- China

- /

- Electronic Equipment and Components

- /

- SHSE:603186

A Piece Of The Puzzle Missing From Zhejiang Wazam New Materials Co.,LTD.'s (SHSE:603186) 44% Share Price Climb

Zhejiang Wazam New Materials Co.,LTD. (SHSE:603186) shareholders have had their patience rewarded with a 44% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 19% in the last twelve months.

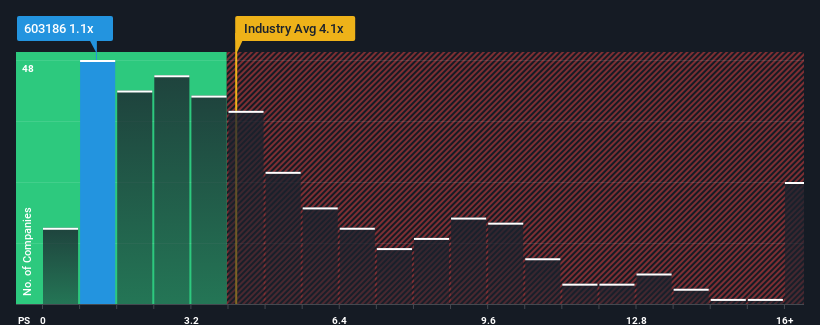

Although its price has surged higher, Zhejiang Wazam New MaterialsLTD may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.1x, since almost half of all companies in the Electronic industry in China have P/S ratios greater than 4.1x and even P/S higher than 8x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Zhejiang Wazam New MaterialsLTD

How Has Zhejiang Wazam New MaterialsLTD Performed Recently?

Recent times have been advantageous for Zhejiang Wazam New MaterialsLTD as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Zhejiang Wazam New MaterialsLTD will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Zhejiang Wazam New MaterialsLTD would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a decent 14% gain to the company's revenues. Revenue has also lifted 22% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 28% as estimated by the lone analyst watching the company. With the industry predicted to deliver 27% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Zhejiang Wazam New MaterialsLTD's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

Zhejiang Wazam New MaterialsLTD's recent share price jump still sees fails to bring its P/S alongside the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've seen that Zhejiang Wazam New MaterialsLTD currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

Having said that, be aware Zhejiang Wazam New MaterialsLTD is showing 2 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Wazam New MaterialsLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603186

Zhejiang Wazam New MaterialsLTD

Engages in the research, development, design, production, and sale of copper clad plate , composite materials, and membrane materials.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026