- China

- /

- General Merchandise and Department Stores

- /

- SHSE:600738

Three Promising Asian Small Caps With Strong Fundamentals

Reviewed by Simply Wall St

Amidst global trade tensions and heightened economic uncertainty, Asian markets have not been immune to the volatility, with small-cap stocks facing significant challenges as reflected by the sharp declines in key indices like the Russell 2000. Despite these headwinds, certain small-cap companies in Asia stand out for their robust fundamentals and potential resilience, making them intriguing prospects for investors seeking opportunities in turbulent times.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tokyo Tekko | 10.92% | 8.23% | 18.26% | ★★★★★★ |

| Ruentex Interior Design | NA | 21.75% | 29.33% | ★★★★★★ |

| Central Forest Group | NA | 5.93% | 20.71% | ★★★★★★ |

| Toho | 59.47% | 4.91% | 62.26% | ★★★★★★ |

| Maxigen Biotech | NA | 8.77% | 24.99% | ★★★★★★ |

| Nitto Fuji Flour MillingLtd | 0.81% | 6.46% | 4.29% | ★★★★★★ |

| Zhejiang Haisen Pharmaceutical | NA | 8.09% | 10.46% | ★★★★★★ |

| Maezawa Kasei Industries | 0.80% | 2.65% | 19.59% | ★★★★★★ |

| Praise Victor Industrial | 85.87% | 1.55% | 51.49% | ★★★★★☆ |

| iMarketKorea | 30.43% | 4.91% | 1.88% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Jasmine Technology Solution (SET:JTS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jasmine Technology Solution Public Company Limited operates in Thailand through its subsidiaries, focusing on the design and installation of telecommunication systems, telecom services, bitcoin mining, and other business activities with a market capitalization of THB23.84 billion.

Operations: Jasmine Technology Solution generates revenue primarily from telecommunication services (THB2.12 billion), with additional contributions from bitcoin mining (THB222 million) and the design and installation of telecommunication systems (THB73 million).

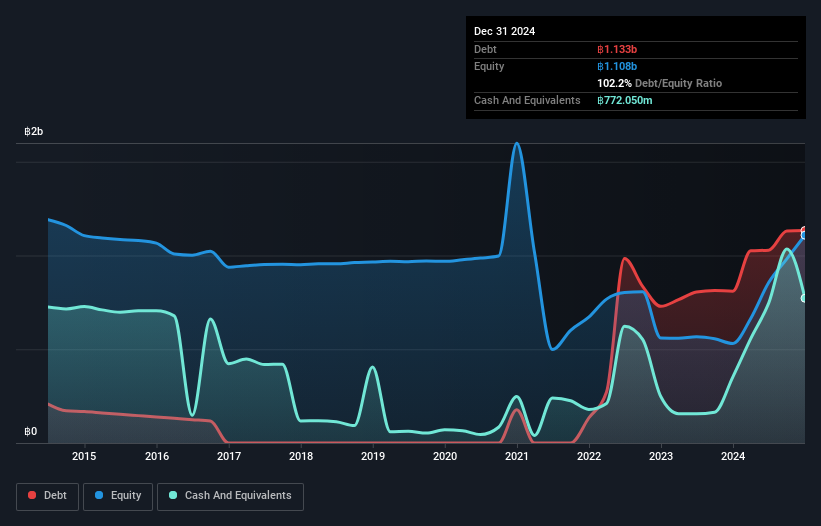

Jasmine Technology Solution has shown remarkable earnings growth of 10295% over the past year, significantly outpacing the telecom industry's 1.7%. Despite a satisfactory net debt to equity ratio of 32.6%, their debt level has increased from 0% to 102.2% over five years, indicating rising leverage concerns. The company's interest payments are well-covered by EBIT at a robust 11.9x coverage, yet their free cash flow remains negative. Recent events highlight challenges with debenture defaults due to unfavorable bond market conditions and economic uncertainties, underscoring the importance of managing cash flow effectively amidst these financial pressures.

Lanzhou Lishang Guochao Industrial GroupLtd (SHSE:600738)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Lanzhou Lishang Guochao Industrial Group Co., Ltd operates department stores in China and internationally, with a market cap of CN¥4.05 billion.

Operations: Lanzhou Lishang Guochao Industrial Group Ltd generates its revenue primarily from operating department stores. The company focuses on retail operations, which form the core of its business model.

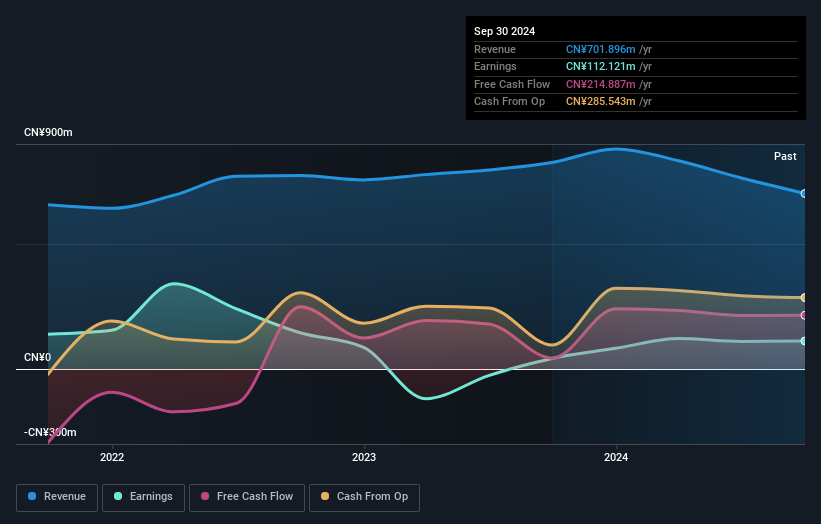

Lanzhou Lishang Guochao Industrial Group, a smaller player in the Multiline Retail sector, showcases impressive earnings growth of 166.5% over the past year, far outpacing the industry average of -7.5%. The company's net debt to equity ratio stands at a satisfactory 22.9%, indicating prudent financial management. Additionally, its interest payments are well covered by EBIT at 10.9 times, reflecting robust operational performance. Despite these strengths, earnings have seen an annual decline of 29.4% over five years and the price-to-earnings ratio is 36.1x compared to an industry average of 42x, suggesting potential value for investors seeking growth opportunities in Asia's retail landscape.

- Take a closer look at Lanzhou Lishang Guochao Industrial GroupLtd's potential here in our health report.

Learn about Lanzhou Lishang Guochao Industrial GroupLtd's historical performance.

Chongqing Chuanyi Automation (SHSE:603100)

Simply Wall St Value Rating: ★★★★★★

Overview: Chongqing Chuanyi Automation Co., Ltd. specializes in the research, manufacturing, and marketing of industrial auto-control systems and devices, along with providing engineering integration services in China, with a market cap of CN¥11.60 billion.

Operations: Chuanyi Automation generates revenue primarily from industrial auto-control systems and devices, alongside engineering integration services. The company's net profit margin is 10.5%, reflecting its efficiency in converting sales into actual profit.

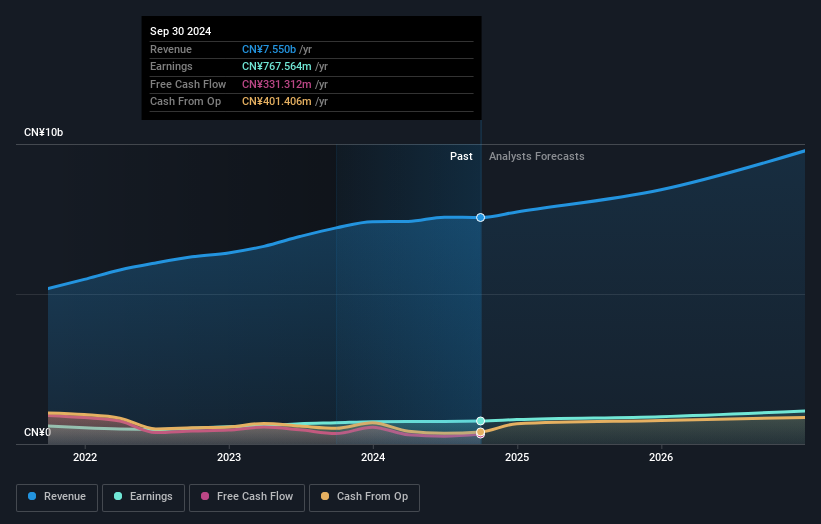

Chongqing Chuanyi Automation, a promising player in the electronic sector, has shown notable performance with earnings growth of 8% over the past year, surpassing the industry's 4.7%. The company's debt-to-equity ratio impressively decreased from 34.9% to 8.1% over five years, indicating effective financial management. Trading at a price-to-earnings ratio of 15.1x, it offers good value compared to the broader CN market's 33.6x average. Recent developments include China National Machinery Industry Corporation's acquisition of a significant stake for CNY 2.39 billion, reflecting confidence in its future prospects and strategic importance within its industry.

- Get an in-depth perspective on Chongqing Chuanyi Automation's performance by reading our health report here.

Understand Chongqing Chuanyi Automation's track record by examining our Past report.

Seize The Opportunity

- Take a closer look at our Asian Undiscovered Gems With Strong Fundamentals list of 2615 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Lanzhou Lishang Guochao Industrial GroupLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600738

Lanzhou Lishang Guochao Industrial GroupLtd

Operates department stores in China and internationally.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives