Range Intelligent Computing Technology Group Company Limited (SZSE:300442) Not Flying Under The Radar

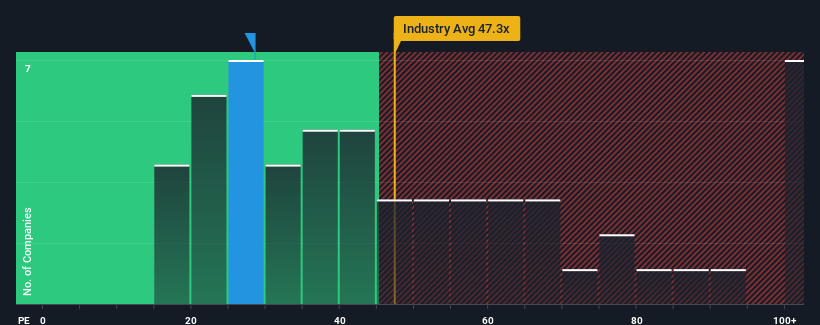

With a median price-to-earnings (or "P/E") ratio of close to 29x in China, you could be forgiven for feeling indifferent about Range Intelligent Computing Technology Group Company Limited's (SZSE:300442) P/E ratio of 28.5x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been advantageous for Range Intelligent Computing Technology Group as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Range Intelligent Computing Technology Group

How Is Range Intelligent Computing Technology Group's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Range Intelligent Computing Technology Group's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 18% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 292% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 32% during the coming year according to the six analysts following the company. That's shaping up to be similar to the 36% growth forecast for the broader market.

In light of this, it's understandable that Range Intelligent Computing Technology Group's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Range Intelligent Computing Technology Group's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Range Intelligent Computing Technology Group maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Having said that, be aware Range Intelligent Computing Technology Group is showing 4 warning signs in our investment analysis, and 2 of those are concerning.

If these risks are making you reconsider your opinion on Range Intelligent Computing Technology Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300442

Range Intelligent Computing Technology Group

Provides server hosting services to internet companies and large cloud vendors in China.

High growth potential moderate.

Market Insights

Community Narratives