- China

- /

- Communications

- /

- SHSE:603660

Suzhou Keda Technology Co.,Ltd (SHSE:603660) Stock Catapults 38% Though Its Price And Business Still Lag The Industry

Suzhou Keda Technology Co.,Ltd (SHSE:603660) shareholders have had their patience rewarded with a 38% share price jump in the last month. Notwithstanding the latest gain, the annual share price return of 2.3% isn't as impressive.

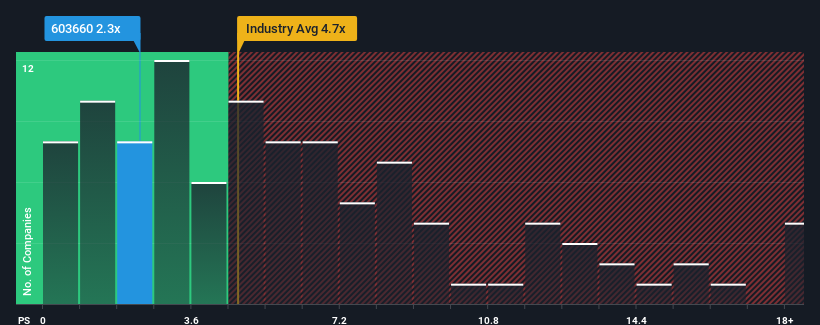

Even after such a large jump in price, Suzhou Keda TechnologyLtd's price-to-sales (or "P/S") ratio of 2.3x might still make it look like a strong buy right now compared to the wider Communications industry in China, where around half of the companies have P/S ratios above 4.7x and even P/S above 8x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Suzhou Keda TechnologyLtd

How Suzhou Keda TechnologyLtd Has Been Performing

As an illustration, revenue has deteriorated at Suzhou Keda TechnologyLtd over the last year, which is not ideal at all. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Suzhou Keda TechnologyLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Suzhou Keda TechnologyLtd?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Suzhou Keda TechnologyLtd's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 12%. As a result, revenue from three years ago have also fallen 47% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 42% shows it's an unpleasant look.

With this information, we are not surprised that Suzhou Keda TechnologyLtd is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What We Can Learn From Suzhou Keda TechnologyLtd's P/S?

Shares in Suzhou Keda TechnologyLtd have risen appreciably however, its P/S is still subdued. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Suzhou Keda TechnologyLtd revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Suzhou Keda TechnologyLtd that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603660

Suzhou Keda TechnologyLtd

Provides video surveillance and conference products, and video application solutions to public and corporate customers in China.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives