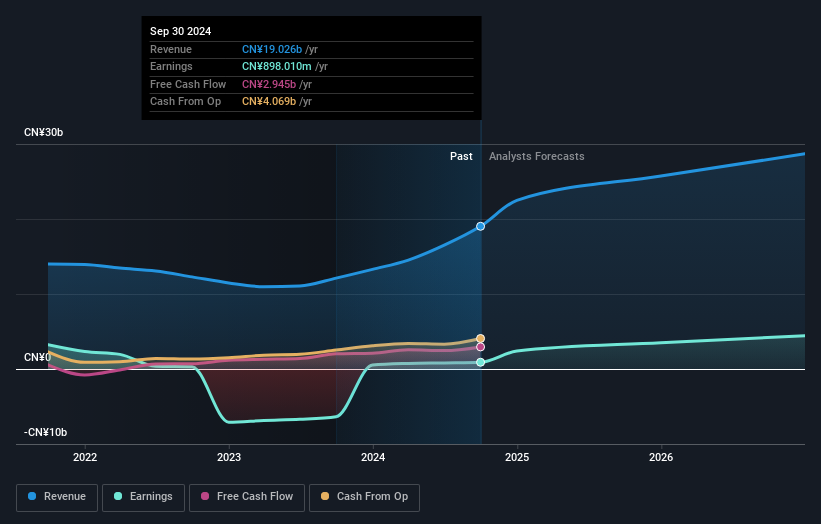

Zhejiang Century Huatong Group has demonstrated substantial growth, with earnings soaring by 319.5% over the past year, significantly outpacing the entertainment industry's average of 16.4%. This robust performance is supported by a notable revenue increase to CNY 27.22 billion from CNY 15.53 billion year-over-year, reflecting a solid annualized growth rate of 16.3%. Additionally, the company's commitment to shareholder value is evident from its recent announcement of a share repurchase program up to CNY 1 billion at no more than CNY 28.77 per share, underlining confidence in its financial health and future prospects.

Perfect World (SZSE:002624)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Perfect World Co., Ltd. focuses on the research, development, distribution, and operation of online games both in China and internationally, with a market cap of CN¥27.92 billion.

Operations: The company generates revenue primarily from its online gaming segment, which includes the development and operation of games in both domestic and international markets. It has a market cap of CN¥27.92 billion.

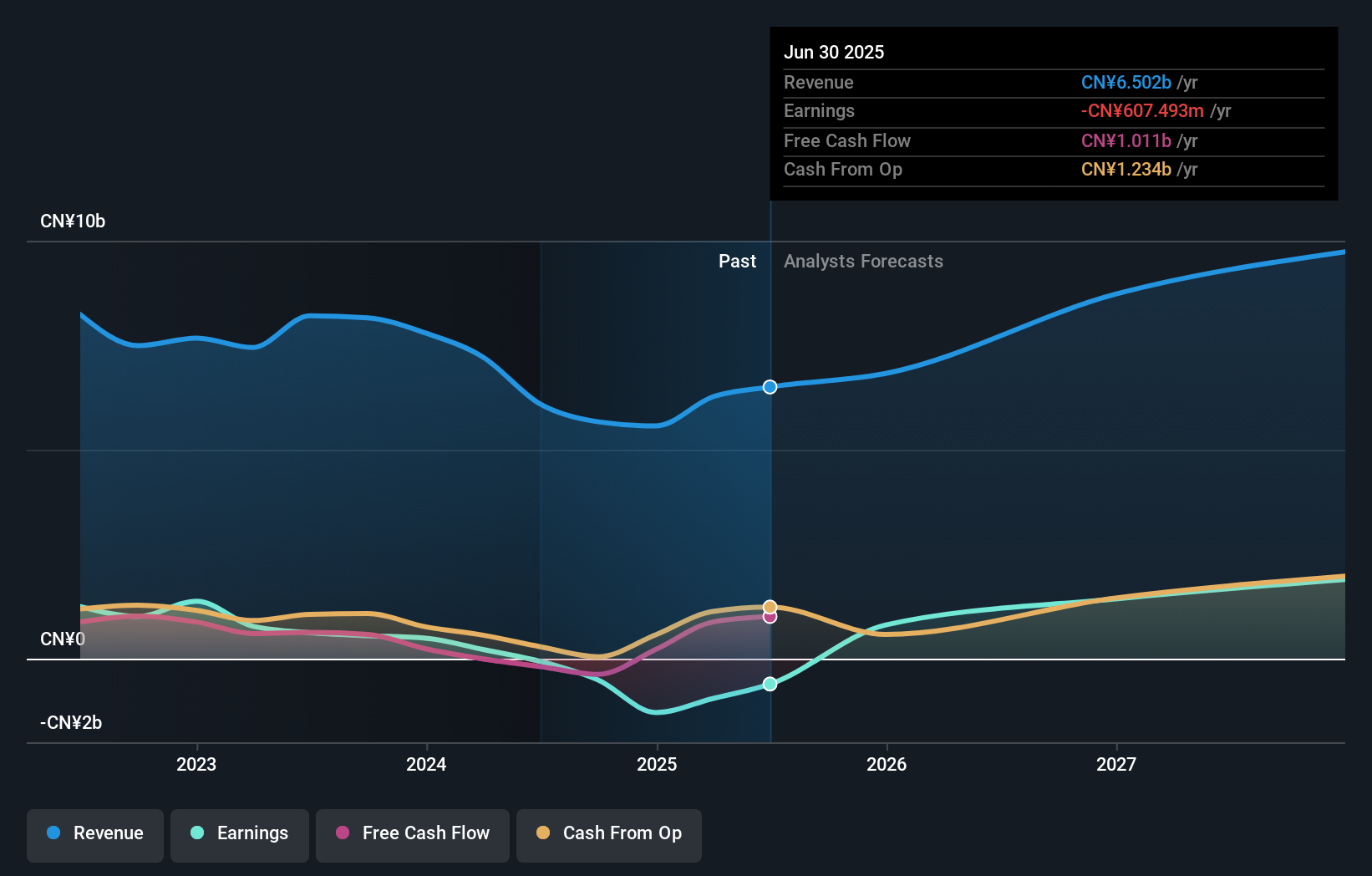

Perfect World's recent performance underscores its rising trajectory in the tech sector, with a significant turnaround from a net loss of CNY 388.81 million to a net income of CNY 665.53 million over the nine months ending September 2025. This shift is mirrored by an impressive annual revenue growth rate of 16.9%, outpacing the broader Chinese market average of 14.6%. The company's strategic amendments to its articles of association further reflect an agile approach to governance, positioning it well within Asia's competitive tech landscape despite previous profitability challenges. These developments, combined with robust earnings growth forecasted at 76.56% annually, suggest a strong upward momentum for Perfect World as it capitalizes on expanding digital entertainment demands.

- Click here and access our complete health analysis report to understand the dynamics of Perfect World.

Explore historical data to track Perfect World's performance over time in our Past section.

Make It Happen

- Click here to access our complete index of 185 Asian High Growth Tech and AI Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688195

Optowide Technologies

Engages in the research, development, production, and sale of precision optics and fiber components in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026