- South Korea

- /

- Aerospace & Defense

- /

- KOSE:A012450

3 Stocks Estimated To Be Trading At Discounts Up To 49.7%

Reviewed by Simply Wall St

Amid a turbulent week in global markets, marked by geopolitical tensions and concerns over consumer spending, major indexes experienced declines despite early gains. As investors navigate these uncertainties, identifying undervalued stocks can offer potential opportunities; these are often characterized by strong fundamentals and resilience against market volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| OSAKA Titanium technologiesLtd (TSE:5726) | ¥1862.00 | ¥3721.49 | 50% |

| América Móvil. de (BMV:AMX B) | MX$14.89 | MX$29.71 | 49.9% |

| Aoshikang Technology (SZSE:002913) | CN¥29.51 | CN¥58.56 | 49.6% |

| CD Projekt (WSE:CDR) | PLN221.70 | PLN441.47 | 49.8% |

| Food & Life Companies (TSE:3563) | ¥4154.00 | ¥8301.16 | 50% |

| BalnibarbiLtd (TSE:3418) | ¥1067.00 | ¥2117.17 | 49.6% |

| Hanwha Aerospace (KOSE:A012450) | ₩682000.00 | ₩1354744.21 | 49.7% |

| Siam Wellness Group (SET:SPA) | THB5.35 | THB10.69 | 49.9% |

| Shenzhen Anche Technologies (SZSE:300572) | CN¥18.69 | CN¥37.15 | 49.7% |

| Doosan Fuel Cell (KOSE:A336260) | ₩16320.00 | ₩32574.92 | 49.9% |

Let's dive into some prime choices out of the screener.

Hanwha Aerospace (KOSE:A012450)

Overview: Hanwha Aerospace Co., Ltd. is involved in the development, production, and maintenance of aircraft engines globally, with a market cap of ₩30.28 trillion.

Operations: Hanwha Aerospace's revenue is derived from several segments, including the Defense Sector at ₩7.24 trillion, Security Sector at ₩2.02 trillion, Aviation Sector at ₩1.86 trillion, ICT Sector at ₩694.56 million, Industrial Equipment Sector at ₩453.40 million, and Aerospace Division at ₩160.56 million.

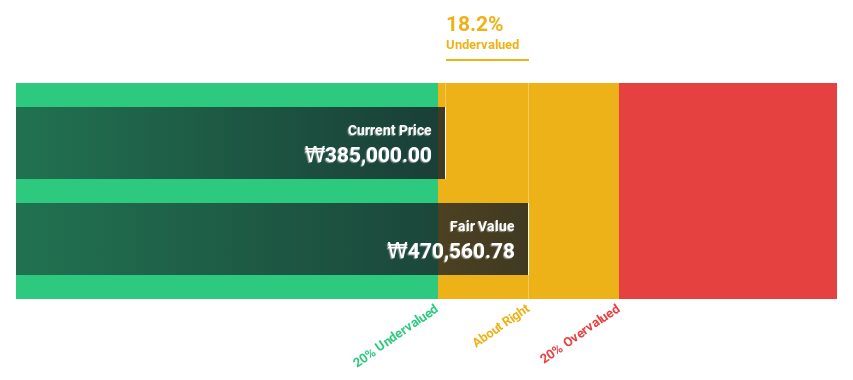

Estimated Discount To Fair Value: 49.7%

Hanwha Aerospace is trading at nearly 50% below its estimated fair value, making it highly undervalued based on discounted cash flow analysis. Despite having high non-cash earnings and a volatile share price, the company is projected to achieve significant revenue and earnings growth of over 30% annually, outpacing the Korean market. However, operating cash flow does not adequately cover debt obligations. The recent appointment of Michael Coulter as global defense CEO may bolster strategic direction in defense sectors.

- Our expertly prepared growth report on Hanwha Aerospace implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Hanwha Aerospace here with our thorough financial health report.

Ningbo Deye Technology Group (SHSE:605117)

Overview: Ningbo Deye Technology Group Co., Ltd. specializes in the production and sales of heat exchangers, inverters, and dehumidifiers across China, the UK, the US, Germany, India, and other international markets with a market cap of CN¥59.26 billion.

Operations: The company's revenue primarily comes from its production and sales of heat exchangers, inverters, and dehumidifiers across various international markets including China, the UK, the US, Germany, and India.

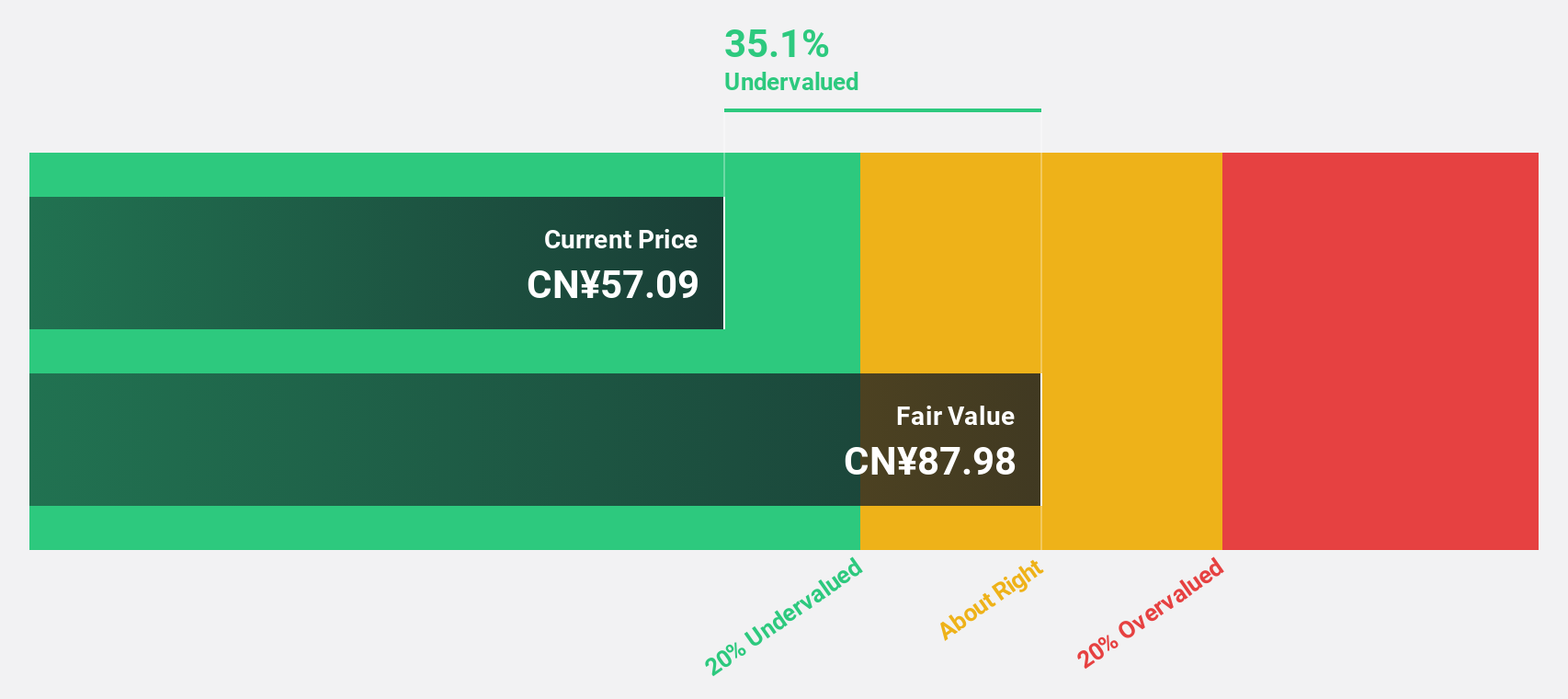

Estimated Discount To Fair Value: 24.5%

Ningbo Deye Technology Group is trading at CN¥92.08, approximately 24.5% below its estimated fair value of CN¥121.9, indicating it is undervalued based on discounted cash flow analysis. The company demonstrates strong growth potential with earnings expected to increase significantly by 27.63% annually and revenue forecasted to grow at 30.4% per year, surpassing the Chinese market average growth rate, making it an attractive option for investors seeking undervalued stocks with robust cash flows.

- The analysis detailed in our Ningbo Deye Technology Group growth report hints at robust future financial performance.

- Take a closer look at Ningbo Deye Technology Group's balance sheet health here in our report.

Zhejiang Lante Optics (SHSE:688127)

Overview: Zhejiang Lante Optics Co., Ltd. manufactures and sells optical products in China with a market cap of CN¥12.32 billion.

Operations: The company's revenue segments include optical lenses at CN¥1.45 billion and optical components at CN¥2.75 billion.

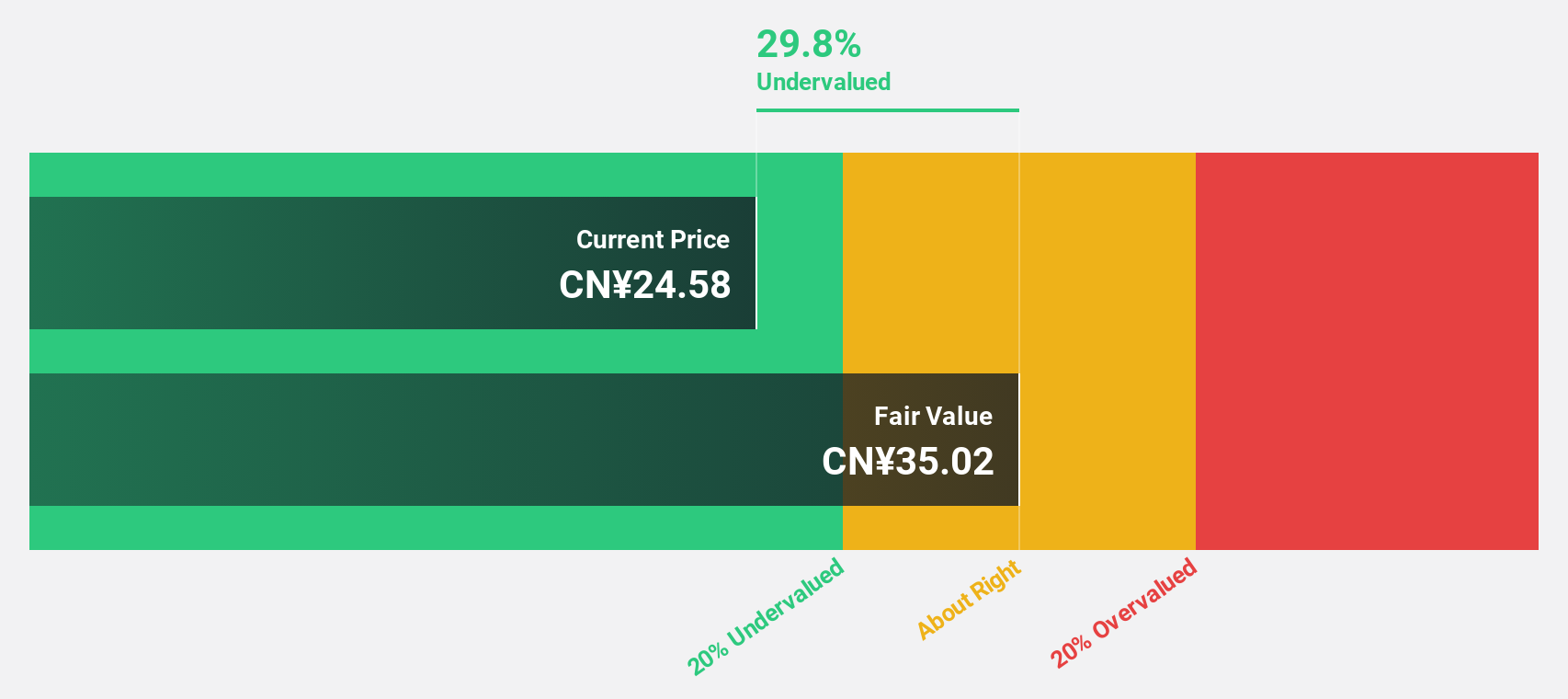

Estimated Discount To Fair Value: 11.3%

Zhejiang Lante Optics is trading at CN¥29.6, slightly below its fair value estimate of CN¥33.37, suggesting it may be undervalued based on cash flows. The company's earnings grew by 21.5% last year and are forecast to increase significantly at 26.39% annually, outpacing the Chinese market average. Recent earnings reported a rise in sales to CN¥1.03 billion and net income of CN¥218.59 million, highlighting strong financial performance potential despite a modest discount from fair value.

- Our growth report here indicates Zhejiang Lante Optics may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Zhejiang Lante Optics.

Turning Ideas Into Actions

- Take a closer look at our Undervalued Stocks Based On Cash Flows list of 915 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanwha Aerospace might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A012450

Hanwha Aerospace

Engages in the development, production, and maintenance of aircraft engines worldwide.

Exceptional growth potential and fair value.

Market Insights

Community Narratives