- China

- /

- Electronic Equipment and Components

- /

- SHSE:688071

High Growth Tech Stocks To Watch In January 2025

Reviewed by Simply Wall St

As we approach January 2025, global markets have shown a mixed performance with major U.S. indices like the Nasdaq Composite and S&P 500 posting gains despite some mid-week reversals, while consumer confidence and manufacturing indicators suggest potential economic headwinds. In this environment, high growth tech stocks continue to capture investor attention due to their potential for innovation and resilience in challenging market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1266 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Shanghai W-Ibeda High Tech.GroupLtd (SHSE:688071)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai W-Ibeda High Tech. Group Co., Ltd. (SHSE:688071) specializes in the development and production of high-tech automotive components, with a market capitalization of approximately CN¥2.28 billion.

Operations: Shanghai W-Ibeda generates revenue primarily from its Auto Parts & Accessories segment, which reported CN¥406.27 million. The company focuses on high-tech automotive components, contributing significantly to its financial performance.

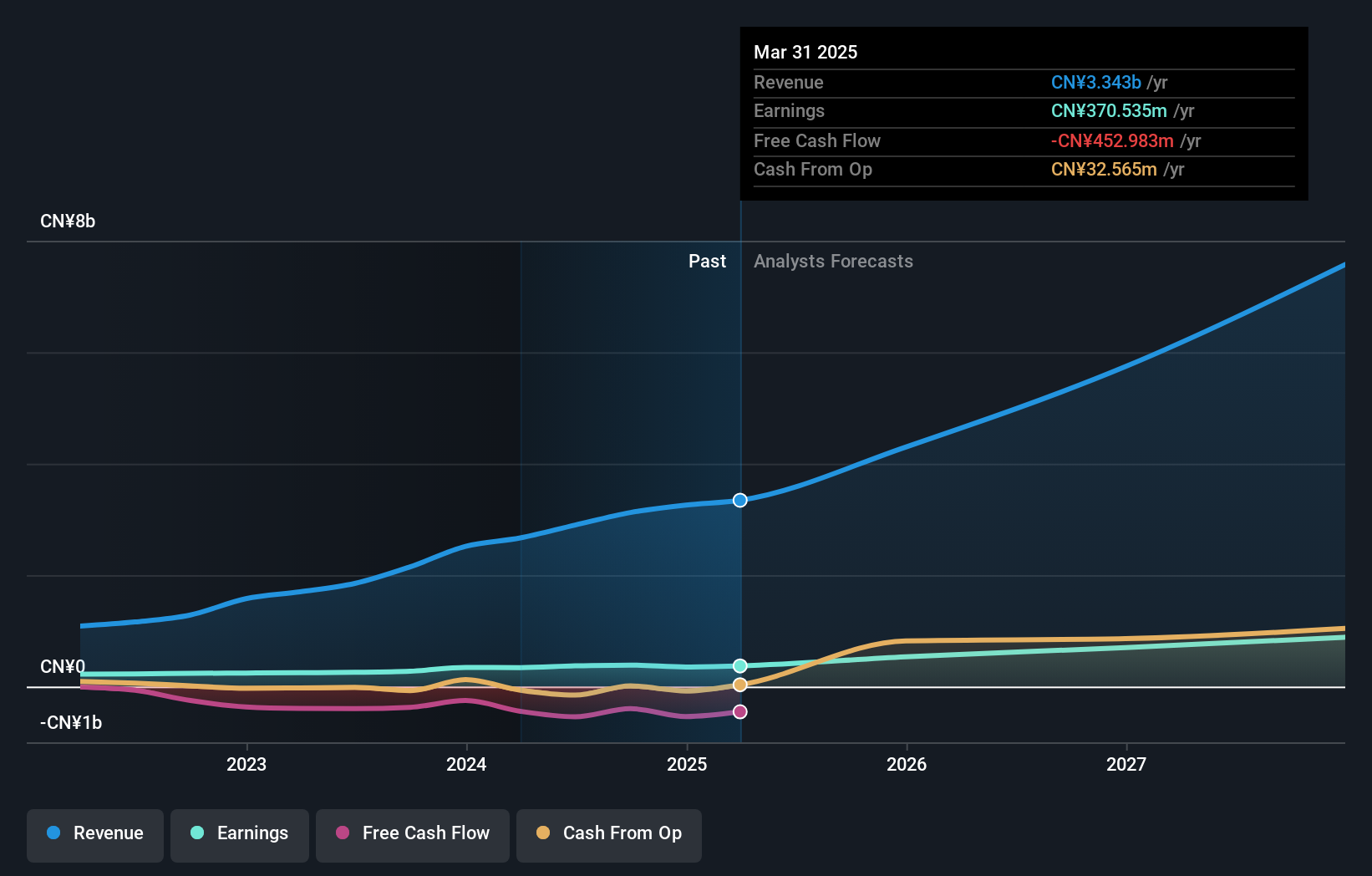

Shanghai W-Ibeda High Tech.GroupLtd., despite its recent financial turbulence, is on a trajectory to outpace the Chinese market with an anticipated revenue growth of 37% per year, significantly higher than the national average of 13.6%. This growth is underpinned by robust forecasts in earnings, expected to surge by approximately 179.3% annually. However, it's important to note that the company remains unprofitable and its share price has been highly volatile over the past three months. In response to these challenges, Shanghai W-Ibeda has not engaged in any new share repurchase activities since completing a modest buyback program last year for CNY 10.6 million, representing just 0.36% of shares outstanding. The firm's strategic focus may need reevaluation as it navigates through profitability concerns and operational cash flow issues which are currently insufficient to cover debts.

Geovis TechnologyLtd (SHSE:688568)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Geovis Technology Co., Ltd focuses on the research, development, and industrialization of digital earth products for various sectors in China, with a market capitalization of CN¥27.73 billion.

Operations: Geovis Technology Co., Ltd specializes in creating digital earth solutions for government, enterprise, and public sectors within China.

Geovis TechnologyLtd has demonstrated robust financial performance, with revenue surging to CNY 2.01 billion, up from CNY 1.4 billion a year earlier, marking a significant growth of 29.3%. This uptrend is coupled with an earnings increase to CNY 145.68 million from CNY 103.12 million, reflecting a solid annualized earnings growth of 37.4%. Despite the volatile share price in recent months, the company's strategic initiatives and strong market position in software innovation continue to attract attention. Notably, its R&D focus remains aggressive as it aims to sustain its competitive edge and cater to evolving technological demands.

Temenos (SWX:TEMN)

Simply Wall St Growth Rating: ★★★★☆☆

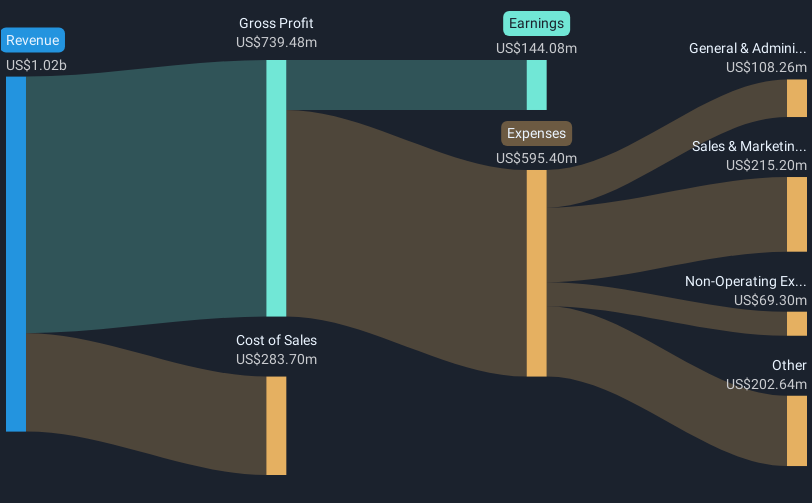

Overview: Temenos AG develops, markets, and sells integrated banking software systems to financial institutions globally, with a market cap of CHF4.68 billion.

Operations: Temenos AG generates revenue primarily through the sale of integrated banking software systems to financial institutions worldwide. The company's business model focuses on licensing, maintenance, and services associated with its software products.

Temenos is shaping the future of banking with its strategic deployment of SaaS and on-premises AI solutions, highlighting a commitment to innovation and client-centric growth. In recent developments, Temenos partnered with NVIDIA to launch high-performance generative AI for banks, enhancing data-driven customer experiences while ensuring data privacy. This move follows a solid financial performance in Q3 2024, where revenue rose to $246.92 million from $236.7 million the previous year, and net income increased significantly to $30.85 million from $21.88 million, showcasing an earnings growth of 11.6% annually. These advancements underscore Temenos's agility in adapting to technological trends and fulfilling evolving market demands efficiently.

- Click here and access our complete health analysis report to understand the dynamics of Temenos.

Evaluate Temenos' historical performance by accessing our past performance report.

Where To Now?

- Investigate our full lineup of 1266 High Growth Tech and AI Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688071

Shanghai W-Ibeda High Tech.GroupLtd

Shanghai W-Ibeda High Tech.Group Co.,Ltd.

High growth potential very low.