Amidst a backdrop of easing trade tensions and robust earnings reports, U.S. markets have shown resilience, with the Nasdaq Composite seeing significant gains and small- to mid-cap indexes advancing for the fourth consecutive week. In this environment where investor sentiment remains cautiously optimistic despite economic uncertainties, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation capabilities and adaptability to navigate potential disruptions in global trade policies.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| KebNi | 20.83% | 67.27% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Yubico | 20.08% | 25.52% | ★★★★★★ |

| Ascelia Pharma | 43.57% | 70.39% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| Arabian Contracting Services | 21.29% | 30.65% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Shenzhen Transsion Holdings (SHSE:688036)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Transsion Holdings Co., Ltd. is a company that manufactures and sells smart devices primarily in Africa and other international markets, with a market cap of CN¥85.44 billion.

Operations: Transsion Holdings focuses on the production and sale of smart devices, with significant operations in Africa and various international markets. The company leverages its extensive distribution network to drive sales across these regions.

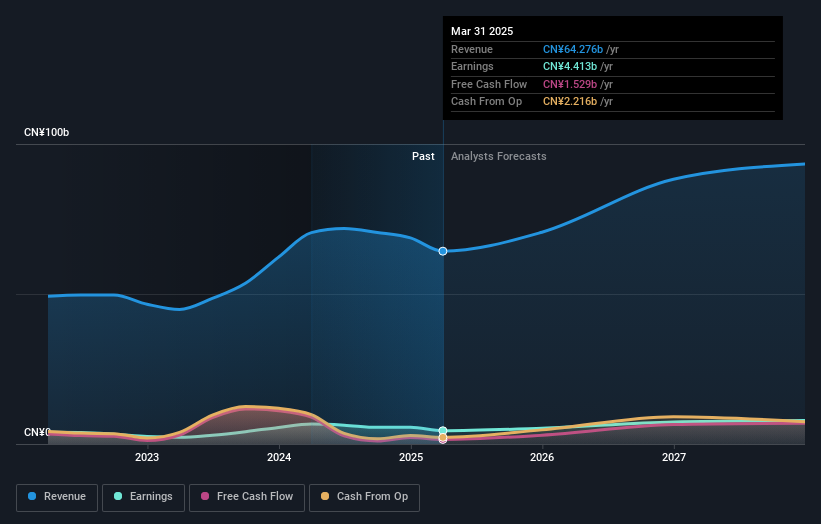

Shenzhen Transsion Holdings, amidst a challenging fiscal quarter with a significant drop in net income from CNY 1.63 billion to CNY 490.09 million, still shows potential due to its strategic market positioning and innovation focus. Despite the recent downturn, the company's commitment to R&D and expected annual revenue growth of 15.7% suggest resilience and adaptability in the fast-evolving tech landscape. Moreover, with an anticipated earnings growth of 24.1% per year over the next three years, Transsion is poised for recovery by leveraging its strong market presence in emerging economies and ongoing product development initiatives.

- Click to explore a detailed breakdown of our findings in Shenzhen Transsion Holdings' health report.

Accelink Technologies CoLtd (SZSE:002281)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Accelink Technologies Co., Ltd. is involved in the research, development, manufacturing, sales, and provision of technical services for optoelectronic chips, devices, modules, and subsystem products primarily in China with a market cap of approximately CN¥33.89 billion.

Operations: Accelink Technologies generates revenue primarily from its communication equipment manufacturing segment, which accounts for CN¥9.16 billion. The company focuses on optoelectronic products and services within this sector in China.

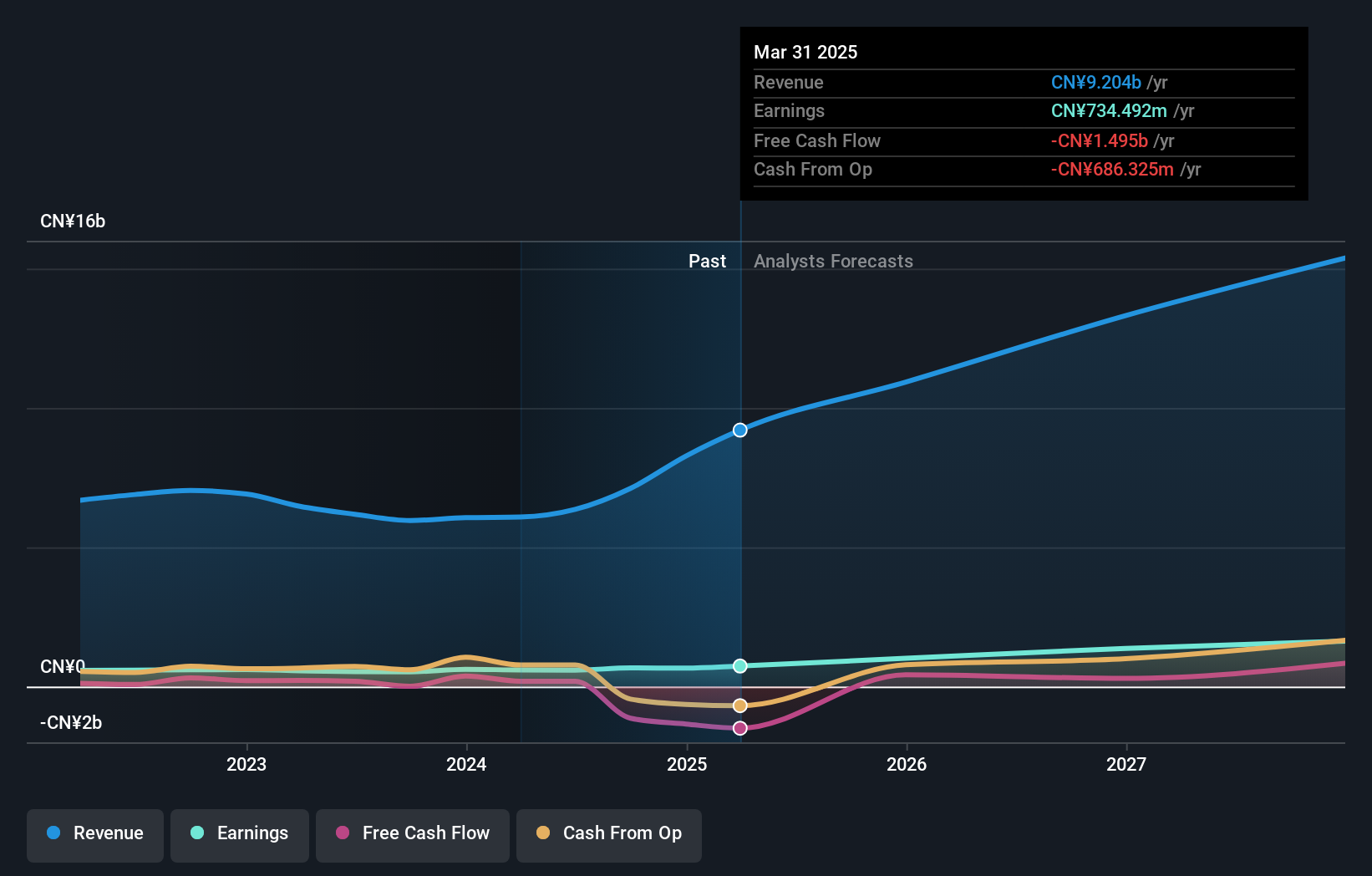

Accelink Technologies CoLtd, with a notable 18.9% annual revenue growth and an impressive 28.7% expected earnings growth per annum, stands out in the tech sector for its robust financial performance. The company's recent presentation at the OCP EMEA Summit underscores its commitment to innovation, particularly in optical communications—a segment that significantly contributed to a revenue surge from CNY 1.29 billion to CNY 2.22 billion year-over-year. Moreover, Accelink's strategic dividend increase and forward-looking shareholder meetings highlight its proactive approach in value creation and corporate governance, positioning it well amidst rapidly evolving technological landscapes.

- Unlock comprehensive insights into our analysis of Accelink Technologies CoLtd stock in this health report.

Learn about Accelink Technologies CoLtd's historical performance.

TRS Information Technology (SZSE:300229)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TRS Information Technology Co., Ltd. specializes in offering artificial intelligence, big data, and data security products and services within China, with a market capitalization of CN¥15.93 billion.

Operations: The company generates revenue by providing a range of products and services focused on artificial intelligence, big data, and data security within China. Its market capitalization is CN¥15.93 billion.

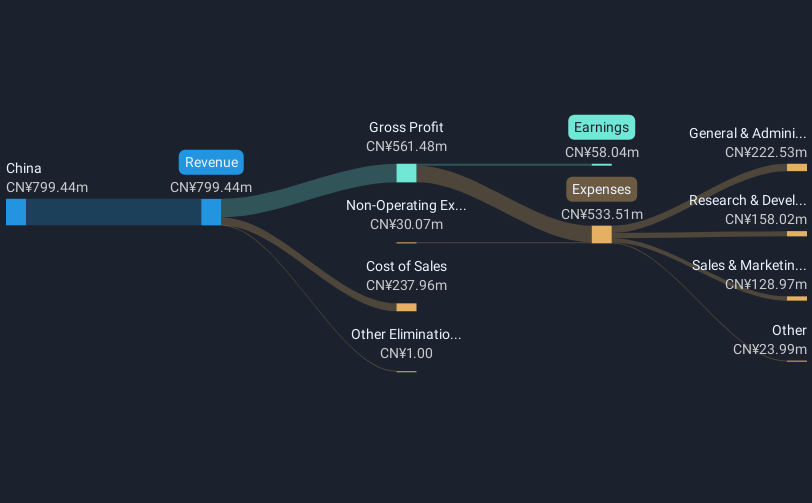

TRS Information Technology, despite a recent dip in earnings with a net loss of CNY 22.93 million in Q1 2025 from a prior net income, shows potential through its robust annual revenue growth forecast at 16.4%. This figure notably surpasses the broader Chinese market's growth rate of 12.6%. The company is on track to become profitable within three years, supported by an expected explosive annual earnings growth rate of nearly 79.7%. These projections suggest that TRS could reshape its financial trajectory significantly, leveraging ongoing investments in R&D which currently stands at a substantial ratio compared to overall revenue, indicating a strong commitment to innovation and future capabilities in the tech sector.

Seize The Opportunity

- Unlock our comprehensive list of 739 Global High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if TRS Information Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300229

TRS Information Technology

Provides artificial intelligence, big data, and data security products and services in China.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Shopify: The Quiet Shift From Store Builder to Commerce Operating System

UnitedHealth Stock: Why Scale, Data, and Integration Still Matter in U.S. Healthcare

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)