- China

- /

- Electronic Equipment and Components

- /

- SHSE:601231

Universal Scientific Industrial (Shanghai) Co., Ltd. (SHSE:601231) Stock Catapults 27% Though Its Price And Business Still Lag The Market

Universal Scientific Industrial (Shanghai) Co., Ltd. (SHSE:601231) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 5.7% over the last year.

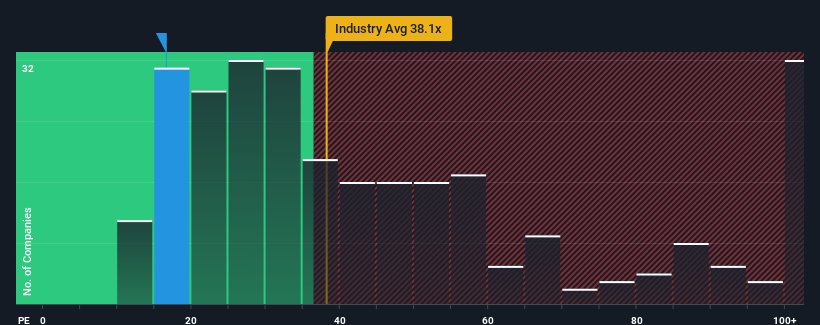

In spite of the firm bounce in price, Universal Scientific Industrial (Shanghai)'s price-to-earnings (or "P/E") ratio of 16.6x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 31x and even P/E's above 56x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings that are retreating more than the market's of late, Universal Scientific Industrial (Shanghai) has been very sluggish. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Universal Scientific Industrial (Shanghai)

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Universal Scientific Industrial (Shanghai)'s to be considered reasonable.

Retrospectively, the last year delivered a frustrating 36% decrease to the company's bottom line. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 11% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 29% over the next year. That's shaping up to be materially lower than the 41% growth forecast for the broader market.

In light of this, it's understandable that Universal Scientific Industrial (Shanghai)'s P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Universal Scientific Industrial (Shanghai)'s P/E

The latest share price surge wasn't enough to lift Universal Scientific Industrial (Shanghai)'s P/E close to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Universal Scientific Industrial (Shanghai)'s analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Universal Scientific Industrial (Shanghai) that you should be aware of.

You might be able to find a better investment than Universal Scientific Industrial (Shanghai). If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Universal Scientific Industrial (Shanghai), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601231

Universal Scientific Industrial (Shanghai)

An electronic design and manufacturing service company, engages in the design, miniaturization, manufacture, industrial software and hardware solutions, material procurement, logistics, and maintenance services of electronic products worldwide.

Excellent balance sheet average dividend payer.