- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6805

Exploring High Growth Tech Stocks With Potential For Your Portfolio

Reviewed by Simply Wall St

In a week marked by busy earnings reports and mixed economic signals, global markets saw major indices like the Nasdaq Composite and S&P MidCap 400 reach record highs before retreating, with small-cap stocks showing resilience compared to their larger counterparts. Amidst this backdrop of cautious optimism and fluctuating market conditions, identifying high growth tech stocks with strong fundamentals can be crucial for investors looking to enhance their portfolios in an evolving economic landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Pharma Mar | 26.94% | 55.09% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.17% | 70.50% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.17% | 71.73% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1292 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Guangzhou Fangbang ElectronicsLtd (SHSE:688020)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Fangbang Electronics Co., Ltd is involved in the research and development, production, sale, and service of electronic materials in China with a market capitalization of approximately CN¥3.10 billion.

Operations: Fangbang Electronics focuses on the electronic materials sector, generating revenue primarily through product sales and associated services. The company's cost structure is influenced by research and development expenses alongside production costs. Notably, it has experienced variations in its gross profit margin over recent periods.

Guangzhou Fangbang Electronics Ltd., despite recent financial strains with sales dropping to CNY 241.56 million and a net loss of CNY 39.63 million, is on a trajectory for significant recovery with expected revenue growth at an impressive rate of 60.9% per year. This forecasted surge outpaces the broader Chinese market's growth rate of 14.1%, positioning the company well within the high-growth tech sector. Moreover, their commitment to innovation is evident from their R&D spending trends, which are crucial for sustaining long-term competitiveness in technology's rapidly evolving landscape. Looking ahead, Fangbang's strategic focus on research and development could be transformative, especially as they navigate from current unprofitability towards projected profitability within three years—an optimistic outlook supported by an anticipated annual profit growth of 237.8%. This potential turnaround is underpinned by their proactive approach to addressing market demands and enhancing technological offerings, setting a robust foundation for future financial health and industry relevance.

- Click here and access our complete health analysis report to understand the dynamics of Guangzhou Fangbang ElectronicsLtd.

Learn about Guangzhou Fangbang ElectronicsLtd's historical performance.

Eson Precision Ind (TWSE:5243)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Eson Precision Ind. Co., Ltd. is engaged in the production and sale of molds and consumer electronic components both in Taiwan and internationally, with a market capitalization of approximately NT$10.84 billion.

Operations: Eson Precision Ind. generates revenue primarily from molds, plastic, and metal products, totaling NT$11.47 billion. The company operates in both domestic and international markets within the consumer electronics sector.

Eson Precision Ind. is navigating a challenging landscape with recent financial figures showing a slight dip in sales to TWD 6.04 billion from TWD 6.13 billion year-over-year, coupled with a decrease in net income from TWD 372.85 million to TWD 237.48 million for the first half of the year. Despite these hurdles, the company's commitment to innovation remains robust, reflected in its R&D spending which is critical for maintaining competitiveness within the tech industry. Notably, Eson's projected revenue growth of 21.4% per annum and earnings growth forecast at an impressive 47.1% per annum suggest potential resilience and recovery in its financial performance moving forward, positioning it favorably against an average market growth rate of only 12.3%. This outlook underscores Eson’s strategic emphasis on leveraging research and development to drive future success amidst evolving market dynamics.

- Navigate through the intricacies of Eson Precision Ind with our comprehensive health report here.

Understand Eson Precision Ind's track record by examining our Past report.

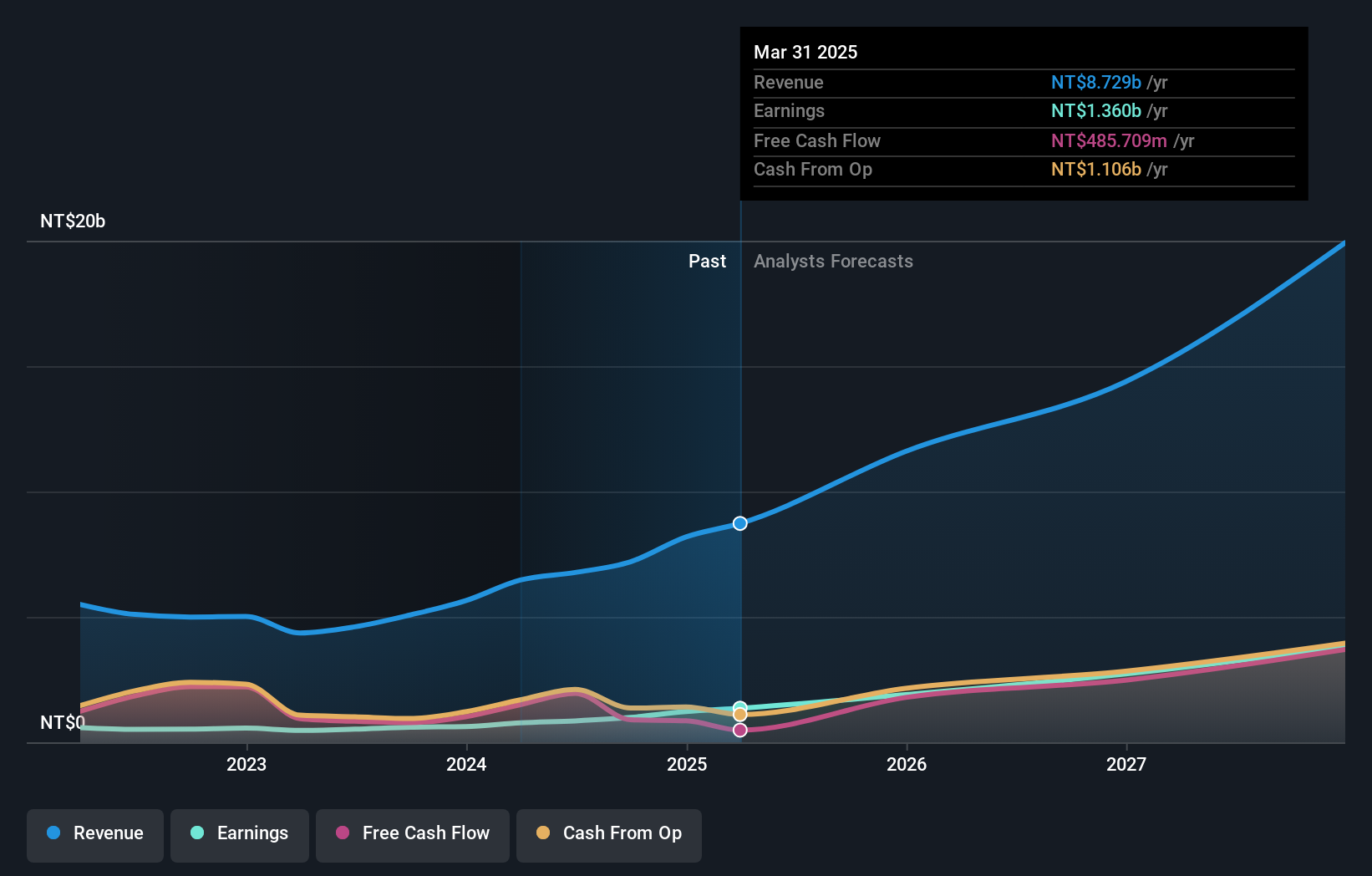

Fositek (TWSE:6805)

Simply Wall St Growth Rating: ★★★★★★

Overview: Fositek Corp. is involved in the manufacture and wholesale of electronic materials and components, with a market capitalization of NT$58.75 billion.

Operations: The company generates revenue primarily from electronic components and parts, amounting to NT$6.77 billion. The focus on this segment highlights its role in Fositek's business model.

Fositek stands out in the tech landscape, recently reporting a robust year-on-year sales increase to TWD 3.43 billion, up from TWD 2.30 billion, reflecting a growth trajectory that surpasses many peers. This performance is underpinned by an aggressive R&D strategy, with expenses marking a substantial proportion of revenue, demonstrating Fositek's commitment to innovation and sector leadership. Notably, the firm's earnings projection shows an impressive annual increase of 49.8%, signaling potential for sustained upward momentum in a competitive industry where technological advancement is paramount.

- Click here to discover the nuances of Fositek with our detailed analytical health report.

Examine Fositek's past performance report to understand how it has performed in the past.

Key Takeaways

- Click this link to deep-dive into the 1292 companies within our High Growth Tech and AI Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6805

Fositek

Engages in the manufacture and wholesale of electronic materials and components.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives