- China

- /

- Electronic Equipment and Components

- /

- SHSE:600552

High Growth Tech Stocks To Explore In February 2025

Reviewed by Simply Wall St

Amid a backdrop of geopolitical tensions and consumer spending concerns, U.S. stocks have experienced fluctuations, with major indexes like the S&P 500 reaching record highs early in the week before closing lower due to shifts in investor sentiment. As global markets navigate these challenges, identifying high growth tech stocks requires careful consideration of companies that can leverage innovation and adaptability to thrive despite economic uncertainties.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Travere Therapeutics | 28.04% | 65.55% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| AVITA Medical | 27.78% | 55.33% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1192 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Samsung SDI (KOSE:A006400)

Simply Wall St Growth Rating: ★★★★☆☆

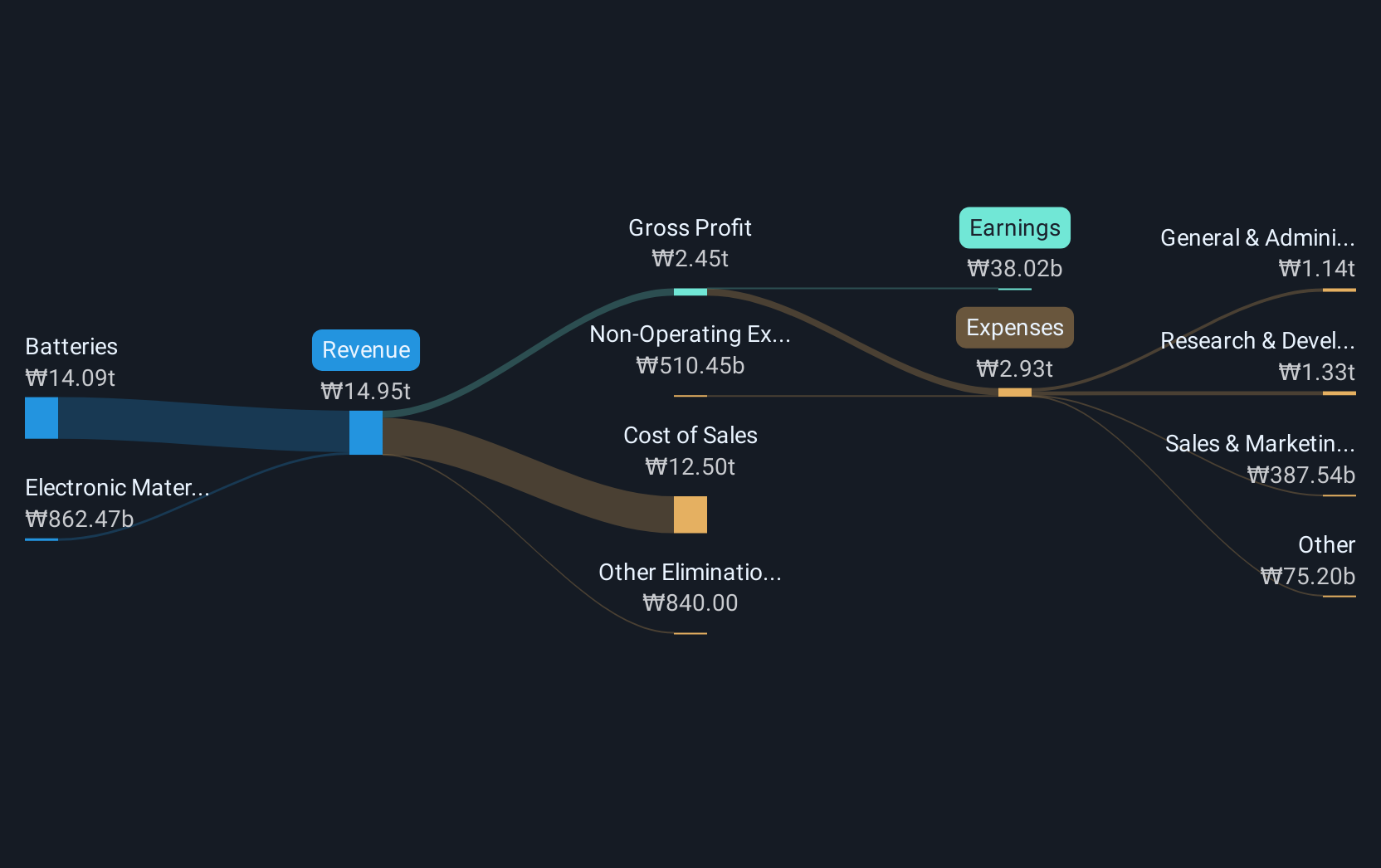

Overview: Samsung SDI Co., Ltd. is a global manufacturer and seller of batteries, operating across South Korea, Europe, China, North America, Southeast Asia, and other international markets with a market cap of ₩16.37 trillion.

Operations: Samsung SDI focuses on the production and sale of batteries, serving diverse regions including South Korea, Europe, China, North America, and Southeast Asia. The company generates revenue primarily from its battery segment.

Despite a challenging year marked by a net loss and a drop from major indices, Samsung SDI's commitment to innovation remains robust, evidenced by its R&D spending aimed at pioneering advancements in battery technology. With an annual revenue growth forecast of 13.4% and earnings expected to surge by 31.2%, the company is poised for recovery. Its recent participation in high-profile global tech conferences underscores its strategic focus on expanding its market influence through cutting-edge energy solutions.

- Dive into the specifics of Samsung SDI here with our thorough health report.

Review our historical performance report to gain insights into Samsung SDI's's past performance.

Triumph Science & TechnologyLtd (SHSE:600552)

Simply Wall St Growth Rating: ★★★★☆☆

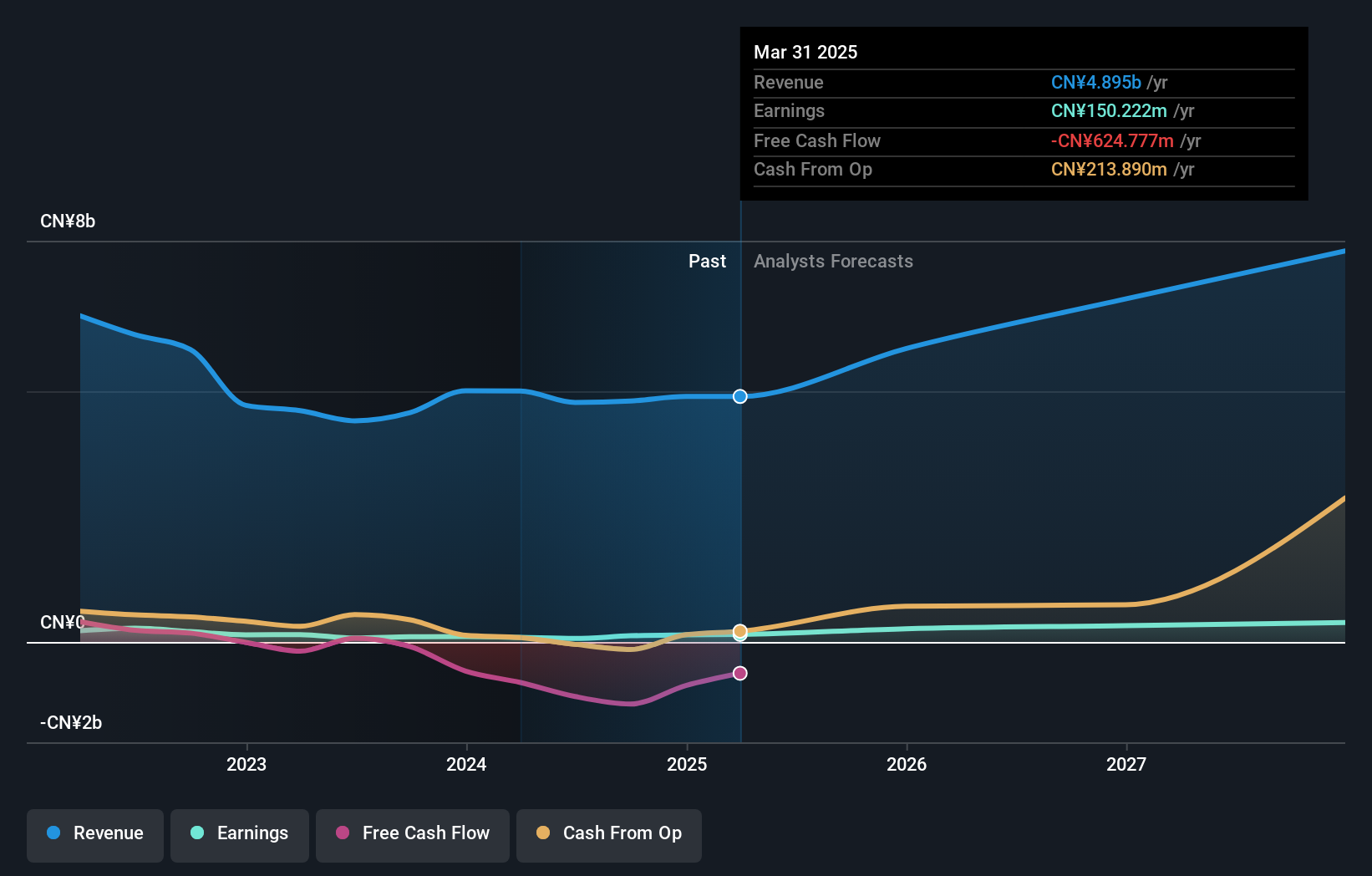

Overview: Triumph Science & Technology Co., Ltd focuses on the development, production, and sale of electronic information displays and new materials both in China and internationally, with a market capitalization of CN¥12.09 billion.

Operations: Triumph Science & Technology Co., Ltd generates revenue primarily through its electronic information displays and new materials segments, serving both domestic and international markets. The company has a market capitalization of CN¥12.09 billion.

Triumph Science & TechnologyLtd has demonstrated a robust growth trajectory, with its revenue expected to increase by 16.5% annually. This outpaces the broader Chinese market's growth rate of 13.4%, underscoring the company's competitive edge in the tech sector. Additionally, earnings are projected to surge by 36.7% per year, significantly above the market average of 25.3%. Despite challenges in covering interest payments fully with earnings, Triumph’s strategic emphasis on innovation is evident from its R&D investments and recent shareholder meetings aimed at steering future technology advancements and corporate governance enhancements.

- Unlock comprehensive insights into our analysis of Triumph Science & TechnologyLtd stock in this health report.

Learn about Triumph Science & TechnologyLtd's historical performance.

Topsec Technologies Group (SZSE:002212)

Simply Wall St Growth Rating: ★★★★☆☆

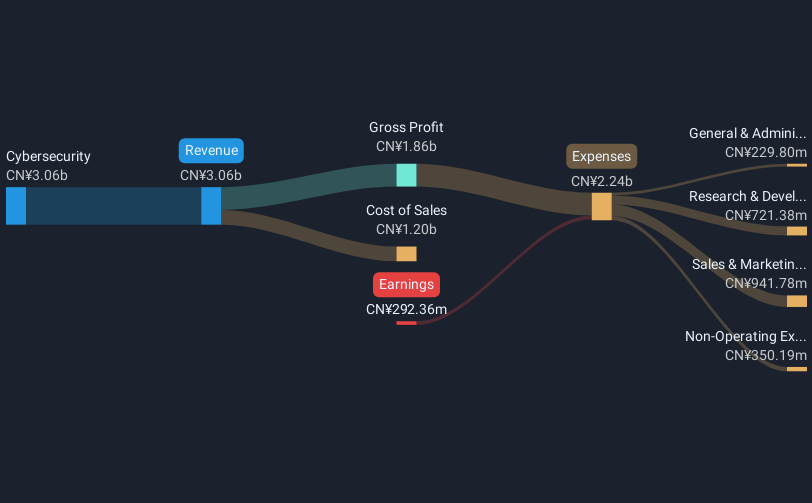

Overview: Topsec Technologies Group Inc. operates in China, offering cybersecurity, big data, and cloud services, with a market capitalization of CN¥10.69 billion.

Operations: The company generates revenue primarily from its cybersecurity segment, which contributes CN¥3.06 billion.

Topsec Technologies Group, despite recent setbacks such as being dropped from the Shenzhen Stock Exchange Component Index, is poised for significant transformation. With an expected earnings growth of 73.67% annually, the company outstrips many within its sector. This anticipated profitability pivot within three years underscores a strategic shift likely spurred by their latest extraordinary shareholder meeting aimed at governance restructuring. Moreover, with a forecasted revenue increase of 15% per year, Topsec is set to outpace the Chinese market's growth rate of 13.4%. This suggests not only resilience but also an aggressive pursuit of innovation and market adaptation in challenging times.

Taking Advantage

- Get an in-depth perspective on all 1192 High Growth Tech and AI Stocks by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Triumph Science & TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600552

Triumph Science & TechnologyLtd

Provides display and applied materials in China and internationally.

Moderate growth potential with acceptable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion