- China

- /

- Electronic Equipment and Components

- /

- SHSE:600353

Exploring 3 Undiscovered Gems In Global Markets

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have been making notable strides, with the Russell 2000 Index outperforming larger indices like the S&P 500. This momentum is fueled by expectations of lower interest rates and a focus on alternative labor market indicators amidst a U.S. government shutdown, creating an environment ripe for discovering hidden opportunities in lesser-known stocks. In this context, identifying a good stock often involves looking for companies that can benefit from these macroeconomic shifts and demonstrate resilience through innovative strategies or niche market positions.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TI Cloud | NA | 12.55% | 6.36% | ★★★★★★ |

| Daphne International Holdings | NA | -5.92% | 82.03% | ★★★★★★ |

| Payton Industries | NA | 5.14% | 14.54% | ★★★★★★ |

| Thai Steel Cable | NA | 4.17% | 18.81% | ★★★★★★ |

| Taiyo KagakuLtd | 0.67% | 5.77% | 2.06% | ★★★★★☆ |

| YuanShengTai Dairy Farm | 15.09% | 11.64% | -31.87% | ★★★★★☆ |

| Palasino Holdings | 9.75% | 10.88% | -14.54% | ★★★★★☆ |

| Tai Sin Electric | 37.42% | 10.92% | 7.66% | ★★★★☆☆ |

| ASL Marine Holdings | 155.37% | 13.24% | 51.91% | ★★★★☆☆ |

| Billion Industrial Holdings | 33.11% | 16.86% | -16.10% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Chengdu Xuguang Electronics (SHSE:600353)

Simply Wall St Value Rating: ★★★★★☆

Overview: Chengdu Xuguang Electronics Co., Ltd. specializes in the production and sale of metal-ceramic triodes, tetrodes, and transmitting tubes both domestically and internationally, with a market capitalization of CN¥13.90 billion.

Operations: Xuguang Electronics generates revenue primarily from the sale of metal-ceramic triodes, tetrodes, and transmitting tubes. The company's financial performance is influenced by its ability to manage production costs effectively.

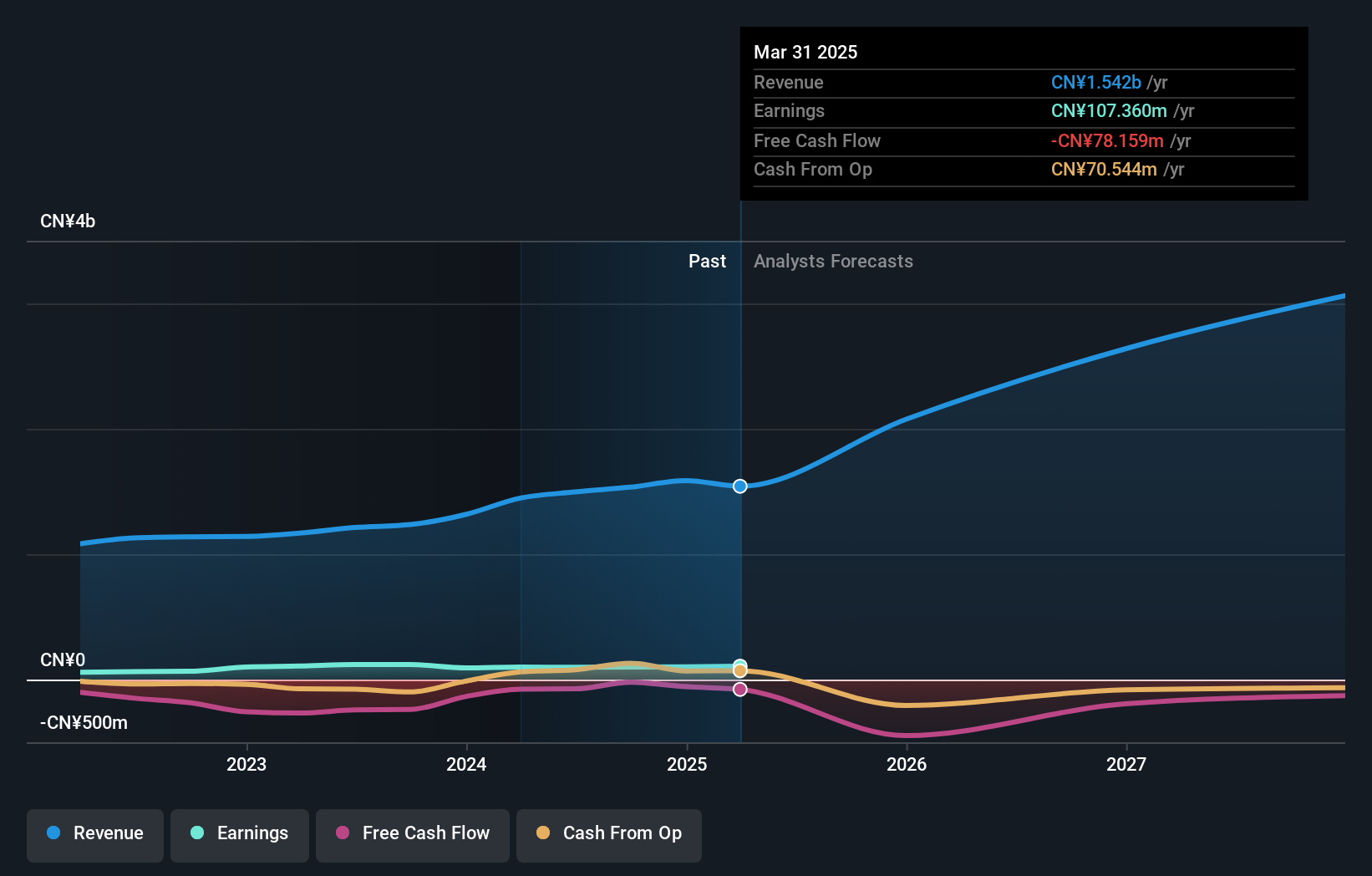

Chengdu Xuguang Electronics, a smaller player in the electronics sector, has shown promising signs with earnings growing 11.9% over the past year, outpacing the industry's 3.8%. Despite a volatile share price recently, it trades at 31.3% below its estimated fair value, suggesting potential upside for investors. The company's net debt to equity ratio stands at a satisfactory 13.4%, and interest payments are well-covered by EBIT at 11.3x coverage. Recent half-year results revealed net income of CNY 63.84 million compared to CNY 56.24 million last year, indicating improved profitability despite stable sales figures around CNY 642 million.

Zhende Medical (SHSE:603301)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhende Medical Co., Ltd. focuses on the research, development, production, and sale of medical care and protective equipment in China with a market cap of CN¥12.43 billion.

Operations: Zhende Medical generates revenue primarily from the sale of medical care and protective equipment in China. The company's financial performance is influenced by its cost structure, impacting its profitability metrics.

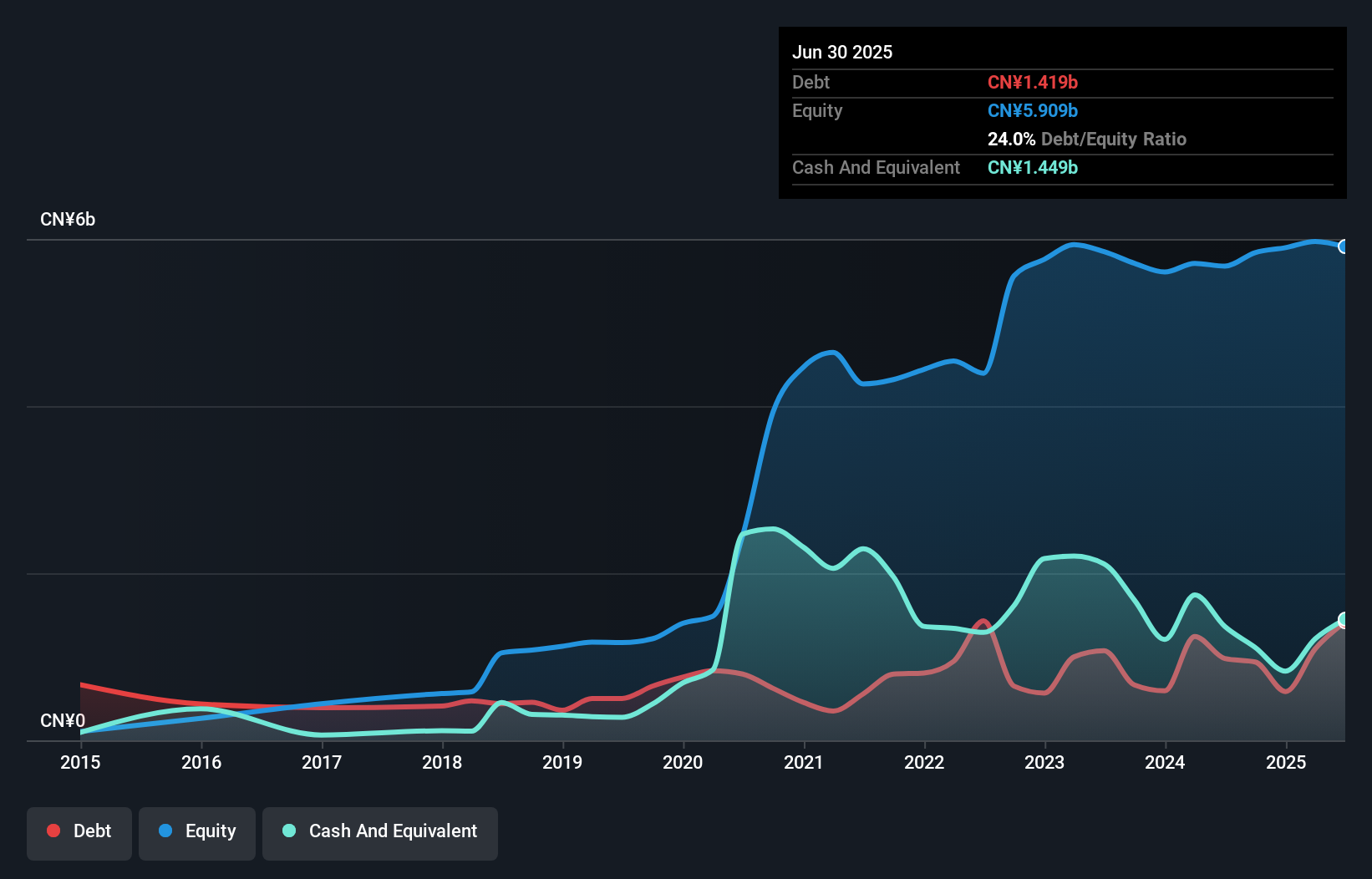

Zhende Medical, a player in the medical equipment sector, has shown impressive earnings growth of 188% over the past year, outpacing the industry average. Its debt to equity ratio improved from 32.3% to 24.5% over five years, signaling stronger financial health. The company recently reported half-year revenue of CN¥2.1 billion and net income of CN¥127.76 million; however, this was lower than last year's CN¥161.11 million net income due to a notable one-off gain impacting results by CN¥86.6 million in June 2025. A recent transaction saw Sun Jimu acquiring a 5% stake for approximately CN¥360 million.

Sichuan Gold (SZSE:001337)

Simply Wall St Value Rating: ★★★★★★

Overview: Sichuan Gold Co., Ltd. is involved in the gold mining industry, with a market capitalization of CN¥11.64 billion.

Operations: Sichuan Gold generates revenue primarily from the production and sale of gold concentrate and alloy gold, amounting to CN¥686.94 million. The company has a market capitalization of CN¥11.64 billion.

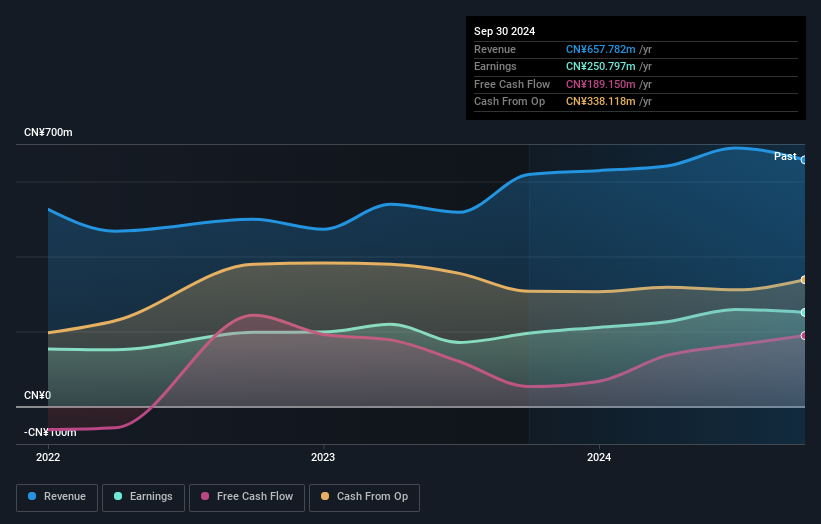

Sichuan Gold's performance has been impressive, with earnings growth of 22.2% over the past year, outpacing the broader Metals and Mining industry which saw a decrease of 1.5%. The company operates debt-free, eliminating concerns about interest payments. Its price-to-earnings ratio stands at 40.5x, slightly below the CN market average of 45.5x, suggesting potential value for investors. Recent changes in corporate governance were approved at an Extraordinary General Meeting in September 2025, reflecting proactive management practices. For the half-year ending June 2025, sales rose to CNY442 million from CNY395 million last year while net income increased to CNY208 million from CNY141 million previously reported.

- Click here to discover the nuances of Sichuan Gold with our detailed analytical health report.

Gain insights into Sichuan Gold's past trends and performance with our Past report.

Next Steps

- Access the full spectrum of 2924 Global Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600353

Chengdu Xuguang Electronics

Manufactures and sells metal-ceramic triodes and tetrodes and transmitting tubes in China and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives