Top Growth Companies With Strong Insider Ownership January 2025

Reviewed by Simply Wall St

As we close out 2024, global markets have experienced a mixed bag of economic indicators, with U.S. consumer confidence dipping and major stock indexes showing moderate gains in the final week of the year. In this environment, growth companies with strong insider ownership can offer a unique advantage, as high insider stakes often signal confidence in a company’s long-term potential and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

We'll examine a selection from our screener results.

Miracle Automation EngineeringLtd (SZSE:002009)

Simply Wall St Growth Rating: ★★★★★☆

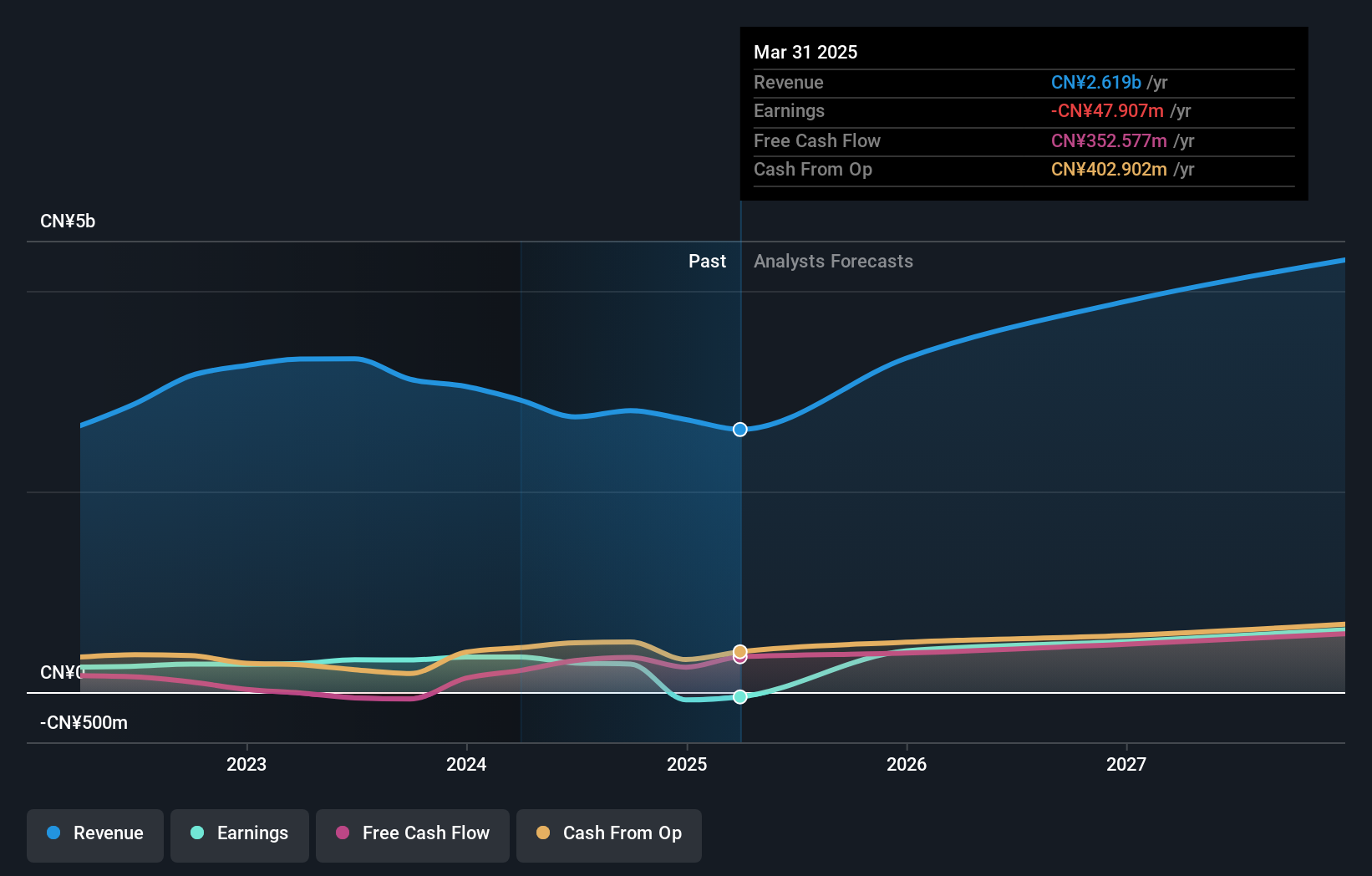

Overview: Miracle Automation Engineering Co. Ltd offers intelligent equipment solutions and services both in China and internationally, with a market cap of CN¥6.12 billion.

Operations: Miracle Automation Engineering Co. Ltd generates its revenue through providing intelligent equipment solutions and services to both domestic and international markets.

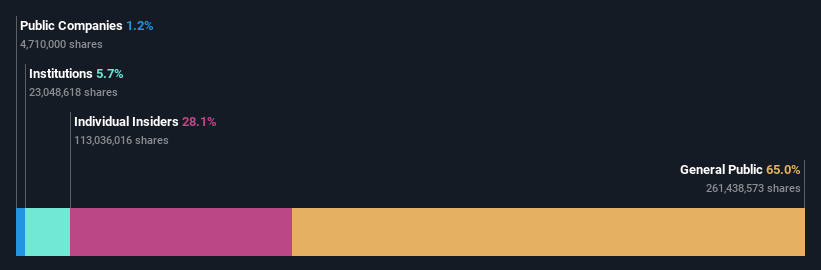

Insider Ownership: 28.1%

Miracle Automation Engineering Ltd. shows promising growth potential, with revenue expected to increase by 47.3% annually, surpassing the market's 13.6% growth rate. The company aims to become profitable in three years, indicating above-average market profit growth expectations. Despite a net loss of CNY 58.03 million for the first nine months of 2024, this was an improvement from the previous year’s larger loss. Recent shareholder meetings focused on director elections and subsidiary guarantees reflect active governance engagement amidst these developments.

- Click here and access our complete growth analysis report to understand the dynamics of Miracle Automation EngineeringLtd.

- Our comprehensive valuation report raises the possibility that Miracle Automation EngineeringLtd is priced lower than what may be justified by its financials.

Hangzhou Zhongtai Cryogenic Technology (SZSE:300435)

Simply Wall St Growth Rating: ★★★★★☆

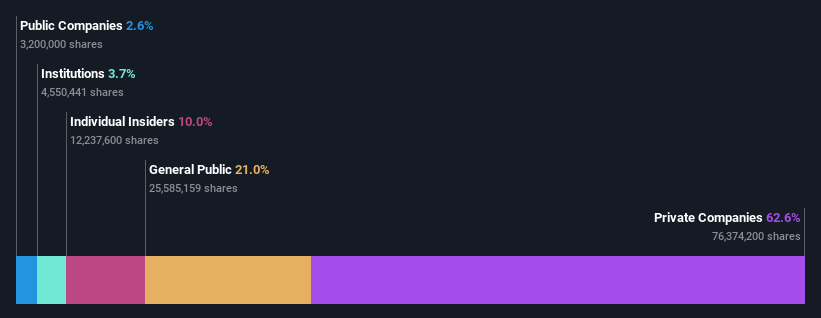

Overview: Hangzhou Zhongtai Cryogenic Technology Corporation develops, designs, manufactures, and sells cryogenic equipment in China with a market cap of CN¥4.61 billion.

Operations: Revenue Segments (in millions of CN¥): The company generates revenue through the development, design, manufacture, and sale of cryogenic equipment within China.

Insider Ownership: 12.3%

Hangzhou Zhongtai Cryogenic Technology is projected to experience significant growth, with earnings expected to rise 34% annually, outpacing the Chinese market. Despite a recent decline in sales and net income for the first nine months of 2024, the stock trades at a substantial discount to its estimated fair value and offers good relative value compared to peers. Recent corporate actions include a share buyback program and an upcoming shareholder meeting addressing connected transactions and governance amendments.

- Take a closer look at Hangzhou Zhongtai Cryogenic Technology's potential here in our earnings growth report.

- According our valuation report, there's an indication that Hangzhou Zhongtai Cryogenic Technology's share price might be on the cheaper side.

Trial Holdings (TSE:141A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Trial Holdings Inc. is a diversified company engaged in retail, logistics, financial/payment services, and retail tech businesses with a market cap of ¥329.01 billion.

Operations: The company's revenue segments include retail, logistics, financial/payment services, and retail tech operations.

Insider Ownership: 10%

Trial Holdings is poised for growth with earnings projected to increase by 21.3% annually, surpassing the JP market's average. Despite a lower forecasted revenue growth of 11.5%, its recent sales performance has been robust, with all store sales increasing over 110% year-over-year in November 2024. The stock is trading significantly below its estimated fair value, and analysts anticipate a price rise of 33.4%, indicating potential upside for investors interested in high insider ownership companies.

- Dive into the specifics of Trial Holdings here with our thorough growth forecast report.

- The analysis detailed in our Trial Holdings valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Embark on your investment journey to our 1505 Fast Growing Companies With High Insider Ownership selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002009

Miracle Automation EngineeringLtd

Provides intelligent equipment solutions and services in China and internationally.

High growth potential and fair value.