- China

- /

- Electronic Equipment and Components

- /

- SHSE:601231

Here's Why Universal Scientific Industrial (Shanghai) (SHSE:601231) Can Manage Its Debt Responsibly

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Universal Scientific Industrial (Shanghai) Co., Ltd. (SHSE:601231) does carry debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

How Much Debt Does Universal Scientific Industrial (Shanghai) Carry?

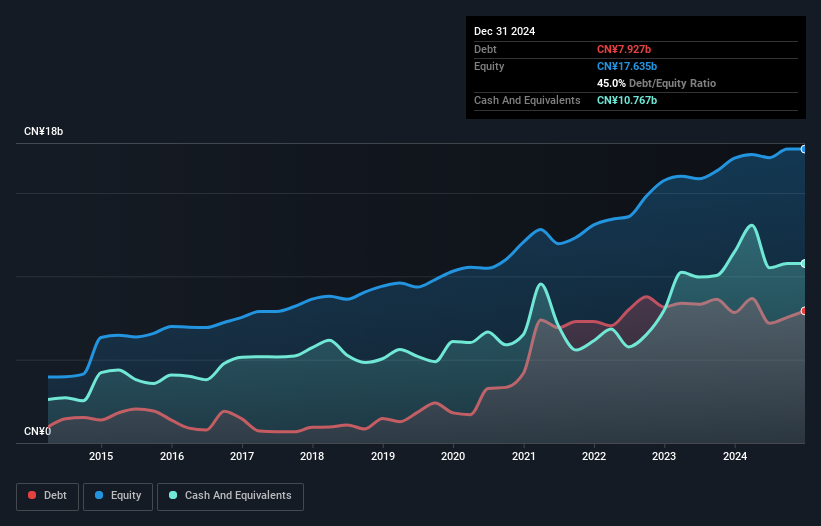

As you can see below, Universal Scientific Industrial (Shanghai) had CN¥7.93b of debt, at September 2024, which is about the same as the year before. You can click the chart for greater detail. However, its balance sheet shows it holds CN¥10.8b in cash, so it actually has CN¥2.84b net cash.

A Look At Universal Scientific Industrial (Shanghai)'s Liabilities

Zooming in on the latest balance sheet data, we can see that Universal Scientific Industrial (Shanghai) had liabilities of CN¥18.7b due within 12 months and liabilities of CN¥4.37b due beyond that. Offsetting these obligations, it had cash of CN¥10.8b as well as receivables valued at CN¥11.2b due within 12 months. So its liabilities total CN¥1.18b more than the combination of its cash and short-term receivables.

Given Universal Scientific Industrial (Shanghai) has a market capitalization of CN¥37.0b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. While it does have liabilities worth noting, Universal Scientific Industrial (Shanghai) also has more cash than debt, so we're pretty confident it can manage its debt safely.

Check out our latest analysis for Universal Scientific Industrial (Shanghai)

But the bad news is that Universal Scientific Industrial (Shanghai) has seen its EBIT plunge 15% in the last twelve months. If that rate of decline in earnings continues, the company could find itself in a tight spot. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Universal Scientific Industrial (Shanghai)'s ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Universal Scientific Industrial (Shanghai) has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Universal Scientific Industrial (Shanghai) actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing Up

While it is always sensible to look at a company's total liabilities, it is very reassuring that Universal Scientific Industrial (Shanghai) has CN¥2.84b in net cash. And it impressed us with free cash flow of CN¥3.3b, being 140% of its EBIT. So we don't have any problem with Universal Scientific Industrial (Shanghai)'s use of debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 1 warning sign for Universal Scientific Industrial (Shanghai) you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601231

Universal Scientific Industrial (Shanghai)

Universal Scientific Industrial (Shanghai) Co., Ltd.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion