- Taiwan

- /

- Tech Hardware

- /

- TWSE:3017

3 Asian Stocks Estimated To Be Trading At Discounts Of 20.3% To 37.6%

Reviewed by Simply Wall St

Amid the global market's cautious tone driven by tariff uncertainties and inflation concerns, Asian markets have shown resilience, with key indices in China and Japan experiencing mixed but generally positive movements. In this environment, identifying undervalued stocks can be crucial for investors looking to capitalize on potential discounts; these stocks may offer opportunities if their intrinsic value exceeds current market prices.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| DIT (KOSDAQ:A110990) | ₩13920.00 | ₩27509.14 | 49.4% |

| Precision Tsugami (China) (SEHK:1651) | HK$21.00 | HK$41.82 | 49.8% |

| Hyosung Heavy Industries (KOSE:A298040) | ₩422500.00 | ₩844375.82 | 50% |

| Nan Ya Printed Circuit Board (TWSE:8046) | NT$132.50 | NT$262.44 | 49.5% |

| Hugel (KOSDAQ:A145020) | ₩322000.00 | ₩641703.18 | 49.8% |

| Sung Kwang BendLtd (KOSDAQ:A014620) | ₩27700.00 | ₩55171.46 | 49.8% |

| BalnibarbiLtd (TSE:3418) | ¥1090.00 | ¥2167.30 | 49.7% |

| OPT Machine Vision Tech (SHSE:688686) | CN¥103.55 | CN¥204.50 | 49.4% |

| Zhejiang Leapmotor Technology (SEHK:9863) | HK$41.50 | HK$82.37 | 49.6% |

| Doosan Fuel Cell (KOSE:A336260) | ₩15990.00 | ₩31590.14 | 49.4% |

Let's explore several standout options from the results in the screener.

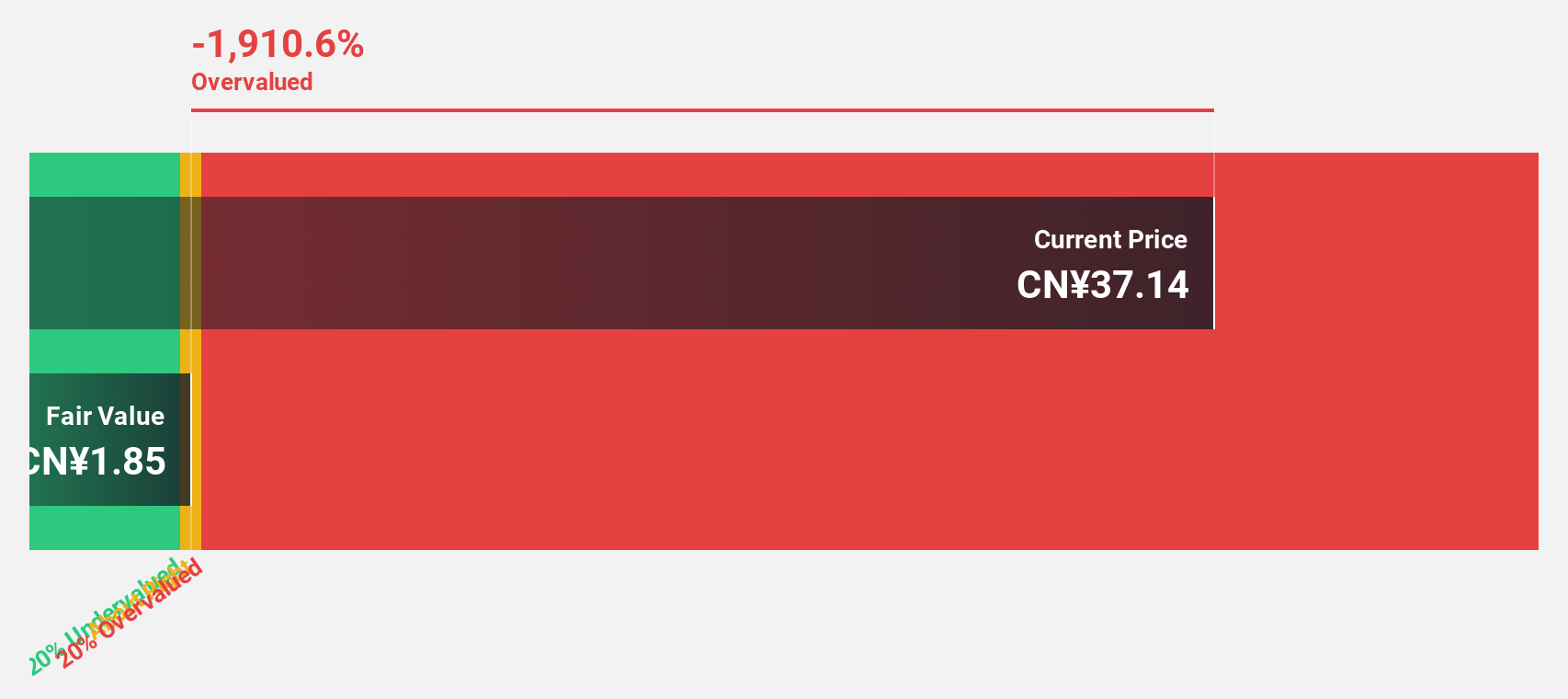

Fujian Torch Electron Technology (SHSE:603678)

Overview: Fujian Torch Electron Technology Co., Ltd. is a company that specializes in the production and sale of electronic components, with a market cap of CN¥16.20 billion.

Operations: Unfortunately, the provided text does not contain specific revenue segment figures for Fujian Torch Electron Technology Co., Ltd.

Estimated Discount To Fair Value: 20.3%

Fujian Torch Electron Technology is trading at CN¥35.54, significantly below its estimated fair value of CN¥44.57, indicating it may be undervalued based on cash flows. The company's earnings are forecast to grow substantially at 36.5% annually, outpacing the broader Chinese market's growth rate of 25.5%. Despite this promising growth trajectory, its return on equity is expected to remain low at 9.1% in three years due to large one-off items impacting financial results.

- The growth report we've compiled suggests that Fujian Torch Electron Technology's future prospects could be on the up.

- Get an in-depth perspective on Fujian Torch Electron Technology's balance sheet by reading our health report here.

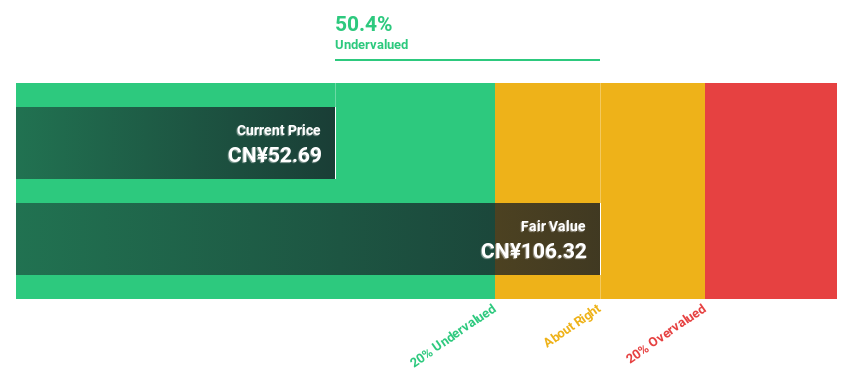

iFLYTEKLTD (SZSE:002230)

Overview: iFLYTEK CO., LTD. operates in the field of artificial intelligence technologies services in China, with a market capitalization of CN¥119.59 billion.

Operations: The company's revenue segments include AI education with CN¥5.32 billion, open platform and consumer products generating CN¥3.47 billion, and smart city initiatives contributing CN¥2.15 billion.

Estimated Discount To Fair Value: 36.9%

iFLYTEK is trading at CN¥52.15, well below its fair value estimate of CN¥82.65, suggesting it could be undervalued based on cash flows. Despite a low forecasted return on equity of 7% in three years, earnings are expected to grow significantly at 62.4% annually, surpassing the Chinese market's growth rate. The recent launch of Spark WallEX in the Middle East highlights iFLYTEK's strategic expansion into high-demand smart technology sectors.

- The analysis detailed in our iFLYTEKLTD growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of iFLYTEKLTD.

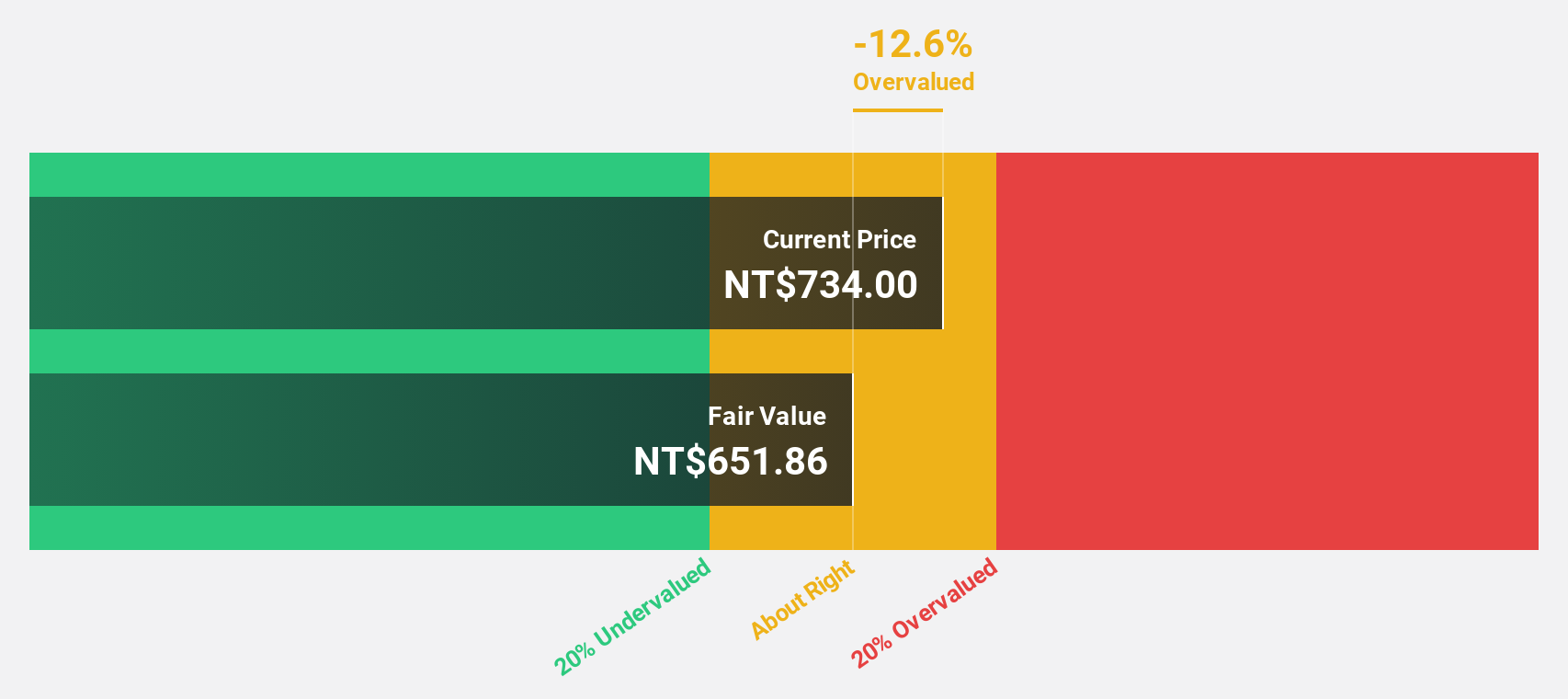

Asia Vital Components (TWSE:3017)

Overview: Asia Vital Components Co., Ltd. offers thermal solutions globally and has a market cap of NT$216.19 billion.

Operations: The company's revenue is derived from its Overseas Operating Department, which contributes NT$72.11 billion, and its Integrated Management Division, which adds NT$51.58 billion.

Estimated Discount To Fair Value: 37.6%

Asia Vital Components, trading at NT$564, is significantly undervalued with a fair value estimate of NT$903.6. The company's earnings are forecast to grow at 30.4% annually, outpacing the Taiwanese market's 17.2%. Revenue growth is also expected to exceed 24.7% per year, surpassing market averages. Despite recent share price volatility, the stock's potential upside and robust growth projections make it an interesting consideration for investors focused on cash flow valuation in Asia.

- Our growth report here indicates Asia Vital Components may be poised for an improving outlook.

- Dive into the specifics of Asia Vital Components here with our thorough financial health report.

Summing It All Up

- Unlock our comprehensive list of 284 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3017

Exceptional growth potential with outstanding track record.