- China

- /

- Electronic Equipment and Components

- /

- SHSE:688160

Kinco Automation (Shanghai) Co.,Ltd's (SHSE:688160) Financials Are Too Obscure To Link With Current Share Price Momentum: What's In Store For the Stock?

Kinco Automation (Shanghai)Ltd (SHSE:688160) has had a great run on the share market with its stock up by a significant 49% over the last month. But the company's key financial indicators appear to be differing across the board and that makes us question whether or not the company's current share price momentum can be maintained. In this article, we decided to focus on Kinco Automation (Shanghai)Ltd's ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

Check out our latest analysis for Kinco Automation (Shanghai)Ltd

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Kinco Automation (Shanghai)Ltd is:

7.0% = CN¥52m ÷ CN¥752m (Based on the trailing twelve months to June 2024).

The 'return' is the income the business earned over the last year. That means that for every CN¥1 worth of shareholders' equity, the company generated CN¥0.07 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Kinco Automation (Shanghai)Ltd's Earnings Growth And 7.0% ROE

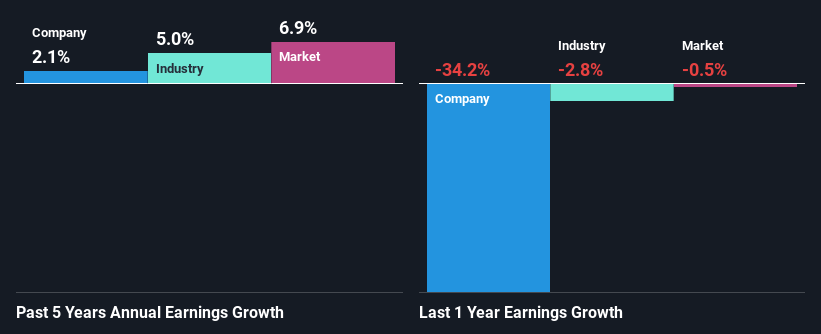

At first glance, Kinco Automation (Shanghai)Ltd's ROE doesn't look very promising. Yet, a closer study shows that the company's ROE is similar to the industry average of 6.5%. Having said that, Kinco Automation (Shanghai)Ltd has shown a meagre net income growth of 2.1% over the past five years. Bear in mind, the company's ROE is not very high . Hence, this does provide some context to low earnings growth seen by the company.

We then compared Kinco Automation (Shanghai)Ltd's net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 5.0% in the same 5-year period, which is a bit concerning.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. Is Kinco Automation (Shanghai)Ltd fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Kinco Automation (Shanghai)Ltd Using Its Retained Earnings Effectively?

Despite having a normal three-year median payout ratio of 37% (or a retention ratio of 63% over the past three years, Kinco Automation (Shanghai)Ltd has seen very little growth in earnings as we saw above. Therefore, there might be some other reasons to explain the lack in that respect. For example, the business could be in decline.

Additionally, Kinco Automation (Shanghai)Ltd has paid dividends over a period of four years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth.

Summary

Overall, we have mixed feelings about Kinco Automation (Shanghai)Ltd. Even though it appears to be retaining most of its profits, given the low ROE, investors may not be benefitting from all that reinvestment after all. The low earnings growth suggests our theory correct. Wrapping up, we would proceed with caution with this company and one way of doing that would be to look at the risk profile of the business. You can see the 3 risks we have identified for Kinco Automation (Shanghai)Ltd by visiting our risks dashboard for free on our platform here.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kinco Automation (Shanghai)Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688160

Kinco Automation (Shanghai)Ltd

Develops, produces, and sells industrial automation standards and intelligent hardware products in China.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)