- China

- /

- Electronic Equipment and Components

- /

- SHSE:601231

Some Investors May Be Willing To Look Past Universal Scientific Industrial (Shanghai)'s (SHSE:601231) Soft Earnings

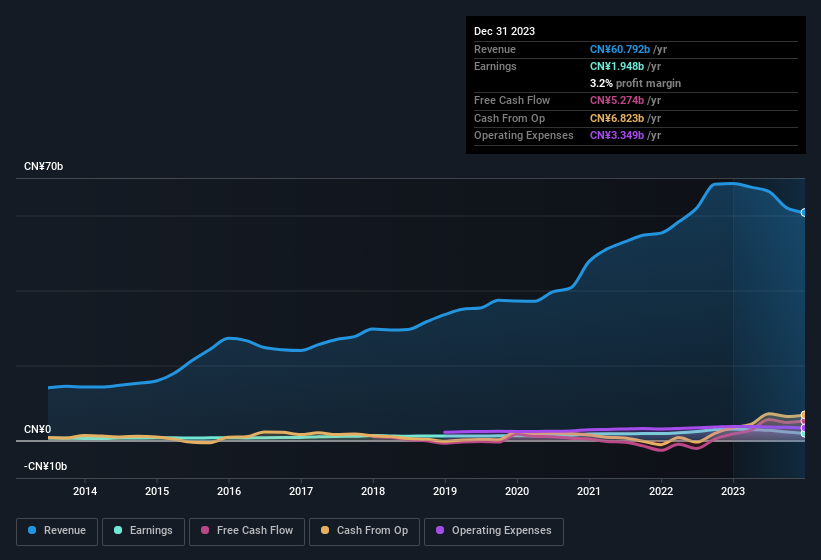

Soft earnings didn't appear to concern Universal Scientific Industrial (Shanghai) Co., Ltd.'s (SHSE:601231) shareholders over the last week. We think that the softer headline numbers might be getting counterbalanced by some positive underlying factors.

See our latest analysis for Universal Scientific Industrial (Shanghai)

Zooming In On Universal Scientific Industrial (Shanghai)'s Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

For the year to December 2023, Universal Scientific Industrial (Shanghai) had an accrual ratio of -0.23. That indicates that its free cash flow quite significantly exceeded its statutory profit. Indeed, in the last twelve months it reported free cash flow of CN¥5.3b, well over the CN¥1.95b it reported in profit. Universal Scientific Industrial (Shanghai) shareholders are no doubt pleased that free cash flow improved over the last twelve months.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Universal Scientific Industrial (Shanghai)'s Profit Performance

As we discussed above, Universal Scientific Industrial (Shanghai)'s accrual ratio indicates strong conversion of profit to free cash flow, which is a positive for the company. Based on this observation, we consider it possible that Universal Scientific Industrial (Shanghai)'s statutory profit actually understates its earnings potential! And the EPS is up 11% annually, over the last three years. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. You'd be interested to know, that we found 1 warning sign for Universal Scientific Industrial (Shanghai) and you'll want to know about this.

This note has only looked at a single factor that sheds light on the nature of Universal Scientific Industrial (Shanghai)'s profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601231

Universal Scientific Industrial (Shanghai)

An electronic design and manufacturing service company, engages in the design, miniaturization, manufacture, industrial software and hardware solutions, material procurement, logistics, and maintenance services of electronic products worldwide.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives