- China

- /

- Communications

- /

- SHSE:603712

These 4 Measures Indicate That TianJin 712 Communication & Broadcasting (SHSE:603712) Is Using Debt Extensively

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that TianJin 712 Communication & Broadcasting Co., Ltd. (SHSE:603712) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for TianJin 712 Communication & Broadcasting

What Is TianJin 712 Communication & Broadcasting's Debt?

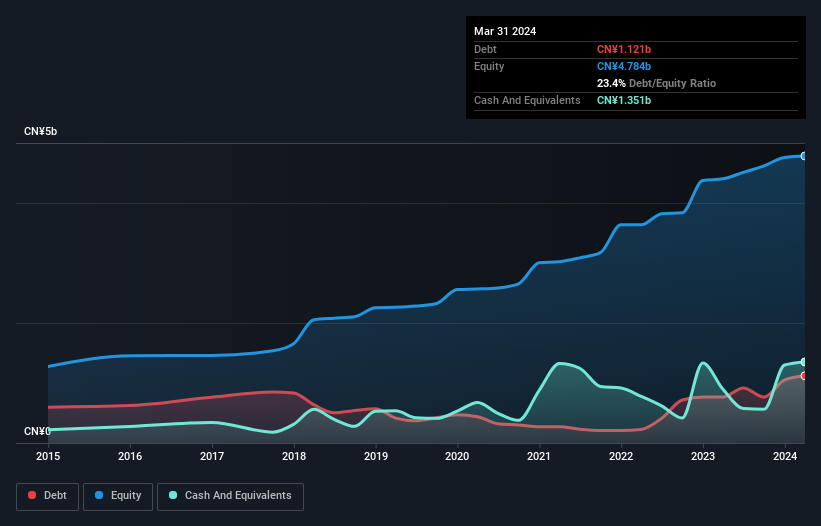

You can click the graphic below for the historical numbers, but it shows that as of March 2024 TianJin 712 Communication & Broadcasting had CN¥1.12b of debt, an increase on CN¥766.5m, over one year. However, it does have CN¥1.35b in cash offsetting this, leading to net cash of CN¥230.7m.

A Look At TianJin 712 Communication & Broadcasting's Liabilities

According to the last reported balance sheet, TianJin 712 Communication & Broadcasting had liabilities of CN¥3.87b due within 12 months, and liabilities of CN¥850.8m due beyond 12 months. Offsetting this, it had CN¥1.35b in cash and CN¥3.91b in receivables that were due within 12 months. So it actually has CN¥542.7m more liquid assets than total liabilities.

This surplus suggests that TianJin 712 Communication & Broadcasting has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, TianJin 712 Communication & Broadcasting boasts net cash, so it's fair to say it does not have a heavy debt load!

The modesty of its debt load may become crucial for TianJin 712 Communication & Broadcasting if management cannot prevent a repeat of the 53% cut to EBIT over the last year. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine TianJin 712 Communication & Broadcasting's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. TianJin 712 Communication & Broadcasting may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last three years, TianJin 712 Communication & Broadcasting burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that TianJin 712 Communication & Broadcasting has net cash of CN¥230.7m, as well as more liquid assets than liabilities. So although we see some areas for improvement, we're not too worried about TianJin 712 Communication & Broadcasting's balance sheet. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 1 warning sign for TianJin 712 Communication & Broadcasting that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TianJin 712 Communication & Broadcasting might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603712

TianJin 712 Communication & Broadcasting

TianJin 712 Communication & Broadcasting Co., Ltd.

High growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)