- China

- /

- Electronic Equipment and Components

- /

- SHSE:603920

High Growth Tech Stocks Including Beijing Vastdata Technology For Your Portfolio

Reviewed by Simply Wall St

Amidst a backdrop of economic uncertainty due to a U.S. government shutdown and mixed signals from labor market data, global markets have shown resilience, with technology stocks leading the charge in recent gains. As interest rates appear poised for potential cuts, small-cap growth stocks, particularly in the tech sector, are capturing investor attention for their ability to thrive in environments where innovation and adaptability are key drivers of success.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 33.55% | 44.13% | ★★★★★★ |

| Zhongji Innolight | 28.78% | 30.84% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| KebNi | 21.99% | 63.71% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| Hacksaw | 26.01% | 37.61% | ★★★★★★ |

| CD Projekt | 35.64% | 43.11% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Beijing Vastdata Technology (SHSE:603138)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Vastdata Technology Co., Ltd. specializes in providing database services within China and has a market capitalization of approximately CN¥4.85 billion.

Operations: Vastdata Technology generates revenue primarily through its software and information technology services, amounting to approximately CN¥400.98 million.

Beijing Vastdata Technology, amidst a challenging fiscal landscape, reported a significant revenue increase to CNY 232.44 million from CNY 203.93 million year-over-year, showcasing robust annual growth of 39.7%. Despite current unprofitability with a net loss widening to CNY 44.71 million, the company is on an upward trajectory with earnings expected to surge by an impressive 112.4% annually over the next three years. This growth is underpinned by substantial R&D investments which are pivotal in driving innovation and securing competitive advantages in the rapidly evolving tech landscape. As Beijing Vastdata transitions towards profitability, its strategic focus on expanding technological capabilities could significantly influence its market position and future revenue streams.

Olympic Circuit Technology (SHSE:603920)

Simply Wall St Growth Rating: ★★★★☆☆

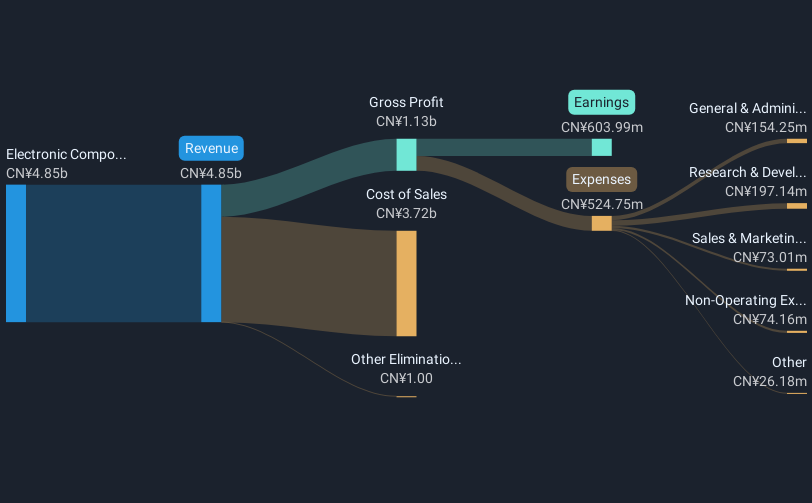

Overview: Olympic Circuit Technology Co., Ltd specializes in the manufacturing and sale of rigid printed circuit boards (PCBs) and has a market capitalization of approximately CN¥32.85 billion.

Operations: The company generates revenue primarily from the sale of electronic components and parts, totaling approximately CN¥5.21 billion.

Olympic Circuit Technology has demonstrated a solid financial performance, with its recent half-year earnings showing a revenue increase to CNY 2.58 billion, up from CNY 2.40 billion the previous year, and net income rising to CNY 384.13 million from CNY 302.74 million. This growth is supported by significant R&D investments that have not only fueled innovation but also positioned the company well within the competitive tech landscape. With an expected annual earnings growth of 23.9% and revenue forecasted to grow at an impressive rate of 24.2% per year, Olympic Circuit is outpacing the broader Chinese market's growth rates significantly, indicating strong future prospects despite its highly volatile share price in recent months.

- Click to explore a detailed breakdown of our findings in Olympic Circuit Technology's health report.

Learn about Olympic Circuit Technology's historical performance.

Nayax (TASE:NYAX)

Simply Wall St Growth Rating: ★★★★★☆

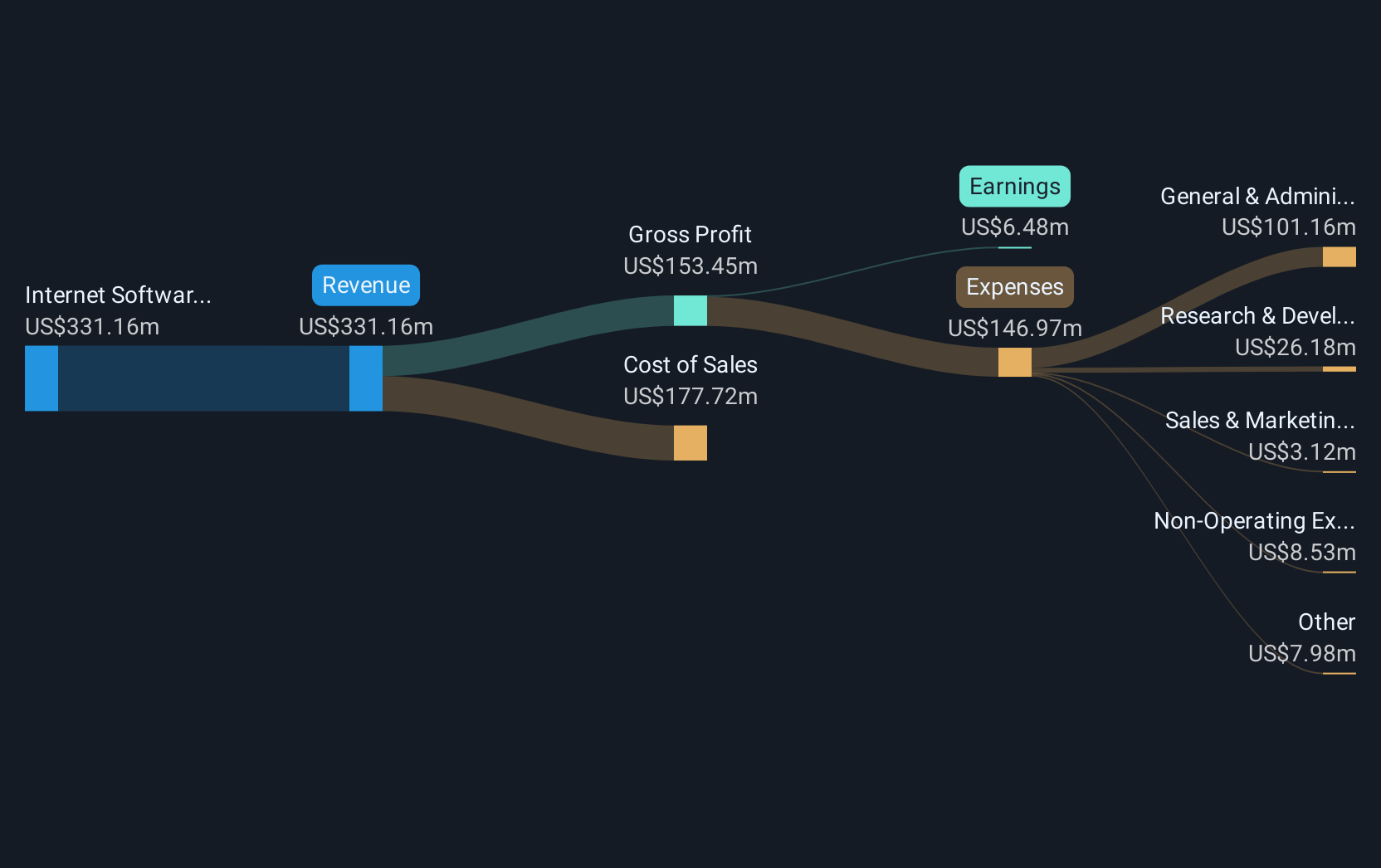

Overview: Nayax Ltd. is a fintech company that provides comprehensive solutions for automated self-service retailers and merchants globally, with a market cap of ₪5.92 billion.

Operations: Nayax Ltd. generates revenue primarily through its Internet Software and Services segment, which brought in $348.66 million. The company operates across various regions, including the United States, Europe, the United Kingdom, Australia, and Israel.

Nayax's recent strategic partnerships, notably with ChargeSmart EV and Autel Energy, underscore its commitment to enhancing the U.S. and European EV charging ecosystems. These alliances not only expand Nayax's footprint in cashless payment solutions but also align with broader industry trends towards integrated, user-friendly services. Financially, Nayax has turned a corner with its Q2 sales jumping to $95.59 million from $78.09 million year-over-year and transforming last year’s net loss into a current net income of $11.65 million. This performance is bolstered by an aggressive R&D strategy that promises to keep it at the forefront of payment technology innovation in the EV sector, positioning it well for sustained growth amidst increasing demand for electric vehicle infrastructure.

- Unlock comprehensive insights into our analysis of Nayax stock in this health report.

Explore historical data to track Nayax's performance over time in our Past section.

Taking Advantage

- Take a closer look at our Global High Growth Tech and AI Stocks list of 243 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603920

Flawless balance sheet with solid track record.

Market Insights

Community Narratives