Discovering Xiamen Leading Optics And 2 Other Small Caps with Strong Financials

Reviewed by Simply Wall St

In a week marked by volatility in global markets, U.S. stocks faced downward pressure due to AI competition fears and mixed corporate earnings, while European markets found some relief from the ECB's rate cut. Amid these fluctuations, small-cap stocks have been navigating a complex landscape shaped by economic indicators and shifting investor sentiment. In this environment, identifying companies with robust financials becomes crucial for investors seeking stability and growth potential within the small-cap segment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.78% | 27.31% | ★★★★☆☆ |

| Sociedad Eléctrica del Sur Oeste | 42.67% | 8.52% | 4.10% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Xiamen Leading Optics (SHSE:605118)

Simply Wall St Value Rating: ★★★★★★

Overview: Xiamen Leading Optics Co., Ltd. is a company that provides optical solutions globally, with a market capitalization of CN¥7.89 billion.

Operations: Xiamen Leading Optics generates revenue primarily from its Optical Manufacturing segment, which amounts to CN¥595.95 million.

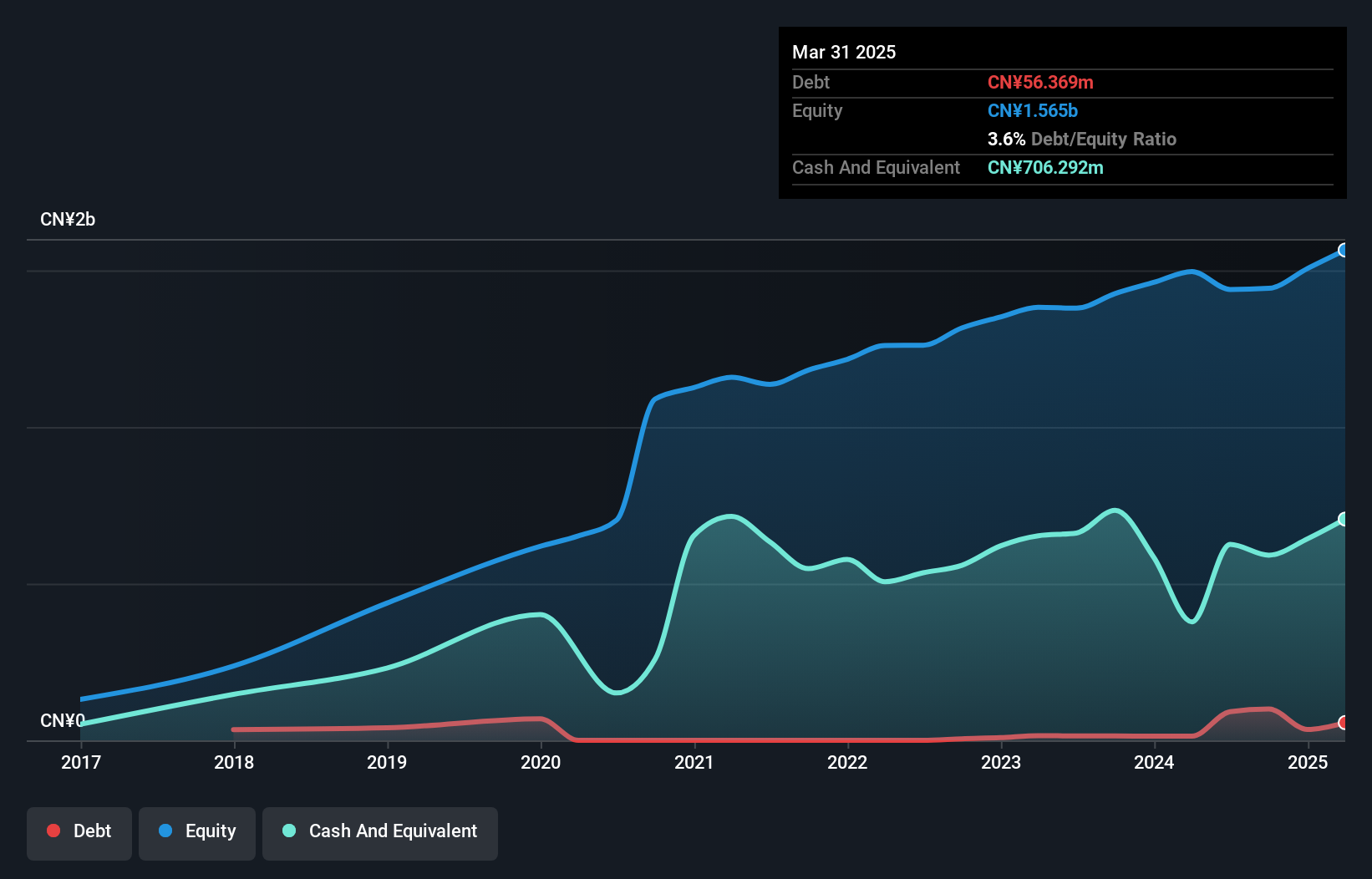

Xiamen Leading Optics, a smaller player in the electronics industry, has shown notable financial resilience. Over the past year, earnings surged by 13%, outpacing the industry's 2% growth. This growth is supported by a solid debt-to-equity ratio reduction from 11% to 7% over five years and high-quality earnings. The company holds more cash than total debt, ensuring no immediate liquidity concerns. Recent free cash flow figures reached US$182 million as of September 2024, suggesting robust operational efficiency. With an extraordinary shareholders meeting scheduled for December 2024, strategic decisions may further shape its trajectory.

Shanghai Hajime Advanced Material Technology (SZSE:301000)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Hajime Advanced Material Technology Co., Ltd. operates in the advanced materials sector, focusing on machinery and industrial equipment, with a market cap of CN¥9.47 billion.

Operations: Hajime Advanced Material Technology generates revenue primarily from the machinery and industrial equipment segment, amounting to CN¥688.37 million.

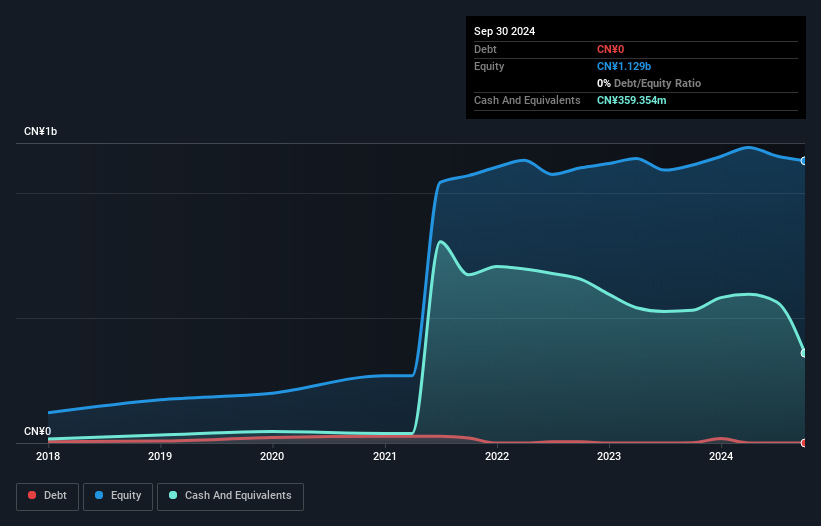

Shanghai Hajime Advanced Material Technology, a relatively small player in the chemicals sector, showcases impressive financial health with no debt and a notable reduction from a 9.5% debt-to-equity ratio five years ago. The company experienced robust earnings growth of 58.8% last year, outperforming the industry average of -5.4%. Despite recent share price volatility, its earnings are projected to grow at an annual rate of 28.67%. However, challenges include negative free cash flow in recent quarters and significant capital expenditures like US$167 million last quarter which could impact liquidity management going forward.

Insyde Software (TPEX:6231)

Simply Wall St Value Rating: ★★★★★★

Overview: Insyde Software Corp. is a company that delivers system firmware and software engineering services to global clients in the mobile, desktop, server, and embedded systems sectors, with a market cap of approximately NT$20.04 billion.

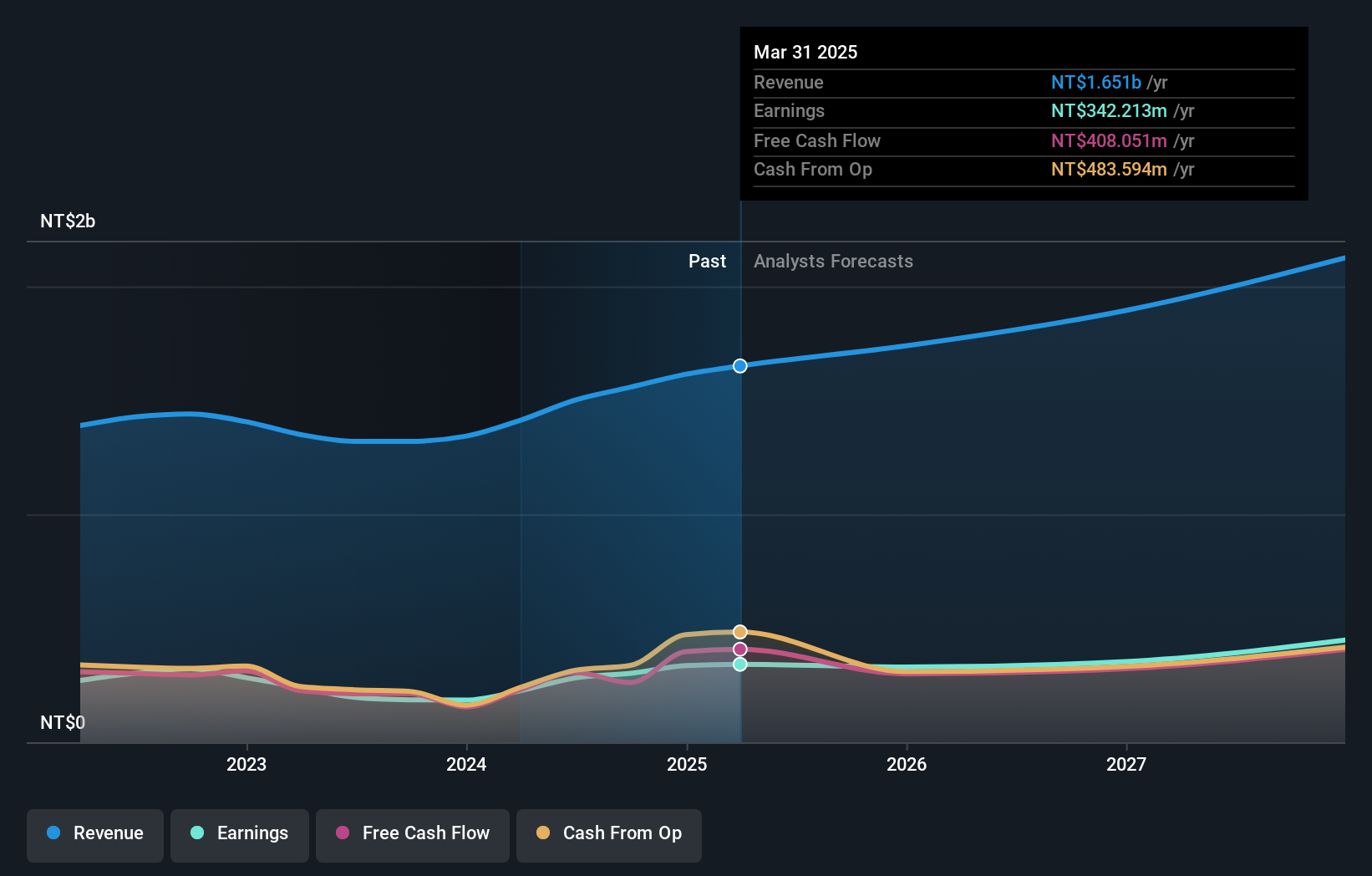

Operations: Insyde Software generates its revenue primarily from the software and programming segment, amounting to NT$1.56 billion. The company's financial performance is influenced by its net profit margin, which reflects the efficiency of its operations in converting revenue into profit.

Insyde Software, a nimble player in the tech world, is catching attention with its impressive financial health. Over the past year, earnings surged by 62%, outpacing the broader software industry growth of 17%. The company trades at a significant discount of nearly 52% below its estimated fair value, suggesting potential for appreciation. Free cash flow remains positive and consistent with no debt on its books, indicating robust financial management. Despite recent share price volatility over three months, Insyde's high-quality non-cash earnings highlight strong operational performance and promising future growth prospects in an evolving market landscape.

- Take a closer look at Insyde Software's potential here in our health report.

Review our historical performance report to gain insights into Insyde Software's's past performance.

Taking Advantage

- Dive into all 4721 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6231

Insyde Software

Provides system firmware and software engineering services for companies in the mobile, desktop, server, and embedded systems industries worldwide.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives