- China

- /

- Electronic Equipment and Components

- /

- SHSE:600707

We Think Caihong Display DevicesLtd (SHSE:600707) Can Stay On Top Of Its Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Caihong Display Devices Co.,Ltd. (SHSE:600707) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Caihong Display DevicesLtd

How Much Debt Does Caihong Display DevicesLtd Carry?

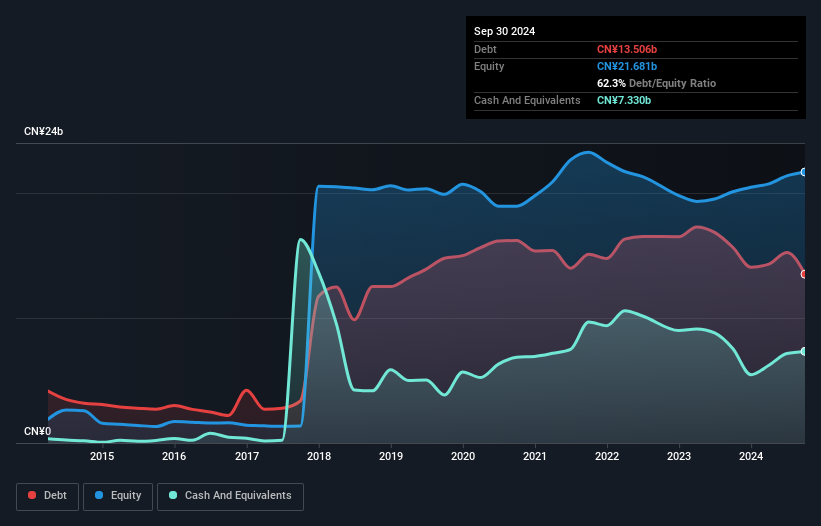

As you can see below, Caihong Display DevicesLtd had CN¥13.5b of debt at September 2024, down from CN¥15.7b a year prior. However, because it has a cash reserve of CN¥7.33b, its net debt is less, at about CN¥6.18b.

A Look At Caihong Display DevicesLtd's Liabilities

Zooming in on the latest balance sheet data, we can see that Caihong Display DevicesLtd had liabilities of CN¥9.47b due within 12 months and liabilities of CN¥9.74b due beyond that. On the other hand, it had cash of CN¥7.33b and CN¥2.30b worth of receivables due within a year. So its liabilities total CN¥9.59b more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since Caihong Display DevicesLtd has a market capitalization of CN¥30.4b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Looking at its net debt to EBITDA of 1.4 and interest cover of 5.6 times, it seems to us that Caihong Display DevicesLtd is probably using debt in a pretty reasonable way. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. We also note that Caihong Display DevicesLtd improved its EBIT from a last year's loss to a positive CN¥1.4b. When analysing debt levels, the balance sheet is the obvious place to start. But it is Caihong Display DevicesLtd's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Over the most recent year, Caihong Display DevicesLtd recorded free cash flow worth 61% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Caihong Display DevicesLtd's conversion of EBIT to free cash flow was a real positive on this analysis, as was its net debt to EBITDA. On the other hand, its level of total liabilities makes us a little less comfortable about its debt. Considering this range of data points, we think Caihong Display DevicesLtd is in a good position to manage its debt levels. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 1 warning sign with Caihong Display DevicesLtd , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600707

Caihong Display DevicesLtd

Engages in the research, development, production, and sale of substrate glass and display panels in China and internationally.

Excellent balance sheet with very low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion